Structural Damage Claims Public Adjusters

How Can Public Adjusters Help With Structural Damage Homeowners Insurance Claims?

100% Contingency Based. We Don't Get Paid Unless YOU Get Paid!

Structural damage public adjusters considerably aid homeowners in managing structural damage claims by leveraging their expertise in insurance policies and claims intricacies.

They meticulously document damages, ensuring no costs are overlooked, and provide thorough assessments that strengthen the claim’s credibility. By negotiating on behalf of the homeowner, public adjusters work to secure fair compensation aligned with the policyholder’s needs.

Their guidance alleviates the stress associated with maneuvering complex claim processes, fostering confidence in achieving ideal outcomes. Understanding their role can reveal crucial strategies that enhance claim success, revealing insights that prove invaluable in challenging situations.

- Public adjusters conduct thorough damage assessments, documenting every detail to strengthen structural damage claims for homeowners.

- We handle all necessary paperwork and negotiations, ensuring timely submission and minimizing delays in the claims process.

- Public adjusters are experts in interpreting insurance policies, identifying coverage areas often overlooked by homeowners.

- Our strategic negotiation techniques help secure fair settlements that accurately reflect the true extent of losses.

- Hiring a public adjuster significantly increases the chances of obtaining higher compensation, providing peace of mind during recovery.

*Some Services Not Available In All Areas. Contingency Fee Not Permitted By Law In Lousianna. By law, services in Kansas are only available for commercial claims.

Request a Free Estimate

- Required Fields

*Some Services May Not Be Available In All Areas

What Our Expert Structural Damage Adjusters Bring To The Table

Policy & Claims Specialists

PCAN's structural damage public adjusters have years of experience in claims & reviewing coverages. As such, they understand the numerous types of policies and endorsements. Their expertise allows them to find & utalize the various coverages your policy may have, and in many cases, inform you of coverage & clauses you may not even know about.

Advocacy

They advocate for your rights as the policy holder. PCAN public adjusters ensure that their clients’ rights are being protected throughout the claims process, and make sure you get all the benefits you are entitled to based on your policy. Your team of expert structural damage claim adjusters will be there with you every step of the way!

Experts In Seen & Unseen Damages

PCAN structural claims adjusters have years of experience identifying damage, and in most cases, come from professional construction, roofing, and insurance backgrounds. As such, they are able to find & isolate damages that you may not even know to look for, or know would/should be covered by your policy! They also incorporate the latest assessment techniques & technology when conducting their property inspections.

Expert Negotiators

Settlement negotiation is critically important when it comes to the claims process. PCAN public adjusters know how the insurance companies think, and come to the negotiation table fully prepared to make sure they know, that they know. Their expertise and experience in claims negotiations ensures that you get what you are actually entitled to under your policy ... not what the insurance company tells you that you are, based on their own interests. When the insurance company plays hardball or puts up a fight, PCAN adjusters aren't afraid to get in that ring and fight them for what's rightfully yours!

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Table of Contents

Key Takeaways

- Public adjusters advocate for homeowners, ensuring accurate damage reporting and fair compensation during the claims process for structural damage.

- They possess specialized knowledge of insurance policies, helping navigate exclusions and coverage limits to maximize payouts.

- Public adjusters meticulously document damages, providing detailed photographs and descriptions to support claims and enhance credibility.

- They leverage strong negotiation skills to secure equitable settlements, mitigating the stress and complexities of the claims process.

- Engaging a public adjuster expedites claims, addressing disputes and delays effectively while guiding homeowners through the intricacies of insurance claims.

Understanding Structural Damage Public Adjusters

Public adjusters play an essential role in the insurance landscape, especially when it comes to steering through the complexities of structural damage claims.

These professionals serve as advocates for policyholders, ensuring that their interests are accurately represented in the claims process. Understanding the public adjuster roles is vital for homeowners facing the stress of property damage.

Public adjusters possess specialized knowledge of the insurance industry, allowing them to navigate policy nuances and assess damages thoroughly.

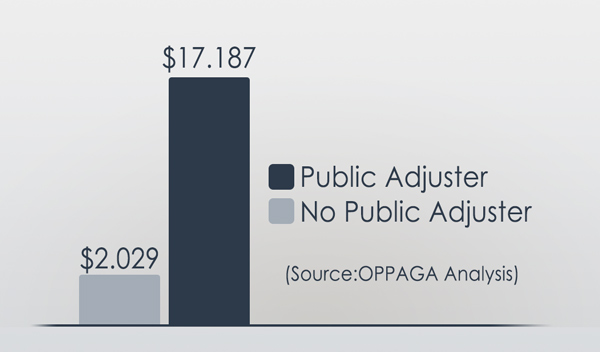

One of the primary insurance claim advantages of hiring a public adjuster is their ability to maximize settlement amounts. They meticulously document damages and losses, often uncovering costs that policyholders might overlook.

Additionally, public adjusters leverage their negotiation skills to engage with insurance companies, working for fair compensation aligned with the policyholder’s needs.

For homeowners, collaborating with a public adjuster translates into a more streamlined claims experience, alleviating the burden of dealing with complex insurance jargon and procedures. This partnership fosters a sense of belonging, as homeowners can rely on expert guidance during challenging times, reinforcing their position in the often intimidating insurance landscape.

The Structural Damage Insurance Claims Process Explained

Navigating through the claims process can be overwhelming for homeowners, particularly after experiencing structural damage. The intricacies of this process demand careful attention to detail, as each step can considerably impact the outcome of your claim.

First, homeowners must notify their insurance company promptly to initiate the claim. Understanding claim timelines is important, as delays can lead to complications that jeopardize coverage.

Once the claim is filed, the insurer will assign an adjuster to assess the damage. It’s important to be aware of potential policy exclusions that might affect your claim. These exclusions can limit coverage for certain types of damage or specific situations, making it essential to review your policy beforehand thoroughly.

Homeowners should maintain clear communication with their insurer and document all interactions, as this can serve as a reference if disputes arise. Engaging a public adjuster can also be invaluable; they will advocate for you, ensuring that all damages are accurately reported and that you receive a fair settlement. Ultimately, understanding the claims process equips homeowners with the knowledge they need to navigate their path to recovery effectively, fostering a sense of community and support during a challenging time.

Assessing Structural Damage For Insurance Claims

Evaluating structural damage necessitates a meticulous initial evaluation to identify visible defects and potential underlying issues.

This foundational assessment must be complemented by thorough damage documentation, capturing photographs, measurements, and expert opinions to substantiate the claim.

Together, these steps not only enhance the accuracy of the claim but also strengthen the policyholder’s position during negotiations with insurers.

Initial Damage Evaluation

Evaluating structural damage requires a meticulous approach to verify that all aspects of the property are thoroughly inspected and documented. The initial inspection is a critical step in the damage evaluation process, allowing public adjusters to identify and quantify the extent of structural issues. This careful examination guarantees that no damage goes unnoticed, which is essential for a successful insurance claim.

Key components of the initial damage evaluation include:

- Visual Inspection: Thoroughly checking for visible cracks, warping, or other signs of distress.

- Structural Integrity Analysis: Evaluating the stability of load-bearing elements such as beams and columns.

- Foundation Examination: Investigating the foundation for signs of settling or shifting that could indicate deeper issues.

- Roof Assessment: Assessing the roof for leaks or structural damage that may compromise the home’s integrity.

- Water Damage Inspection: Identifying any water intrusion or mold growth that could exacerbate structural problems.

Comprehensive Damage Documentation

Extensive damage documentation is a critical component in the insurance claims process, serving as the foundation for a claim. A thorough damage assessment is essential for accurately portraying the extent of structural damage sustained by your home.

Public adjusters excel in this area, employing their expertise to document every aspect of the damage meticulously. This includes detailed photographs, written descriptions, and thorough reports that outline the condition of your property.

Furthermore, these professionals collaborate with contractors to obtain precise repair estimates, ensuring that every cost associated with restoring your home is accounted for. By presenting a well-documented claim, public adjusters not only enhance the credibility of your case but also elevate the likelihood of a favorable settlement.

Homeowners often feel overwhelmed during this process, but aligning with a public adjuster fosters a sense of belonging and reassurance. You’re not maneuvering through this challenge alone; you have an advocate who understands the intricacies of insurance claims. Essentially, thorough damage documentation is not merely a procedural necessity—it’s a strategic tool that empowers homeowners to effectively reclaim their investment and restore their cherished spaces.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Maximizing Structural Damage Insurance Payouts

Maximizing insurance payouts requires a thorough understanding of policy coverage to identify all applicable benefits.

Thorough documentation of damage is vital, as it serves as the foundation for a compelling claim that substantiates the extent of loss.

Additionally, effective negotiation strategies are necessary to guarantee that settlements reflect the true value of the damages incurred, ultimately safeguarding the policyholder’s financial interests.

Understanding Policy Coverage

Understanding your insurance policy coverage is essential when maneuvering through structural damage claims, as it directly impacts the potential payout you may receive. Familiarity with the specifics of your policy, including coverage limits and policy exclusions, will empower you to advocate effectively for your claim.

Key elements to evaluate include:

- Coverage Limits: Understand the maximum amount your policy will pay for structural damage.

- Policy Exclusions: Identify what is not covered, as this can greatly affect your claim.

- Deductibles: Be aware of the costs you must cover before your insurance kicks in.

- Replacement Cost vs. Actual Cash Value: Know whether your policy reimburses you for the full replacement cost or the depreciated value of the damaged structure.

- Additional Living Expenses: Check if your policy provides coverage for living expenses while your home is being repaired.

Navigating these complexities can be intimidating; however, by grasping your policy’s nuances, you position yourself to maximize your insurance payouts. Partnering with a public adjuster can further enhance this process, ensuring you receive the compensation you deserve.

Documenting Damage Thoroughly

Effective documentation of structural damage is an essential step in securing a favorable outcome for your insurance claim. A thorough damage assessment is necessary in illustrating the extent of the loss, helping to guarantee that you receive the compensation you are entitled to. It is imperative to meticulously record every aspect of the damage, from minor cracks to considerable structural failures.

Photographic evidence plays an important role in this process. Capturing high-quality images from multiple angles allows for a detailed visual representation of the damage, which can greatly enhance your claim’s credibility. Accompany these images with detailed notes describing the damage’s circumstances, including dates, times, and any relevant weather conditions.

Additionally, involving a public adjuster can further strengthen your case. Their expertise in damage assessment guarantees that no detail is overlooked, and they can help organize the documentation in a compelling manner that aligns with your insurance policy. By prioritizing thorough documentation, you fortify your claim and cultivate a sense of belonging and support within a community of homeowners facing similar challenges. This meticulous approach can lead to maximized insurance payouts and a smoother claims process.

Negotiating Fair Settlements

Negotiating a fair settlement is critical to the insurance claims process, particularly when addressing structural damage. Homeowners often find themselves at a disadvantage due to the complexities involved, making it essential to employ effective settlement strategies and negotiation tactics. Public adjusters serve as invaluable advocates, ensuring that clients receive equitable compensation for their losses.

To maximize insurance payouts, public adjusters utilize various approaches, including:

- Comprehensive Damage Assessment: Thoroughly documenting all damage to substantiate the claim.

- Understanding Policy Limits: Familiarizing themselves with the specifics of the homeowner’s policy.

- Building a Strong Case: Presenting detailed evidence and expert testimony to support the claim.

- Effective Communication: Engaging in clear and direct dialogues with insurance representatives.

- Maintaining Professionalism: Upholding a respectful demeanor to foster productive negotiations.

Common Challenges Faced In Structural Damage Homeowners Insurance Claims

Numerous challenges arise during the process of filing structural damage claims, often complicating the path to fair compensation.

Insurance disputes frequently emerge due to differing interpretations of policy coverage, especially when the extent of damage is in question.

Homeowners may disagree with their insurance carriers about what constitutes necessary repairs or the total cost of restoration. This can lead to heightened frustration, particularly when expectations clash with the insurer’s assessment.

Additionally, claim delays are a common hurdle that can further exacerbate the already stressful situation. The intricate nature of structural damage assessments often results in prolonged waiting periods for approvals or denials, leaving homeowners in limbo while they grapple with the financial implications of their losses.

Navigating these challenges requires an understanding of the insurance landscape and the ability to advocate effectively for one’s rights. Given the complexities of claims processes and potential pitfalls, homeowners can benefit considerably from the expertise of public adjusters.

These professionals can help mitigate disputes and expedite the claims process, ensuring that homeowners feel supported and empowered throughout their journey to recovery.

Choosing The Right Adjuster

Selecting the right public adjuster can greatly influence the outcome of a structural damage claim, particularly in light of the challenges homeowners face in dealing with insurance carriers.

The process can be intimidating, but understanding the qualifications needed and evaluating adjuster fees can notably streamline your decision-making.

When choosing a public adjuster, consider the following factors:

- Licensing and Certification: Verify the adjuster holds the necessary state licenses and certifications.

- Experience and Expertise: Look for an adjuster with a proven track record in handling structural damage claims similar to yours.

- Reputation: Seek referrals and reviews from previous clients to gauge their reliability and professionalism.

- Communication Skills: A good adjuster should be able to clearly articulate the claims process and keep you informed.

- Fee Structure: Understand the adjuster fees upfront, including any commission percentage and potential additional costs.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

The Structural Damage Insurance Claim Recovery Process

PCAN’s State-licensed public structural damage adjuster members are fluent in “Insurance Policy Jargon”, and will guide you through the entire property insurance claims process, while we fight to make sure you get the highest compensation possible for your claim!

View 7-Step Structural Insurance Claims Process

Step #1

Make Sure Your Family Is Safe

When disaster strikes, the priority is to make sure your family is safe. Always have an emergency bag!

Step #2

Contact A PCAN Structural Damage Public Adjuster

Contact one of our network’s verified, State-licensed, & highly experienced public insurance adjusters to schedule an appointment for them to come out & meet with you to inspect the damage.

Step #3

Thorough Review Of Your Policy

Your public adjuster will conduct a comprehensive review of your policy, note any coverage restrictions, coinsurance requirements, limitations, and review additional options that may be available to you.

Step #4

Create A Claims Strategy That Works For Your Specific Goals & Needs

They will discuss what is most important to you when it comes to your claim, then create & tailor the right claims strategy to take care of your family.

Step #5

Your Public Adjuster Takes Care Of All Insurance Related Paperwork, Negotiations, & Follow Up.

Once you & your PCAN public adjuster have agreed on a strategy, your adjuster will:

- Meet with insurance company adjusters & personnel at the loss/damage location.

- Agree to the scope of damages & make sure that they are including all the damages in the scope, as well as clearly deciding on what should be repaired vs. replaced.

- Prepare a detailed reconstruction estimate.

- Prepare a detailed inventory of personal property.

Step #6

Negotiations & Final Settlement

Your public adjuster will work to make sure you receive the highest settlement possible under your specific insurance policy.

Step #7

Restoration | Reconstruction | Relocation

They will negotiate with the insurance company to ensure that you can achieve your specific goals. Whether that’s full or partial restoration, rebuilding your property, or a full-relocation.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Get The HIGHEST & Most FAIR Settlement Amount Possible From Your Structural Damage Property Claim!

Get a free on-site inspection & insurance policy evaluation from one of our expert public claims adjusters!

Work with public insurance claim adjusters who are licensed, bonded, and trained to handle all residential or commercial insurance claims, big or small! Our public insurance adjusters’ technical and detailed expertise has satisfied countless homeowners, business owners, condominium management companies, and HOAs.

Our team of experts have years of experience dealing with insurance companies. Many of our public adjusters also have previous backgrounds in construction, giving us a significant advantage in quickly securing the most compensation for our clients. We know what to look for, what repairs actually cost, and what the insurance company’s adjusters tend to ignore (and hope you don’t know about!).

Our inspections are free, and we are 100% contingency-based, meaning we only get paid if you do!

We take pride in maintaining superior customer service and providing clear and friendly communication. Contact us to speak with one of our expert adjusters today!

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Guide To Home Structural Damage Repairs & Costs

Does Personal Property Insurance Cover Appliances?

Guide To Filing Personal Property Insurance Claims

What Is Scheduled Personal Property Coverage?

What Is Special Personal Property Coverage?

Guide To Personal Property Insurance For Valuables

What Does Personal Property Insurance Cover?

What Is Personal Property Coverage In Home Insurance?

How Much Personal Property Coverage Do I Need?

Does Homeowners Insurance Cover Structural Damages & Repairs?

What Is Considered Structural Damage?

Are Structural Repairs To A Home Tax Deductible?

How Many Years Does A Home Warranty Cover Structural Damage?

Guide To Structural Engineer Charges & Fees

What Is A Structural Engineer?

Can Structural Damage To A House Be Fixed?

Guide To Structural Damage Inspections & Assessments

Types Of Structural Damage Issues & Problems

How To Fix Structural Cracks In Walls

Cracks In Plaster & When To Worry

10 Structural Damage Homeowners Insurance Claims Tips

Public Adjusters For Structural Damage Homeowners Insurance Claims

Learn how structural damage public adjusters can simplify your structural damage homeowners insurance claims process, and maximize your compensation, ensuring higher settlement opportunities.

Service Type: Public Adjusters For Structural Damage Homeowners Insurance Claims

Price: 10-20%

Currency: USD

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.