Storm & Wind Damage Public Adjusters

How Can Public Adjusters Help With Storm & Wind Damage Homeowners Insurance Claims?

100% Contingency Based. We Don't Get Paid Unless YOU Get Paid!

Storm & wind damage public adjusters greatly aid homeowners in maneuvering storm and wind damage claims. Their expertise guarantees thorough documentation of damages, including both visible and hidden issues often overlooked by insurers.

They possess a deep understanding of policy intricacies, enhancing the likelihood of maximized settlements. By skillfully negotiating with insurance companies, public adjusters advocate for the best interests of homeowners, often resulting in compensation that exceeds the costs of their services.

This professional guidance alleviates the stress of managing complex claims processes. Discover more about how employing a public adjuster can streamline your insurance experience and improve your compensation outcome.

- Public adjusters conduct thorough damage assessments, documenting every detail to strengthen storm & wind damage claims for homeowners.

- We handle all necessary paperwork and negotiations, ensuring timely submission and minimizing delays in the claims process.

- Public adjusters are experts in interpreting insurance policies, identifying coverage areas often overlooked by homeowners.

- Our strategic negotiation techniques help secure fair settlements that accurately reflect the true extent of losses.

- Hiring a public adjuster significantly increases the chances of obtaining higher compensation, providing peace of mind during recovery.

*Some Services Not Available In All Areas. Contingency Fee Not Permitted By Law In Lousianna. By law, services in Kansas are only available for commercial claims.

Request a Free Estimate

- Required Fields

*Some Services May Not Be Available In All Areas

What Our Expert Storm & Wind Damage Adjusters Bring To The Table

Policy & Claims Specialists

PCAN's storm & wind damage public adjusters have years of experience in claims & reviewing coverages. As such, they understand the numerous types of policies and endorsements. Their expertise allows them to find & utalize the various coverages your policy may have, and in many cases, inform you of coverage & clauses you may not even know about.

Advocacy

They advocate for your rights as the policy holder. PCAN public adjusters ensure that their clients’ rights are being protected throughout the claims process, and make sure you get all the benefits you are entitled to based on your policy. Your team of expert storm & wind damage claim adjusters will be there with you every step of the way!

Experts In Seen & Unseen Damages

PCAN storm & wind claims adjusters have years of experience identifying damage, and in most cases, come from professional construction, roofing, and insurance backgrounds. As such, they are able to find & isolate damages that you may not even know to look for, or know would/should be covered by your policy! They also incorporate the latest assessment techniques & technology when conducting their property inspections.

Expert Negotiators

Settlement negotiation is critically important when it comes to the claims process. PCAN public adjusters know how the insurance companies think, and come to the negotiation table fully prepared to make sure they know, that they know. Their expertise and experience in claims negotiations ensures that you get what you are actually entitled to under your policy ... not what the insurance company tells you that you are, based on their own interests. When the insurance company plays hardball or puts up a fight, PCAN adjusters aren't afraid to get in that ring and fight them for what's rightfully yours!

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Table of Contents

Key Takeaways

- Public adjusters evaluate and document storm and wind damage, ensuring comprehensive evidence to support homeowners’ claims.

- They possess in-depth knowledge of insurance policies, helping homeowners navigate complex terms and coverage limits.

- Skilled negotiators, public adjusters aim to maximize settlements, often covering their fees through increased compensation.

- They identify both visible and hidden damages, providing unbiased assessments that strengthen the claims process.

- Public adjusters manage communication with insurance companies, reducing stress and facilitating smoother negotiations for homeowners.

Understanding Storm & Wind Damage Public Adjusters

Steering through the complexities of homeowners insurance claims can be intimidating for many policyholders, often leaving them vulnerable to coverage inadequacies.

Public adjusters play a crucial role in guiding this intricate insurance claim process. These licensed professionals advocate for homeowners, ensuring that they receive fair and just compensation for their losses.

The primary responsibilities of public adjusters include evaluating property damage, documenting losses, and negotiating with insurance companies on behalf of the policyholder. Their expertise in the insurance claim process is indispensable, as they possess a deep understanding of policy language and coverage limits. By employing a public adjuster, homeowners can level the playing field against insurance companies, which often employ their own adjusters to minimize payouts.

Moreover, public adjusters not only streamline the claims process but also provide peace of mind to policyholders who may feel overwhelmed by the intricacies of insurance claims. Their primary goal is to safeguard the interests of homeowners, ensuring they receive adequate compensation for their claims. Ultimately, understanding the essential roles that public adjusters play can empower policyholders to make informed decisions about their insurance claims and foster a sense of security in their coverage.

The Storm & Wind Damage Insurance Claims Process Simplified

Steering through the homeowners insurance claims process can often feel overwhelming for many policyholders, yet understanding its fundamental steps is important for maximizing compensation.

The claims process typically begins with notifying your insurance company about the storm or wind damage, which initiates your claim timeline. Prompt reporting is essential, as delays can hinder your claim’s progress.

Once your claim is filed, the next step involves thorough claim documentation. Policyholders should meticulously gather evidence, including photographs of the damage, repair estimates, and any relevant receipts. This documentation will serve as the backbone of your claim and can greatly influence the outcome.

Following submission, an adjuster will assess the damage, aligning their findings with your documentation. This stage is critical; therefore, engaging in open communication with your insurance representative is important to addressing any questions or discrepancies.

Benefits Of Hiring A Public Adjuster For Storm & Wind Damage

When managing the complexities of homeowners insurance claims, hiring a public adjuster can provide notable advantages for policyholders.

These professionals possess the expertise to navigate intricate claims processes, ensuring that homeowners receive an equitable settlement.

Here are three compelling benefits of engaging a public adjuster:

- Expert Guidance: Public adjusters are well-versed in insurance policies and regulations, offering insights that can greatly enhance the clarity of the claims process. Their expertise can help policyholders avoid costly mistakes.

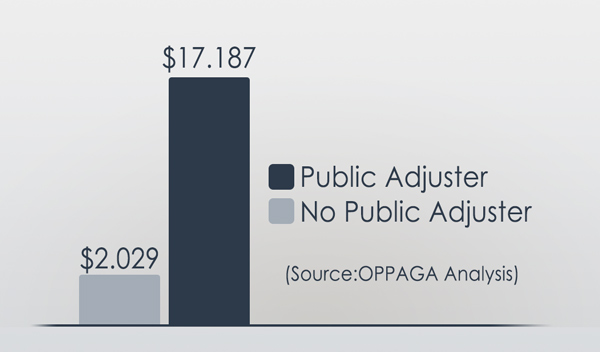

- Maximized Settlements: With their extensive knowledge and negotiation skills, public adjusters work diligently to secure the highest possible settlement for clients. Numerous client testimonials highlight the success stories of policyholders who received far more than they initially anticipated.

- Cost Considerations: While some may view hiring a public adjuster as an additional expense, the reality is that the benefits often outweigh the costs. The potential increase in settlement amounts frequently covers their fees, making it a financially sound decision.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Assessing Storm and Wind Damage Before Filing A Homeowners Insurance Claim

The aftermath of a storm can leave homeowners grappling with the intimidating task of evaluating wind damage and its impact on their property.

A thorough damage assessment is essential, as it not only determines the extent of repairs needed but also influences the outcome of insurance claims.

Homeowners must meticulously examine both visible and hidden damages, including roof leaks, broken windows, and compromised structural integrity.

The storm impact can vary greatly, making it imperative to document every detail. Taking photographs and notes can help create a detailed record that may prove invaluable during the insurance claims process.

Engaging a public adjuster can further enhance this assessment, as these professionals possess the expertise to identify damages that homeowners may overlook. They can provide an unbiased perspective, ensuring that all storm-related damages are accounted for accurately.

Ultimately, a thorough damage assessment not only fosters peace of mind but also empowers homeowners in their journey to restore their properties. By embracing a proactive approach and seeking professional guidance, homeowners can navigate the complexities of storm damage with confidence, fostering a sense of belonging within their community.

Negotiating With Insurance Companies

Negotiating with insurance companies requires a thorough understanding of your policy coverage to guarantee that all eligible claims are appropriately addressed.

Effective communication strategies are essential in articulating your needs and expectations while fostering a collaborative relationship with the insurer.

By strategically presenting your case, you can enhance the likelihood of achieving a favorable settlement.

Understanding Policy Coverage

Understanding the nuances of policy coverage is essential for homeowners seeking to navigate the complexities of insurance claims effectively. A thorough comprehension of coverage limits and policy exclusions can greatly enhance the likelihood of receiving a fair settlement. Homeowners often face challenges when dealing with insurance companies, and knowing the specifics of their policy can empower them in negotiations.

To facilitate this understanding, consider these key points:

- Policy Exclusions: Familiarize yourself with what is not covered under your policy. This knowledge is crucial, as certain perils may be explicitly excluded, which could impact your claim.

- Coverage Limits: Understand the maximum amount your policy will pay for specific types of damage. Being aware of these limits helps in setting realistic expectations during the claims process.

- Additional Living Expenses: Know whether your policy covers temporary housing costs if your home is uninhabitable due to storm damage. This can alleviate financial strain during repairs.

Effective Communication Strategies

Effective communication stands as a crucial element in the negotiation process with insurance companies, where clarity and assertiveness can greatly influence the outcome of a claim. To navigate this complex landscape, employing strategies such as active listening and clear messaging is essential.

Active listening allows homeowners to fully understand the nuances of the insurance adjuster’s perspective, fostering a respectful dialogue that encourages collaboration. By acknowledging the adjuster’s points, homeowners demonstrate engagement and openness, which can facilitate better negotiation outcomes.

Simultaneously, clear messaging is essential when articulating the specifics of the claim. Homeowners should prepare concise summaries of their damages and articulate the rationale for their claims with precision. This clarity not only showcases the legitimacy of the claim but also helps prevent misunderstandings that could delay the process.

Ultimately, effective communication serves as the bridge between homeowners and insurance companies. By mastering these strategies, homeowners can advocate for their interests more effectively, fostering a sense of belonging within the claims process. This approach not only enhances the likelihood of a favorable outcome but also builds a foundation of trust and cooperation with insurance professionals.

Maximizing Your Storm & Wind Damage Insurance Payout

To maximize your insurance payout, it is essential to fully understand your policy coverage, as this knowledge directly influences the claims process.

Effectively documenting damage with thorough evidence further strengthens your position during negotiations with insurers.

By strategically leveraging these elements, homeowners can greatly enhance their chances of receiving a fair and adequate compensation for their losses.

Understanding Policy Coverage

Maneuvering the complexities of homeowners insurance policies is crucial for maximizing your insurance payout following a loss. Policy coverage’s nuances can greatly impact your financial recovery after storm or wind damage. Homeowners often overlook critical aspects that dictate how and when they can file claims.

Key considerations include:

- Policy Exclusions: Familiarize yourself with what is not covered. Some policies may exclude specific types of storm damage, such as flooding or wear and tear, which could leave homeowners vulnerable.

- Coverage Limits: Each policy has defined limits on various types of damage. Knowing these limits can help you strategize your claims and avoid unpleasant surprises during the settlement process.

- Endorsements and Riders: These additions can enhance your coverage. Understanding available endorsements can help guarantee that essential protections are in place, allowing for a more thorough approach to your claim.

Documenting Damage Effectively

Documenting damage meticulously is essential for ensuring a favorable outcome in your homeowners insurance claim. A thorough damage assessment allows homeowners to present a compelling case to insurers, thereby maximizing their potential payout. Effective documentation techniques are key in this process, as they provide clear evidence of the extent and impact of the damage incurred.

Begin by taking high-quality photographs of all affected areas, capturing both wide shots and close-ups of specific damages. Be sure to record the date and time of the incident and make notes on the conditions that contributed to the damage. This detailed narrative can serve as a valuable reference during your claim process.

Additionally, organize relevant receipts, repair estimates, and contractor assessments to further substantiate your claim. These documents will reinforce your position and demonstrate the financial implications of the damage. Engaging a public adjuster can also enhance your documentation efforts, as they possess expertise in conducting thorough damage assessments and ensuring that no detail is overlooked. By focusing on meticulous documentation, you empower yourself to navigate the complexities of insurance claims and secure the compensation you rightfully deserve.

Negotiating With Insurers

Negotiating with insurers requires a strategic approach that emphasizes clear communication and a well-supported claim. Homeowners often face claim disputes that can greatly affect their settlement outcomes.

To maximize your insurance payout, consider the following settlement strategies:

- Comprehensive Documentation: Confirm that all damage is thoroughly documented, including photographs, repair estimates, and expert opinions. This evidence will strengthen your position during negotiations.

- Understand Policy Terms: Familiarize yourself with your insurance policy’s specific terms and coverage limits. A clear understanding will empower you to articulate your claim effectively and challenge any unjust denials or low offers.

- Engage a Public Adjuster: Partnering with a public adjuster can be invaluable. They are experienced negotiators who understand the intricacies of insurance claims and can advocate on your behalf, making sure your interests are prioritized.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

The Storm & Wind Damage Insurance Claim Recovery Process

PCAN’s State-licensed public storm & wind damage adjuster members are fluent in “Insurance Policy Jargon”, and will guide you through the entire property insurance claims process, while we fight to make sure you get the highest compensation possible for your claim!

View 7-Step Storm & Wind Insurance Claims Process

Step #1

Make Sure Your Family Is Safe

When disaster strikes, the priority is to make sure your family is safe. Always have an emergency bag!

Step #2

Contact A PCAN Storm & Wind Public Adjuster

Contact one of our network’s verified, State-licensed, & highly experienced public insurance adjusters to schedule an appointment for them to come out & meet with you to inspect the damage.

Step #3

Thorough Review Of Your Policy

Your public adjuster will conduct a comprehensive review of your policy, note any coverage restrictions, coinsurance requirements, limitations, and review additional options that may be available to you.

Step #4

Create A Claims Strategy That Works For Your Specific Goals & Needs

They will discuss what is most important to you when it comes to your claim, then create & tailor the right claims strategy to take care of your family.

Step #5

Your Public Adjuster Takes Care Of All Insurance Related Paperwork, Negotiations, & Follow Up.

Once you & your PCAN public adjuster have agreed on a strategy, your adjuster will:

- Meet with insurance company adjusters & personnel at the loss/damage location.

- Agree to the scope of damages & make sure that they are including all the damages in the scope, as well as clearly deciding on what should be repaired vs. replaced.

- Prepare a detailed reconstruction estimate.

- Prepare a detailed inventory of personal property.

Step #6

Negotiations & Final Settlement

Your public adjuster will work to make sure you receive the highest settlement possible under your specific insurance policy.

Step #7

Restoration | Reconstruction | Relocation

They will negotiate with the insurance company to ensure that you can achieve your specific goals. Whether that’s full or partial restoration, rebuilding your property, or a full-relocation.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Get The HIGHEST & Most FAIR Settlement Amount Possible From Your Storm & Wind Damage Property Claim!

Get a free on-site inspection & insurance policy evaluation from one of our expert public claims adjusters!

Work with public insurance claim adjusters who are licensed, bonded, and trained to handle all residential or commercial insurance claims, big or small! Our public insurance adjusters’ technical and detailed expertise has satisfied countless homeowners, business owners, condominium management companies, and HOAs.

Our team of experts have years of experience dealing with insurance companies. Many of our public adjusters also have previous backgrounds in construction, giving us a significant advantage in quickly securing the most compensation for our clients. We know what to look for, what repairs actually cost, and what the insurance company’s adjusters tend to ignore (and hope you don’t know about!).

Our inspections are free, and we are 100% contingency-based, meaning we only get paid if you do!

We take pride in maintaining superior customer service and providing clear and friendly communication. Contact us to speak with one of our expert adjusters today!

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Guide To The Storm Damage Home Insurance Claims Process

Guide To Storm Damage Roof Insurance Claims

Wind Damage Guide: How Public Adjusters Can Maximize Your Insurance Claim

Does Homeowners Insurance Cover Storm Damage Tree Removal?

Windstorm Insurance: Coverage, Costs, & State Requirements

Does Homeowners Insurance Cover Pool Damage From Storm?

What Is A Windstorm Mitigation Inspection?

Wind Mitigation: What Is It, Do I Need It, & Benefits

Wind Mitigation Costs & Credits Guide 2025

Wind Mitigation Inspection Checklist 2025

10 Storm & Wind Damage Homeowners Insurance Claims Tips

Wind Mitigation Inspection Reports & Home Insurance Savings

4 Point Inspections Vs. Wind Mitigation: Differences & Costs

Does Homeowners Insurance Cover Blown Down Fences?

Is Wind Damage To Fences Covered By Home Insurance?

Does Homeowners Insurance Cover Wind Damage To Siding?

Does Homeowners Insurance Cover Wind Damage To Trees?

Do I Need Wind And Hail Insurance?

Wind & Hail Insurance Guide: Deductables, Coverage, & Costs

Does Homeowners Insurance Cover Wind Damage?

Public Adjusters For Storm & Wind Damage Insurance Claims

Learn how Storm & Wind Damage public adjusters can simplify your Storm & Wind Damage homeowners insurance claims process, and maximize your compensation, ensuring higher settlement opportunities.

Service Type: Public Adjusters For Storm & Wind Damage Insurance Claims

Price: 10-20%

Currency: USD

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.