Property Claims Adjusters

How Can Public Adjusters Help With Property Damage Homeowners Insurance Claims?

100% Contingency Based. We Don't Get Paid Unless YOU Get Paid!

Property claims adjusters play an essential role in assisting homeowners with property damage insurance claims. They serve as advocates, maneuvering through the complexities of the claims process while ensuring accurate documentation of damages.

By conducting thorough assessments and estimates, they help homeowners understand their policy terms and potential coverage limits. Their expertise in negotiation often leads to fairer settlements, maximizing the compensation received.

Additionally, public adjusters alleviate homeowners’ emotional burdens by managing intricate claim details. With their support, clients gain confidence in handling claims, paving the way for a smoother resolution to property damage disputes. Further insights can enhance your understanding of this indispensable service.

- Public adjusters conduct thorough damage assessments, documenting every detail to strengthen property damage claims for homeowners.

- We handle all necessary paperwork and negotiations, ensuring timely submission and minimizing delays in the claims process.

- Public adjusters are experts in interpreting insurance policies, identifying coverage areas often overlooked by homeowners.

- Our strategic negotiation techniques help secure fair settlements that accurately reflect the true extent of losses.

- Hiring a public adjuster significantly increases the chances of obtaining higher compensation, providing peace of mind during recovery.

*Some Services Not Available In All Areas. Contingency Fee Not Permitted By Law In Lousianna. By law, services in Kansas are only available for commercial claims.

Request a Free Estimate

- Required Fields

*Some Services May Not Be Available In All Areas

What Our Expert Property Damage Adjusters Bring To The Table

Policy & Claims Specialists

PCAN's property damage public adjusters have years of experience in claims & reviewing coverages. As such, they understand the numerous types of policies and endorsements. Their expertise allows them to find & utalize the various coverages your policy may have, and in many cases, inform you of coverage & clauses you may not even know about.

Advocacy

They advocate for your rights as the policy holder. PCAN public adjusters ensure that their clients’ rights are being protected throughout the claims process, and make sure you get all the benefits you are entitled to based on your policy. Your team of expert property damage claim adjusters will be there with you every step of the way!

Experts In Seen & Unseen Damages

PCAN property claims adjusters have years of experience identifying damage, and in most cases, come from professional construction, roofing, and insurance backgrounds. As such, they are able to find & isolate damages that you may not even know to look for, or know would/should be covered by your policy! They also incorporate the latest assessment techniques & technology when conducting their property inspections.

Expert Negotiators

Settlement negotiation is critically important when it comes to the claims process. PCAN public adjusters know how the insurance companies think, and come to the negotiation table fully prepared to make sure they know, that they know. Their expertise and experience in claims negotiations ensures that you get what you are actually entitled to under your policy ... not what the insurance company tells you that you are, based on their own interests. When the insurance company plays hardball or puts up a fight, PCAN adjusters aren't afraid to get in that ring and fight them for what's rightfully yours!

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Table of Contents

Key Takeaways

- Public adjusters advocate for homeowners, managing the complexities of property damage claims and ensuring fair settlements with insurance companies.

- They provide expert damage assessments and thorough documentation, increasing the likelihood of successful claims.

- Public adjusters clarify confusing insurance policy terms, helping homeowners understand coverage limits and exclusions.

- They leverage negotiation skills to maximize settlements, often resulting in higher compensation for policyholders.

- Hiring a public adjuster alleviates the emotional stress of the claims process, allowing homeowners to focus on recovery.

Understanding Property Damage Public Adjusters

Although many property owners may be unfamiliar with the role of public adjusters, understanding their function is critical in managing the complexities of property damage claims.

Public adjusters serve as advocates for policyholders, specifically trained to navigate the intricate insurance claim process following property damage incidents.

Unlike insurance company adjusters, who represent the insurer’s interests, public adjusters prioritize the policyholder’s perspective, ensuring that claims are accurately assessed and justified.

Property damage adjusters primary responsibilities encompass evaluating property damage, documenting losses, and formulating thorough claims proposals. They meticulously gather evidence, including photographs, repair estimates, and witness statements, to substantiate the claim.

Public adjusters also negotiate with insurance companies, aiming for fair settlements that reflect the true extent of the damages. Moreover, they provide invaluable assistance in understanding policy language, thereby clarifying coverage limits and exclusions.

Their expertise enables property owners to make informed decisions throughout the claims process, ultimately leading to more favorable outcomes. By assuming the complexities of the insurance claim process, public adjusters empower homeowners, alleviating the stress associated with property damage claims and fostering a sense of security in uncertain times.

Benefits Of Hiring A Property Claims Adjuster

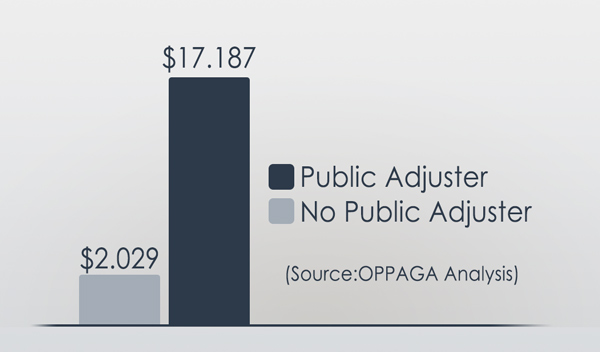

Hiring a public adjuster can greatly enhance the likelihood of a successful property damage claim, particularly in complex situations involving extensive damage.

Public adjusters serve as claims advocates for homeowners, maneuvering the often intricate landscape of insurance policies and claim submissions.

Their expertise allows them to accurately assess the extent of damage, which is essential for maximizing compensation.

One of the primary benefits of hiring a public adjuster is their ability to interpret and apply the nuances of insurance policies. Many homeowners find policy language confusing; public adjusters clarify these complexities, ensuring that all eligible damages are documented and claimed.

This policy maneuvering level can greatly influence a claim’s outcome, particularly when dealing with contentious insurance companies. Moreover, public adjusters bring experience and negotiation skills to the table, often resulting in higher settlements than homeowners negotiated.

They provide emotional relief by managing the claims process, allowing homeowners to focus on recovery rather than the intricacies of insurance disputes. To sum up, hiring a public adjuster streamlines the claims process and fosters a sense of security and confidence during a challenging time.

The Property Damage Claims Process Explained

Understanding the claims process is vital for homeowners maneuvering the aftermath of property damage.

The claims process typically begins with notification to the insurance company, initiating the claims timeline.

Homeowners must provide essential details about the incident, including the date, cause of damage, and any relevant documentation or evidence.

Following this initial report, the insurer assigns a claims adjuster to evaluate the situation. This stage involves technical insurance terminology, as adjusters assess the extent of damage and determine coverage under the policy. Homeowners should be prepared to discuss their policy limits and any exclusions that may affect their claim.

Once the adjuster completes their evaluation, they will submit a report to the insurer, which will ultimately influence the settlement offer presented to the homeowner. It is imperative for homeowners to stay engaged throughout this process, asking questions and seeking clarification on any terms or conditions they do not understand.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Assessment Of Property Damage

Property damage assessment is a critical step in the claims process, requiring a thorough evaluation of the extent and nature of the damage incurred.

This involves a detailed documentation process to guarantee that all affected areas and items are accurately recorded and assessed.

Expert damage estimation is essential to determining the appropriate compensation needed to restore the property to its pre-loss condition.

Thorough Damage Evaluation

Conducting a thorough damage evaluation is vital for accurately assessing property damage following an incident. This process begins with extensive inspections, where public adjusters meticulously assess the property to identify all affected areas. By utilizing their expertise, they can uncover hidden damages that may not be visible to the untrained eye, guaranteeing that no aspect of the loss is overlooked.

Once the inspection is complete, damage categorization plays a significant role in determining the extent of the loss. Public adjusters classify damages into structural, cosmetic, and functional categories to facilitate a clearer understanding of the overall impact on the property. This systematic approach not only aids in crafting a detailed claim but also guarantees homeowners receive the full compensation they deserve.

This depth of analysis is fundamental in establishing a strong foundation for the insurance claim process. Public adjusters empower homeowners by confirming that every detail is accounted for, fostering a sense of security and trust in the claims process. As a result, a thorough damage evaluation is not merely a procedural step; it is an integral part of advocating for the rights and interests of property owners in the aftermath of a loss.

Detailed Documentation Process

Rudimentary documentation during property damage assessments is the cornerstone of a successful insurance claim. A thorough damage assessment enables public adjusters to create a detailed record of the incident, detailing every aspect of the loss.

Effective claim documentation not only substantiates the claim but also facilitates communication with insurance providers, guaranteeing that all necessary information is presented clearly.

The following table outlines key elements involved in the documentation process:

| Documentation Element | Description |

|---|---|

| Photographs | Visual evidence of damages incurred |

| Written Reports | Detailed accounts of the damage assessment |

| Repair Estimates | Cost projections for necessary repairs |

| Inventory Lists | Itemized records of lost or damaged property |

| Witness Statements | Accounts from individuals present during the incident |

Engaging in precise claim documentation fosters a sense of belonging among homeowners, as they become active participants in the claims process. By collaborating with public adjusters, property owners can guarantee that their claims are well-supported, thereby enhancing the likelihood of a favorable outcome.

Expert Damage Estimation

Expert damage estimation plays a significant role in evaluating property damage and determining the appropriate compensation for policyholders. This process involves a thorough assessment of the extent and severity of damage, which is vital for accurate insurance valuation. Public adjusters use their expertise to conduct detailed inspections, identify affected areas, and estimate repair costs based on industry standards.

A key component of expert damage estimation is the analysis of relevant data, including photographs, contractor estimates, and market conditions. By compiling this information, public adjusters can present an extensive and substantiated claim that reflects the true value of the loss incurred. This meticulous approach is essential for effective claim adjustments, ensuring that policyholders receive fair compensation for their losses.

Moreover, public adjusters advocate for homeowners throughout the claims process, maneuvering complex insurance policies and engaging with insurance companies on their behalf. By leveraging their knowledge and skills, they help policyholders avoid common pitfalls, maximizing the potential for a successful outcome. Ultimately, expert damage estimation is invaluable for homeowners seeking to reclaim their peace of mind after a property loss, fostering a sense of community and support during challenging times.

Property Damage Negotiation Strategies For Settlements

Effective negotiation strategies for settlements in property damage claims hinge on a thorough understanding of policy terms, which allows public adjusters to advocate effectively for their clients.

Thorough documentation of damage is essential, as it provides the necessary evidence to support claims and influences the negotiation process.

Additionally, employing effective communication techniques can enhance the clarity and persuasiveness of the argument, ultimately facilitating a more favorable settlement outcome.

Understanding Policy Terms

Understanding the nuances of policy terms is vital for effectively negotiating settlements in property damage claims. Homeowners must familiarize themselves with their insurance policy’s specific language, particularly regarding coverage limits and policy exclusions. Coverage limits denote the maximum amount an insurer will pay for a covered loss, while policy exclusions outline specific circumstances or types of damage that are not covered.

When negotiating, homeowners should closely examine these terms to guarantee that the claim aligns with the policy’s provisions. Misinterpretations or lack of understanding can lead to unfavorable outcomes, where rightful claims are denied or undervalued. Public adjusters play a significant role here; they possess the expertise to interpret complex policy language and identify how coverage limits apply to specific claims.

Additionally, public adjusters can advocate effectively on behalf of homeowners, emphasizing the importance of extensive coverage and seeking to minimize the impact of exclusions. By leveraging their knowledge, they can negotiate settlements that reflect the true value of the loss, ensuring that homeowners receive the compensation they deserve. Ultimately, a firm grasp of policy terms fosters a more robust negotiation strategy in property damage claims.

Documenting Damage Thoroughly

Thorough documentation of damage is vital in the negotiation process for property damage claims, as it serves as the foundation for substantiating the extent and value of losses incurred. Effective damage documentation techniques should incorporate a systematic approach to capturing all relevant details, including photographs, videos, and written descriptions of the affected areas.

Visual evidence plays an essential role, providing tangible proof of the damage and making it easier for public adjusters and insurance companies to assess the situation accurately. When documenting damage, homeowners should guarantee that they record the date of the incident, the specific types of damage, and any actions taken immediately following the event.

This all-encompassing approach strengthens the claim and promotes transparency, fostering trust between the homeowner and the insurer. Also, maintaining an organized file of receipts and repair estimates can further enhance the claim’s credibility.

Effective Communication Techniques

Mastery of communication techniques is pivotal in the negotiation process for property damage claims. Public adjusters utilize effective listening as a cornerstone of their strategy, fostering strong client relationships and ensuring the homeowner’s needs and concerns are fully understood. By attentively engaging with clients, adjusters can gather critical information about their negotiation tactics.

Moreover, clear and concise communication is essential when articulating the details of the claim to insurance adjusters. Public adjusters must present compelling evidence and narratives that resonate with insurers, establishing a credible representation of the homeowner’s situation. This requires an analytical approach, where adjusters assess the strengths and weaknesses of the claim and adapt their negotiation strategies accordingly.

Building rapport with clients and insurance representatives increases the likelihood of a favorable settlement. Public adjusters should employ empathetic communication, acknowledging the emotional aspects of property damage while remaining focused on the facts. In doing so, they create a collaborative environment that encourages open dialogue, ultimately leading to more successful negotiations and satisfactory outcomes for all parties involved.

Common Misconceptions About Property Damage Adjusters

Many homeowners hold misconceptions about the role and function of public adjusters in the property damage claims process.

One prevalent public adjuster myth is that these professionals work exclusively for insurance companies.

In reality, public adjusters advocate for the policyholder, ensuring that homeowners receive fair compensation for their claims.

This fundamental misunderstanding can deter homeowners from utilizing their services.

Another common homeowner misconception is that hiring a public adjuster is an unnecessary expense. While a fee is involved, often a percentage of the settlement, their expertise can considerably increase the claim amount, making their services a worthwhile investment.

Additionally, some believe that public adjusters are only needed for large claims; however, they can add value to claims of any size by steering through the complexities of the insurance process.

Lastly, there is a belief that public adjusters can guarantee a specific claim outcome. While they aim for the best possible results through diligent advocacy, the final determination rests with the insurance company. By addressing these public adjuster myths, homeowners can make informed decisions and potentially enhance their claims experience.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

The Property Damage Insurance Claim Recovery Process

PCAN’s State-licensed public property damage adjuster members are fluent in “Insurance Policy Jargon”, and will guide you through the entire property insurance claims process, while we fight to make sure you get the highest compensation possible for your claim!

View 7-Step Property Insurance Claims Process

Step #1

Make Sure Your Family Is Safe

When disaster strikes, the priority is to make sure your family is safe. Always have an emergency bag!

Step #2

Contact A PCAN Property Public Adjuster

Contact one of our network’s verified, State-licensed, & highly experienced public insurance adjusters to schedule an appointment for them to come out & meet with you to inspect the damage.

Step #3

Thorough Review Of Your Policy

Your public adjuster will conduct a comprehensive review of your policy, note any coverage restrictions, coinsurance requirements, limitations, and review additional options that may be available to you.

Step #4

Create A Claims Strategy That Works For Your Specific Goals & Needs

They will discuss what is most important to you when it comes to your claim, then create & tailor the right claims strategy to take care of your family.

Step #5

Your Public Adjuster Takes Care Of All Insurance Related Paperwork, Negotiations, & Follow Up.

Once you & your PCAN public adjuster have agreed on a strategy, your adjuster will:

- Meet with insurance company adjusters & personnel at the loss/damage location.

- Agree to the scope of damages & make sure that they are including all the damages in the scope, as well as clearly deciding on what should be repaired vs. replaced.

- Prepare a detailed reconstruction estimate.

- Prepare a detailed inventory of personal property.

Step #6

Negotiations & Final Settlement

Your public adjuster will work to make sure you receive the highest settlement possible under your specific insurance policy.

Step #7

Restoration | Reconstruction | Relocation

They will negotiate with the insurance company to ensure that you can achieve your specific goals. Whether that’s full or partial restoration, rebuilding your property, or a full-relocation.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Get The HIGHEST & Most FAIR Settlement Amount Possible From Your Property Damage Property Claim!

Get a free on-site inspection & insurance policy evaluation from one of our expert public claims adjusters!

Work with public insurance claim adjusters who are licensed, bonded, and trained to handle all residential or commercial insurance claims, big or small! Our public insurance adjusters’ technical and detailed expertise has satisfied countless homeowners, business owners, condominium management companies, and HOAs.

Our team of experts have years of experience dealing with insurance companies. Many of our public adjusters also have previous backgrounds in construction, giving us a significant advantage in quickly securing the most compensation for our clients. We know what to look for, what repairs actually cost, and what the insurance company’s adjusters tend to ignore (and hope you don’t know about!).

Our inspections are free, and we are 100% contingency-based, meaning we only get paid if you do!

We take pride in maintaining superior customer service and providing clear and friendly communication. Contact us to speak with one of our expert adjusters today!

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

What Insurance Covers Property Damage?

Landscaper Damaged My Property – What To Do?

How To Handle Damage Caused By Contractors

Does Homeowners Insurance Cover Damage To Neighbors Property?

What To Do If Contractor Damaged My Property

Guide To Suing Contractors For Property Damage

What Is It Called When Someone Damages Your Property?

What Is Property Damage Liability Coverage?

How To Prove Someone Damaged Your Property

Car Hit My Fence – Who Pays?

What Can I Do If Someone Damaged My Property?

Property Damage Report: What Is It & How To File One

How Much Can You Sue For Property Damage?

Understanding Compensation For Damage To Property

What Is Direct Compensation Property Damage?

Are Insurance Proceeds For Property Damage Taxable?

Does Renters Insurance Cover Property Damage?

What Are The 4 Major Classifications Of Property Damage?

Guide To The Property Damage Insurance Claims Process

Property Damage: Types, 4 Major Classifications, & Claims

What Does A Property Damage Public Adjuster Do?

Public Adjusters For Property Damage Homeowners Insurance Claims

Property claims adjusters can simplify your property damage homeowners insurance claims process, and maximize your compensation, ensuring higher settlement opportunities.

Service Type: Property Claims Adjuster

Price: 10-20%

Currency: USD

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.