Water Damage Adjusters

How Can Public Adjusters Help With Water Damage Homeowners Insurance Claims?

100% Contingency Based. We Don't Get Paid Unless YOU Get Paid!

Water Damage Public Adjusters are your best advocates for managing water damage insurance claims. They assess damage thoroughly, ensuring you document everything needed to support your case.

Their expertise helps you understand your policy and identify coverage that could be overlooked. By handling paperwork and negotiating directly with your insurance company, they minimize delays and maximize your settlement potential.

Public adjusters also gather extensive evidence to strengthen your claim, providing peace of mind during this stressful time. If you want to enhance your understanding of this critical process, there’s more valuable information waiting for you.

- Public adjusters conduct thorough damage assessments, documenting every detail to strengthen water damage claims for homeowners.

- Their handle all necessary paperwork and negotiations, ensuring timely submission and minimizing delays in the claims process.

- Public adjusters are experts in interpreting insurance policies, identifying coverage areas often overlooked by homeowners.

- Their strategic negotiation techniques help secure fair settlements that accurately reflect the true extent of losses.

- Hiring a public adjuster significantly increases the chances of obtaining higher compensation, providing peace of mind during recovery.

*Some Services Not Available In All Areas. Contingency Fee Not Permitted By Law In Lousianna. By law, services in Kansas are only available for commercial claims.

Request a Free Estimate

- Required Fields

*Some Services May Not Be Available In All Areas

What Our Expert Water Damage Adjusters Bring To The Table

Policy & Claims Specialists

PCAN's water damage public adjusters have years of experience in claims & reviewing coverages. As such, they understand the numerous types of policies and endorsements. Their expertise allows them to find & utalize the various coverages your policy may have, and in many cases, inform you of coverage & clauses you may not even know about.

Advocacy

They advocate for your rights as the policy holder. PCAN public adjusters ensure that their clients’ rights are being protected throughout the claims process, and make sure you get all the benefits you are entitled to based on your policy. Your team of expert water damage claim adjusters will be there with you every step of the way!

Experts In Seen & Unseen Damages

PCAN water claims adjusters have years of experience identifying damage, and in most cases, come from professional construction, roofing, and insurance backgrounds. As such, they are able to find & isolate damages that you may not even know to look for, or know would/should be covered by your policy! They also incorporate the latest assessment techniques & technology when conducting their property inspections.

Expert Negotiators

Settlement negotiation is critically important when it comes to the claims process. PCAN public adjusters know how the insurance companies think, and come to the negotiation table fully prepared to make sure they know, that they know. Their expertise and experience in claims negotiations ensures that you get what you are actually entitled to under your policy ... not what the insurance company tells you that you are, based on their own interests. When the insurance company plays hardball or puts up a fight, PCAN adjusters aren't afraid to get in that ring and fight them for what's rightfully yours!

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Table of Contents

Understanding Water Damage Claims

Water damage claims can be complex, but understanding the process is essential for ensuring you receive the compensation you deserve.

You need to familiarize yourself with the different water damage types, such as burst pipes, flooding, and leaks, as each can affect your claim differently. Knowing these distinctions helps you articulate your situation more clearly when filing a claim.

When you review your insurance policy, pay close attention to the exclusions. Many policies may not cover certain types of water damage, like gradual leaks or sewer backups, which can leave you vulnerable if disaster strikes. Being aware of these potential exclusions allows you to take proactive measures, like obtaining additional coverage if needed.

Documenting the damage thoroughly is key. Take photos, gather repair estimates, and keep records of any related expenses. This information will support your claim and demonstrate the full extent of your loss.

Staying organized and informed about your policy can greatly improve your chances of receiving a fair settlement. You’re not alone in steering through this process; many homeowners face similar challenges, and understanding these elements can empower you to advocate effectively for your rights.

Role Of Water Damage Public Adjusters

Water damage adjusters serve as your advocates in maneuvering the often complicated landscape of insurance claims, ensuring you receive the full compensation you’re entitled to for water damage.

Their expertise can make a significant difference in the claim process simplification, allowing you to focus on recovering from the incident rather than battling with insurance companies.

Here are three key public adjuster roles that enhance your experience:

Assessment of Damage: They conduct thorough evaluations of the water damage, documenting every detail to support your claim effectively.

Claim Preparation: Public adjusters prepare and submit all necessary paperwork, streamlining the process to minimize delays and ensuring nothing is overlooked.

Negotiation with Insurers: With their industry knowledge, they negotiate directly with your insurance company, advocating for a fair settlement that reflects the true extent of your losses.

Benefits Of Hiring A Water Damage Claims Public Adjuster

Hiring a public water damage insurance adjuster can greatly enhance your chances of securing a fair settlement for your water damage claim, allowing you to navigate the complexities of the insurance process with greater ease and confidence.

Public adjusters are experts in the field, skilled at evaluating damages and understanding the nuances of your policy. This expertise means they can help debunk common insurance myths that often mislead homeowners.

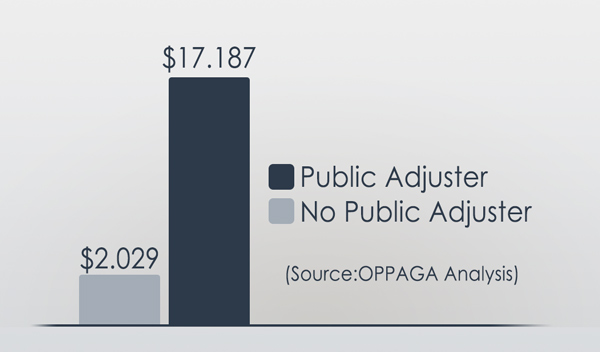

By employing a public adjuster, you gain a dedicated advocate who works solely for you, not the insurance company. They handle all the paperwork, negotiations, and communications, so you can focus on what truly matters—restoring your home. Many satisfied clients share testimonials highlighting their positive experiences with public adjusters, often noting significant increases in their settlements compared to those who went it alone.

Ultimately, hiring a water damage claims adjuster isn’t just about simplifying the process; it’s about ensuring you receive the full compensation you deserve. By placing your trust in their expertise, you’re not only protecting your financial interests but also gaining peace of mind during a challenging time. Embrace the support of a public adjuster, and take a confident step toward reclaiming your home.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Common Challenges In Water Damage Claims

Maneuvering the claims process can be overwhelming, especially when facing obstacles like underestimations of damage or delays in communication from your insurance provider.

You might find yourself battling common challenges that can derail your water damage claim.

Here are three issues to watch out for:

Claim Denials: Sometimes, insurers may deny your claim based on their interpretation of the policy. This can leave you feeling frustrated and helpless.

Policy Limitations: Many homeowners aren’t fully aware of their policy limitations, which can lead to unexpected out-of-pocket expenses. It’s vital to read the fine print and understand what’s covered.

Inconsistent Communication: Delays in getting updates or responses from your insurance adjuster can extend the claims process. This uncertainty can be incredibly stressful when you’re already dealing with the aftermath of water damage.

Understanding these challenges is essential for steering through the claims landscape. By being proactive and informed, you can better position yourself for a successful resolution. Don’t let these difficulties keep you from securing the compensation you deserve!

How Water Damage Adjusters Advocate For You

When you face water damage claims, a public insurance claims adjuster specializing in water damage homeowners insurance claims brings essential expertise in claim negotiation to the table. They conduct thorough damage assessments, ensuring no detail is overlooked, which strengthens your position when dealing with insurance companies.

With their advocacy, you’re more likely to secure a fair settlement that truly reflects your losses.

Expertise in Claim Negotiation

Public adjusters leverage their extensive knowledge of insurance policies and claims processes to effectively advocate for your rights and secure the compensation you deserve. They understand the complexities of claim negotiation strategies and adjust to industry standards, ensuring you’re not left with less than what you’re entitled to.

Here are three ways public adjusters enhance your claim negotiation:

- Expert Analysis: They review your policy in detail, pinpointing coverage areas you might overlook.

- Strategic Negotiation: With their experience, they employ effective negotiation techniques, pushing back against lowball offers from insurers.

- Comprehensive Documentation: They gather and present all necessary evidence, from photographs to repair estimates, making it harder for insurers to dispute your claim.

Ensure Accurate Damage Assessments

To guarantee an accurate damage assessment, you need a thorough inspection process that scrutinizes every affected area. Documenting damage evidence is vital, as it provides tangible proof for your claim. Finally, estimating repair costs accurately will help you secure the compensation you deserve, making it imperative to work with experienced professionals.

A thorough damage assessment is essential for ensuring you receive the full compensation you’re entitled to, as public adjusters meticulously evaluate every aspect of the water damage to support your claim effectively. They know that different damage types, such as structural, electrical, and mold-related issues, can greatly impact your claim’s outcome.

Using various assessment methods, public adjusters identify and document all damage accurately. They’ll conduct visual inspections, use moisture meters, and even engage specialists for more complex evaluations. This detailed approach helps paint a complete picture of the damage, ensuring no critical aspects are overlooked.

Moreover, public adjusters serve as your advocates, translating their findings into clear, compelling documentation that insurance companies can’t ignore. They understand the intricacies of homeowners insurance policies and know what evidence is necessary for a successful claim.

Thorough Inspection Process

Guaranteeing an accurate damage assessment starts with a meticulous inspection process that identifies both visible and hidden issues caused by water damage. As a homeowner, you’ll want to guarantee that every aspect of the damage is thoroughly examined. Public adjusters use advanced inspection techniques to provide a thorough understanding of your property’s condition and classify the damage effectively.

Here are three vital steps in the inspection process:

Visual Assessment: Public adjusters begin with a detailed visual inspection, identifying apparent water damage on walls, ceilings, and floors.

Moisture Detection: Using specialized tools, they measure moisture levels in various materials, making sure no hidden damage is overlooked.

Damage Classification: Once the inspection is complete, they classify the extent of the damage, categorizing it into classes and types to facilitate accurate claims processing.

Document Water Damage Evidence

After completing the inspection, public adjusters focus on documenting damage evidence to create a solid foundation for your water damage claim. This process is essential, as it guarantees that every detail is captured accurately, which can greatly impact your claim’s outcome. Public adjusters utilize photographic documentation to provide visual proof of the damage. They take clear, thorough photos that highlight affected areas, making sure that nothing is overlooked.

But it doesn’t stop at taking pictures. Evidence organization plays a fundamental role in presenting your case effectively. Adjusters categorize the documentation systematically, correlating photos with specific damage reports and notes. This organized approach makes it easier for insurance companies to understand the severity of the situation and can help expedite your claim processing.

Estimating Repair Costs

Accurate repair cost estimation is essential for presenting a compelling water damage claim that reflects the true extent of the damage. When you face water damage, knowing how much repairs will cost helps you navigate your insurance policy effectively. This is where a public adjuster can make a real difference. They’ll conduct a thorough insurance policy analysis and guarantee you receive the compensation you deserve.

Here are three key aspects of repair cost estimation that public adjusters handle expertly:

- Comprehensive Damage Assessment: They’ll evaluate all affected areas, capturing hidden damages that may go unnoticed.

- Precise Cost Calculations: With their industry expertise, they provide accurate cost estimates, guaranteeing that your claim covers all necessary repairs.

- Documentation and Presentation: They’ll compile a detailed report that presents your claim in a compelling manner, increasing your chances of approval.

Navigating The Claims Process

Steering through the claims process for water damage can feel overwhelming, but understanding each step will empower you to advocate effectively for your rights.

First, familiarize yourself with your policy limitations. Knowing what’s covered and what’s excluded can save you time and frustration as you navigate your claim.

Next, keep an eye on claim timelines. Insurance companies often have specific deadlines for filing claims, so it’s crucial to act quickly. Document every detail related to the water damage—photos, receipts, and repair estimates—to support your case.

Once you submit your claim, maintain regular communication with your insurer. Ask about the status and follow up if you don’t receive timely updates. If you encounter any roadblocks, don’t hesitate to enlist the help of a water damage adjuster. They understand the intricacies of the claims process and can advocate on your behalf.

Maximizing Your Insurance Settlement

To guarantee you receive the highest possible insurance settlement for your water damage claim, it’s important to take strategic steps throughout the process.

By understanding your insurance policy coverage and being aware of common claim denial reasons, you can position yourself for success.

Here are three essential tips to maximize your settlement:

Document Everything: Take photos and videos of the damage immediately. This visual evidence is vital for supporting your claim and demonstrating the extent of the loss.

Understand Your Coverage: Review your insurance policy thoroughly. Know what’s covered and what’s not. Being familiar with your coverage helps you avoid surprises and strengthens your negotiation position.

Work with a Public Adjuster: Engaging a public adjuster can greatly enhance your claim process. They understand the ins and outs of insurance claims and will advocate on your behalf, ensuring you don’t miss out on any potential benefits.

The Water Damage Insurance Claim Recovery Process

PCAN’s State-licensed public water damage adjuster members are fluent in “Insurance Policy Jargon”, and will guide you through the entire property insurance claims process, while we fight to make sure you get the highest compensation possible for your claim!

View 7-Step Water Insurance Claims Process

Step #1

Make Sure Your Family Is Safe

When disaster strikes, the priority is to make sure your family is safe. Always have an emergency bag!

Step #2

Contact A PCAN Water Public Adjuster

Contact one of our network’s verified, State-licensed, & highly experienced public insurance adjusters to schedule an appointment for them to come out & meet with you to inspect the damage.

Step #3

Thorough Review Of Your Policy

Your public adjuster will conduct a comprehensive review of your policy, note any coverage restrictions, coinsurance requirements, limitations, and review additional options that may be available to you.

Step #4

Create A Claims Strategy That Works For Your Specific Goals & Needs

They will discuss what is most important to you when it comes to your claim, then create & tailor the right claims strategy to take care of your family.

Step #5

Your Public Adjuster Takes Care Of All Insurance Related Paperwork, Negotiations, & Follow Up.

Once you & your PCAN public adjuster have agreed on a strategy, your adjuster will:

- Meet with insurance company adjusters & personnel at the loss/damage location.

- Agree to the scope of damages & make sure that they are including all the damages in the scope, as well as clearly deciding on what should be repaired vs. replaced.

- Prepare a detailed reconstruction estimate.

- Prepare a detailed inventory of personal property.

Step #6

Negotiations & Final Settlement

Your public adjuster will work to make sure you receive the highest settlement possible under your specific insurance policy.

Step #7

Restoration | Reconstruction | Relocation

They will negotiate with the insurance company to ensure that you can achieve your specific goals. Whether that’s full or partial restoration, rebuilding your property, or a full-relocation.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Get The HIGHEST & Most FAIR Settlement Amount, That You Are Legally Entitled To, From Your Water Damage Insurance Claim!

Get a free on-site inspection & insurance policy evaluation from one of our expert public claims adjusters!

Work with public insurance claim adjusters who are licensed, bonded, and trained to handle all residential or commercial insurance claims, big or small! Our public insurance adjusters’ technical and detailed expertise has satisfied countless homeowners, business owners, condominium management companies, and HOAs.

Our team of experts have years of experience dealing with insurance companies. Many of our public adjusters also have previous backgrounds in construction, giving us a significant advantage in quickly securing the most compensation for our clients. We know what to look for, what repairs actually cost, and what the insurance company’s adjusters tend to ignore (and hope you don’t know about!).

Our inspections are free, and we are 100% contingency-based, meaning we only get paid if you do!

We take pride in maintaining superior customer service and providing clear and friendly communication. Contact us to speak with one of our expert adjusters today!

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Water Damage Guide: How Public Adjusters Can Maximize Your Insurance Claim

Does Home Insurance Cover Water Leaks?

Does Homeowners Insurance Cover Water Damage From Rain?

List Of Water Damages Covered By Home Insurance Claims

Does Homeowners Insurance Cover Water Damage & Leaks?

Insurance Claim Consultants: What Are They & What Do They Do

What Type Of Water Damage Is Covered By Homeowners Insurance?

Should I File A Home Insurance Claim For Water Damage?

Water Damage Claim Denied – Why You Need A Public Adjuster

Average Insurance Payout For Water Damage [2025]

How To File Water Damaged Carpet Insurance Claims

Guide To Wood Floor Damage Repairs & Costs

How To Fix Hardwood Floor Water Damage

How To File Insurance Claims For Water Damaged Wood Floors

Signs Of Water Damage Under Tile

Signs Of Water Damage Under Floor

Signs Of Water Damage On Hardwood Floors

How To Spot Water Damage In A House

Water Damage In House – What To Do

How Long For Cupped Floors To Dry?

New Hardwood Floors Cupping – What To Do

Water Damage Adjuster For Water Damage Claims

Water Damage Public Adjusters Who Can Help Make The Water Damage Insurance Claims Process Faster & Easier!

Service Type: Water Damage Adjuster For Water Damage Claims

Price: 10-20%

Currency: USD

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Insurance Claim Types We Specialize In

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.