Roofing Adjusters

How Can Public Adjusters Help With Roof Damage Homeowners Insurance Claims?

100% Contingency Based. We Don't Get Paid Unless YOU Get Paid!

Roofing adjusters are invaluable when it comes to managing roof damage insurance claims for homeowners.

They simplify the claims process by evaluating damage, gathering essential documentation, and advocating for fair settlements with insurance companies.

Their expertise guarantees all damages are accounted for, which can lead to more favorable outcomes.

Additionally, roofing insurance claim public adjusters handle the intricate details of claim negotiations, relieving homeowners of considerable stress.

By providing support during a challenging time, they help secure timely repairs and compensation. Those interested in maximizing their claims can discover further insights on the benefits of hiring a public adjuster.

- Public adjusters conduct thorough damage assessments, documenting every detail to strengthen roof damage claims for homeowners.

- We handle all necessary paperwork and negotiations, ensuring timely submission and minimizing delays in the claims process.

- Public adjusters are experts in interpreting insurance policies, identifying coverage areas often overlooked by homeowners.

- Our strategic negotiation techniques help secure fair settlements that accurately reflect the true extent of losses.

- Hiring a public adjuster significantly increases the chances of obtaining higher compensation, providing peace of mind during recovery.

*Some Services Not Available In All Areas. Contingency Fee Not Permitted By Law In Lousianna. By law, services in Kansas are only available for commercial claims.

Request a Free Estimate

- Required Fields

*Some Services May Not Be Available In All Areas

What Our Expert Roof Damage Adjusters Bring To The Table

Policy & Claims Specialists

PCAN's roof damage public adjusters have years of experience in claims & reviewing coverages. As such, they understand the numerous types of policies and endorsements. Their expertise allows them to find & utalize the various coverages your policy may have, and in many cases, inform you of coverage & clauses you may not even know about.

Advocacy

They advocate for your rights as the policy holder. PCAN public adjusters ensure that their clients’ rights are being protected throughout the claims process, and make sure you get all the benefits you are entitled to based on your policy. Your team of expert roof damage claim adjusters will be there with you every step of the way!

Experts In Seen & Unseen Damages

PCAN roof claims adjusters have years of experience identifying damage, and in most cases, come from professional construction, roofing, and insurance backgrounds. As such, they are able to find & isolate damages that you may not even know to look for, or know would/should be covered by your policy! They also incorporate the latest assessment techniques & technology when conducting their property inspections.

Expert Negotiators

Settlement negotiation is critically important when it comes to the claims process. PCAN public adjusters know how the insurance companies think, and come to the negotiation table fully prepared to make sure they know, that they know. Their expertise and experience in claims negotiations ensures that you get what you are actually entitled to under your policy ... not what the insurance company tells you that you are, based on their own interests. When the insurance company plays hardball or puts up a fight, PCAN adjusters aren't afraid to get in that ring and fight them for what's rightfully yours!

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Table of Contents

Key Takeaways

- Roofing public adjusters advocate for homeowners, ensuring their interests are prioritized during the claims process for roof damage.

- They conduct thorough assessments, identifying all types of damage, including those often overlooked by insurers.

- Roofing adjusters prepare detailed loss documentation and negotiate with insurance companies for favorable settlements.

- Their expertise in insurance policies helps homeowners understand coverage details and maximize claim payouts.

- Hiring a roofing public claims adjuster alleviates stress, as they manage the entire claims process, saving homeowners time and effort.

Understanding Roof Damage Insurance Claims

Maneuvering the complexities of roof damage claims requires a clear understanding of the processes involved and the types of damage that can occur.

Homeowners often face challenges when seeking insurance coverage for roof repair, as various factors influence the outcome of a claim.

It is vital to recognize the common types of roof damage, including storm-related issues, wear and tear, and structural failures, as each type has different implications for insurance policies.

Understanding your specific insurance coverage is critical. Policies can vary considerably, with some covering only certain types of damage or requiring specific documentation to substantiate a claim. Homeowners should familiarize themselves with their policy details to guarantee they are adequately protected.

This includes knowing deductibles, policy limits, and any applicable exclusions.

When facing roof damage, documenting the extent of the damage through photographs and detailed notes can bolster your claim. Engaging with your insurance provider early in the process can also streamline communication and expedite the claim outcome.

Ultimately, a proactive approach to understanding roof damage claims empowers homeowners to navigate their insurance coverage effectively, guaranteeing they receive the support needed for timely roof repairs.

Role Of Expert Public Roofing Adjusters

Public adjusters’ role in roof damage claims is critical for homeowners seeking to maximize their insurance benefits.

These professionals serve as advocates for homeowners, ensuring that their interests are prioritized throughout the claims process.

Public adjuster responsibilities include thoroughly evaluating the damage, preparing detailed loss documentation, and negotiating with insurance companies on behalf of the homeowner.

By leveraging their expertise, public adjusters help homeowners navigate the complexities of insurance policies, which can often be overwhelming. They understand the nuances of the claims process, enabling them to identify all eligible damages that may be overlooked, ultimately leading to a more favorable settlement.

Homeowner advocacy is at the forefront of their mission; they work tirelessly to protect the rights of policyholders, working to secure the compensation necessary for proper repairs. In an environment where homeowners may feel vulnerable, public adjusters provide reassurance and support.

Their knowledge and commitment empower homeowners, transforming a intimidating experience into a manageable one. By engaging a public adjuster, homeowners can rest assured that they have a dedicated partner in their corner, working diligently to achieve a fair resolution for their roof damage claims.

Assessing Roof Damage Effectively

Effectively evaluating roof damage requires a systematic approach that includes visual inspection techniques, thorough documentation of damage evidence, and an all-encompassing understanding of relevant insurance policies.

Each of these elements plays a critical role in accurately gauging the extent of the damage and ensuring that claims are supported by compelling evidence.

By mastering these assessment strategies, homeowners can considerably improve their chances of a successful insurance claim.

Visual Inspection Techniques

Systematic visual inspection techniques are vital for accurately evaluating roof damage following a storm or other adverse events. A thorough evaluation guarantees that all potential issues are identified and builds a strong foundation for homeowners seeking to file insurance claims.

Among the most effective inspection methods are drone inspections. Drones provide a bird’ s-eye view of the roof, allowing for a detailed examination of hard-to-reach areas. Drones can quickly capture high-resolution images, revealing any signs of damage that may go unnoticed from the ground. This technology enhances safety by reducing the need for ladders and increases efficiency in evaluating large properties.

In addition to drone inspections, thermal imaging offers another layer of insight into roof conditions. By detecting temperature variations, thermal imaging can uncover hidden leaks or moisture issues that may not be visible during a standard inspection. This technology enables public adjusters to present a thorough evaluation, guaranteeing that homeowners receive the full insurance coverage benefits.

These visual inspection techniques empower homeowners by providing accurate evaluations that promote informed decision-making regarding necessary repairs and claims.

Documenting Evidence Of Roofing Damage

Accurate documentation of roof damage is essential for successfully maneuvering the claims process with insurance companies. Homeowners must meticulously gather and present evidence to substantiate their claims, ensuring they receive fair compensation for necessary repairs.

Photographic evidence plays a pivotal role in this documentation; clear, high-quality images can vividly illustrate the extent of damage sustained during a storm or other incidents. These visuals not only capture the condition of the roof but also provide context regarding the surrounding environment.

Additionally, maintenance records should be compiled and presented alongside photographic evidence. These records demonstrate the homeowner’s commitment to regular upkeep and can counter any potential claims of negligence by the insurance company. Homeowners reinforce their position by showcasing a history of maintenance, emphasizing that the damage was not due to poor care but rather external factors beyond their control.

Engaging a public adjuster can further enhance this process. These professionals are adept at compiling and presenting thorough documentation, ensuring all evidence is organized and compelling. By prioritizing accurate documentation, homeowners can significantly increase their chances of a successful claims outcome, fostering a sense of security and belonging in their community.

Understanding Roof Damage Insurance Policies

Managing the complexities of insurance policies is essential for homeowners seeking to assess roof damage effectively. Understanding the intricacies of your insurance policy can significantly impact your ability to obtain a fair settlement.

Homeowners must familiarize themselves with their policy details, including coverage limits and potential policy exclusions that could affect their claim.

Consider the following key aspects when reviewing your policy:

- Coverage Limits: Know how much your policy will pay for roof repairs or replacements.

- Policy Exclusions: Identify damages that are not covered, such as wear and tear or neglect.

- Deductibles: Understand the amount you must pay out-of-pocket before your insurance kicks in.

- Claim Process: Familiarize yourself with the steps to file a claim and any necessary documentation.

- Time Limits: Be aware of the timeframe to report damage and file a claim.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Documenting Losses For Roof Damage Homeowners Insurance Claims

Accurate documentation is essential for ensuring a successful roof damage claim, as it serves as the foundation for establishing the extent of the loss.

Various types of supporting evidence, including photographs, receipts, and repair estimates, can greatly strengthen your case.

Organizing this documentation efficiently not only streamlines the claims process but also enhances your credibility with insurers.

Importance Of Accurate Records

Maintaining thorough and precise records is essential when managing roof damage claims, as it directly influences the outcome of the insurance process. Effective record-keeping enhances claim accuracy and establishes credibility with your insurance provider. Documenting every aspect of the damage and your interactions with contractors sets a solid foundation for your claim.

To guarantee your records are exhaustive, consider including the following:

- Photographic Evidence: Capture clear images of the damage before any repairs.

- Repair Estimates: Keep all estimates from contractors to validate repair costs.

- Correspondence Records: Document all communications with your insurer and adjusters.

- Receipts and Invoices: Maintain receipts for any repairs or materials purchased.

- Timeline of Events: Create a chronological record of the damage occurrence and subsequent actions taken.

Types Of Supporting Evidence

While documenting losses for roof damage claims may seem intimidating, providing thorough supporting evidence is essential for a successful outcome. Homeowners must compile various types of documentation to substantiate their claims effectively.

One of the most crucial forms of supporting evidence is photographic evidence. Capturing clear images of the roof damage from multiple angles illustrates the extent of the loss and serves as a visual record that insurers can reference.

In addition to photographs, repair estimates play an essential role in the claims process. Obtaining detailed estimates from licensed contractors allows homeowners to present a clear picture of the necessary repairs and associated costs. These estimates should outline the scope of work required to restore the roof to its pre-damage condition, providing insurers with concrete figures to reflect on when evaluating the claim.

Together, photographic evidence and repair estimates create a compelling narrative that underscores the validity of the claim. By gathering and presenting these types of supporting evidence, homeowners can greatly improve their chances of receiving a fair settlement, fostering a sense of community and support among those facing similar challenges.

Organizing Documentation Efficiently

Organizing documentation efficiently is essential for homeowners seeking to navigate the complexities of roof damage claims. Properly documenting your losses not only supports your case but also helps you adhere to insurance company claim timelines. A well-structured approach can greatly enhance your chances of a successful claim.

To streamline this process, consider the following organizational strategies:

- Photographs: Capture detailed images of the roof damage, including close-ups and overall shots.

- Repair Estimates: Obtain multiple estimates from licensed contractors to provide a thorough view of repair costs.

- Correspondence: Keep records of all communications with your insurance company, including emails and phone call notes.

- Receipts: Maintain receipts for temporary repairs or related expenses incurred due to the damage.

- Policy Documents: Familiarize yourself with your insurance policy to understand coverage and exclusions.

Negotiating Roof Damage Claims With Homeowners Insurance Companies

Steering through the complexities of negotiating with insurance companies requires a strategic approach and a thorough understanding of policy details.

Homeowners facing roof damage can find this process intimidating, but effective claim strategies can greatly enhance the likelihood of a favorable outcome.

Engaging in negotiations without a solid grasp of your insurance policy can lead to missed opportunities and inadequate settlements.

Utilizing proven negotiation tactics is essential. For instance, being prepared with detailed documentation, including photographs of the damage and repair estimates, can strengthen your position. Clearly articulating the extent of the damage and its impact on your home’s value can help insurers understand the necessity of a fair payout.

Moreover, remaining assertive yet professional throughout the negotiation process fosters a collaborative atmosphere. Insurance companies are more likely to respond positively when approached with respect and clarity. Homeowners should also be aware of their rights and the obligations of the insurer, which can provide leverage in discussions.

With the right strategies and tactics, homeowners can navigate these negotiations more effectively, ensuring their claims are not only heard but adequately addressed.

Benefits Of Hiring An Expert Roofing Adjuster

Steering through the intricacies of roof damage claims can be overwhelming, but hiring a public adjuster can greatly streamline the process.

A public adjuster brings specialized knowledge and advocacy to your claim, ensuring it is handled with care and expertise.

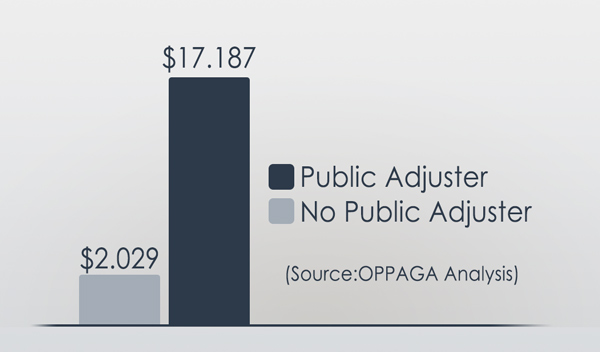

The public adjuster advantages are numerous, enhancing claim process efficiency and helping you secure the compensation you deserve.

Engaging a public adjuster not only enhances the efficiency of your claims process but also fosters a sense of belonging to a community that values professionalism and support during recovery.

Here are some key benefits of hiring a public adjuster:

- Expertise in Insurance Policies: They understand the fine print and can interpret your policy effectively.

- Thorough Damage Assessment: Public adjusters provide detailed evaluations, ensuring no damage is overlooked.

- Time-Saving: They manage all communications and paperwork, freeing you to focus on your life.

- Negotiation Skills: With experience in negotiations, they advocate for your best interests and maximize your payout.

- Peace of Mind: Knowing a professional is handling your claim reduces stress during a challenging time.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

The Roof Damage Insurance Claim Recovery Process

PCAN’s State-licensed public roof damage adjuster members are fluent in “Insurance Policy Jargon”, and will guide you through the entire property insurance claims process, while we fight to make sure you get the highest compensation possible for your claim!

View 7-Step Roof Insurance Claims Process

Step #1

Make Sure Your Family Is Safe

When disaster strikes, the priority is to make sure your family is safe. Always have an emergency bag!

Step #2

Contact A PCAN Roof Public Adjuster

Contact one of our network’s verified, State-licensed, & highly experienced public insurance adjusters to schedule an appointment for them to come out & meet with you to inspect the damage.

Step #3

Thorough Review Of Your Policy

Your public adjuster will conduct a comprehensive review of your policy, note any coverage restrictions, coinsurance requirements, limitations, and review additional options that may be available to you.

Step #4

Create A Claims Strategy That Works For Your Specific Goals & Needs

They will discuss what is most important to you when it comes to your claim, then create & tailor the right claims strategy to take care of your family.

Step #5

Your Public Adjuster Takes Care Of All Insurance Related Paperwork, Negotiations, & Follow Up.

Once you & your PCAN public adjuster have agreed on a strategy, your adjuster will:

- Meet with insurance company adjusters & personnel at the loss/damage location.

- Agree to the scope of damages & make sure that they are including all the damages in the scope, as well as clearly deciding on what should be repaired vs. replaced.

- Prepare a detailed reconstruction estimate.

- Prepare a detailed inventory of personal property.

Step #6

Negotiations & Final Settlement

Your public adjuster will work to make sure you receive the highest settlement possible under your specific insurance policy.

Step #7

Restoration | Reconstruction | Relocation

They will negotiate with the insurance company to ensure that you can achieve your specific goals. Whether that’s full or partial restoration, rebuilding your property, or a full-relocation.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Get The HIGHEST & Most FAIR Settlement Amount Possible From Your Roof Damage Homeowners Insurance Claim!

Get a free on-site inspection & insurance policy evaluation from one of our expert public claims adjusters!

Work with public insurance claim adjusters who are licensed, bonded, and trained to handle all residential or commercial insurance claims, big or small! Our public insurance adjusters’ technical and detailed expertise has satisfied countless homeowners, business owners, condominium management companies, and HOAs.

Our team of experts have years of experience dealing with insurance companies. Many of our public adjusters also have previous backgrounds in construction, giving us a significant advantage in quickly securing the most compensation for our clients. We know what to look for, what repairs actually cost, and what the insurance company’s adjusters tend to ignore (and hope you don’t know about!).

Our inspections are free, and we are 100% contingency-based, meaning we only get paid if you do!

We take pride in maintaining superior customer service and providing clear and friendly communication. Contact us to speak with one of our expert adjusters today!

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Dealing With Insurance Adjuster On Hail Damage – How Public Adjusters Help

Roof Solar Panel Benefits: Environmental, Financial, In-Home

What Is The Average Roof Replacement Deductible In Texas?

Storm Damage Roof Repair: Signs, Costs, & Insurance Claims

Will My Insurance Go Up If I Get A New Roof?

How To Get A New Roof Without Paying A Deductible (For Free)

Tornado Roof Guide: Class 4 Impact Resistant Shingles & Roofing

Roof Hurricane Damage: Types, Signs, Costs, & Home Insurance

Roof Solar Shingle Tiles: Types, Credits & Costs, Insurance

Texas Roof Insurance Claims Process Guide

Insurance Adjuster Says No Hail Damage – How Public Adjusters Help

Hail Damage Vs Roof Blistering: Differences & Insurance Claim Guide

Best Roof Color For Energy Efficiency

Roofer Wants Me To Sign Over Insurance Check?

Ultimate Guide To Roofing Laws In Texas

Storm Damage Roof Inspection Checklist

How Much Does A Roofer Charge Per Hour?

Will Solar Panel Work With Broken Glass?

How To Pay For A New Roof: Cash, Financing, & Insurance

10 Signs Of Hail Damage On Your Roof

Shingle Roof Hail Damage: Repairs, Costs, & Insurance Claims

Roofing Adjusters For Roof Damage Homeowners Insurance Claims

Learn how roofing adjusters can simplify your roof damage homeowners insurance claims process, and maximize your compensation, ensuring higher settlement opportunities.

Service Type: Roofing Adjusters For Roof Damage Homeowners Insurance Claims

Price: 10-20%

Currency: USD

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.