Lightning Strike Insurance Claims

How Can Public Adjusters Help With Lightning Strike Homeowners Insurance Claims?

100% Contingency Based. We Don't Get Paid Unless YOU Get Paid!

Public adjusters provide expert guidance and advocacy to homeowners negotiating lightning strike insurance claims. To substantiate claims and counter potential insurance company disputes, they thoroughly document damaged items, including age and value.

Public adjusters help homeowners avoid pitfalls and secure fair settlements by understanding insurance policy limitations and exclusions. They also expedite the claims process, allowing for quicker recovery from lightning-related losses.

As licensed experts, public adjusters possess the knowledge and expertise to maximize settlement amounts and guarantee favorable outcomes, making their involvement a valuable asset in the claims process, with benefits that can be further explored.

- Public adjusters conduct thorough damage assessments, documenting every detail to strengthen lightning damage claims for homeowners.

- We handle all necessary paperwork and negotiations, ensuring timely submission and minimizing delays in the claims process.

- Public adjusters are experts in interpreting insurance policies, identifying coverage areas often overlooked by homeowners.

- Our strategic negotiation techniques help secure fair settlements that accurately reflect the true extent of losses.

- Hiring a public adjuster significantly increases the chances of obtaining higher compensation, providing peace of mind during recovery.

*Some Services Not Available In All Areas. Contingency Fee Not Permitted By Law In Lousianna. By law, services in Kansas are only available for commercial claims.

Request a Free Estimate

- Required Fields

*Some Services May Not Be Available In All Areas

What Our Expert Lightning Damage Adjusters Bring To The Table

Policy & Claims Specialists

PCAN's lightning damage public adjusters have years of experience in claims & reviewing coverages. As such, they understand the numerous types of policies and endorsements. Their expertise allows them to find & utalize the various coverages your policy may have, and in many cases, inform you of coverage & clauses you may not even know about.

Advocacy

They advocate for your rights as the policy holder. PCAN public adjusters ensure that their clients’ rights are being protected throughout the claims process, and make sure you get all the benefits you are entitled to based on your policy. Your team of expert lightning damage claim adjusters will be there with you every step of the way!

Experts In Seen & Unseen Damages

PCAN lightning claims adjusters have years of experience identifying damage, and in most cases, come from professional construction, roofing, and insurance backgrounds. As such, they are able to find & isolate damages that you may not even know to look for, or know would/should be covered by your policy! They also incorporate the latest assessment techniques & technology when conducting their property inspections.

Expert Negotiators

Settlement negotiation is critically important when it comes to the claims process. PCAN public adjusters know how the insurance companies think, and come to the negotiation table fully prepared to make sure they know, that they know. Their expertise and experience in claims negotiations ensures that you get what you are actually entitled to under your policy ... not what the insurance company tells you that you are, based on their own interests. When the insurance company plays hardball or puts up a fight, PCAN adjusters aren't afraid to get in that ring and fight them for what's rightfully yours!

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Table of Contents

Key Takeaways

- Public adjusters document and value property damage to substantiate lightning damage claims effectively, improving chances of fair settlements.

- They navigate insurance policies to identify exclusions or limitations on coverage, helping homeowners avoid potential pitfalls.

- Public adjusters gather and present evidence, including expert evaluations, to counter insurer tactics and maximize settlement amounts.

- They negotiate directly with insurance providers to streamline the claims process, expediting recovery from lightning-related losses.

- Public adjusters provide guidance to homeowners, helping them understand complex insurance policies and ensuring accurate documentation of all affected items.

Understanding Lightning Strike Insurance Claims

Lightning damage claims can be complex and nuanced, often requiring a multifaceted approach to secure a successful outcome.

When a lightning strike causes property damage, homeowners must navigate the intricacies of their insurance claims to receive a fair settlement.

A thorough understanding of the homeowners insurance policy is essential, as coverage terms can vary, and policyholders must know what is included and excluded.

Documenting damaged items, including their age and value, is vital to guarantee a successful claim. This documentation serves as evidence of the damage caused by the lightning strike, which insurers often require to approve the claim.

However, even with thorough documentation, claims may still face challenges, such as disputed causes or the extent of damage. In these situations, understanding the claims process and being prepared to address potential issues can make a significant difference in achieving a favorable outcome.

Role Of Public Adjusters In Lighting Insurance Claims

When maneuvering the complexities of a lightning damage claim, the involvement of a public adjuster can be instrumental in securing a favorable outcome.

Public adjusters are licensed experts who advocate for homeowners, ensuring they receive fair settlements for lightning damage claims.

Their expertise encompasses:

- Thoroughly documenting and valuing the extent of property damage to substantiate claims

- Traversing the complexities of insurance policies to identify potential exclusions or limitations

- Gathering and presenting evidence, such as expert evaluations, to counter insurer tactics to undervalue losses

- Negotiating directly with insurance providers on behalf of homeowners to streamline the claims process

Navigating Lighting Strike Insurance Claim Process

Following a lightning damage incident, the insurance claim process can be a challenging and intricate ordeal for homeowners.

Public adjusters are crucial in steering this process, ensuring that property owners receive a fair settlement for their losses.

By documenting damage thoroughly, including taking photos and videos, public adjusters establish a clear record of the destruction, which is essential for a successful insurance claim.

Public adjusters also help homeowners understand their insurance policy, highlighting coverage limitations and exclusions related to lightning damage. This expertise enables them to prepare detailed reports and assessments that support the homeowner’s claim, countering potential disputes from insurance companies regarding the cause or extent of the damage.

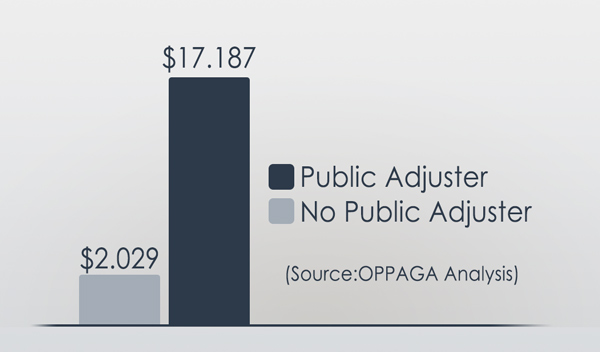

During on-site inspections with insurance adjusters, public adjusters act as advocates, ensuring all areas of concern are highlighted and adequately evaluated. By leveraging their expertise, public adjusters can negotiate more favorable settlements on behalf of homeowners, often resulting in higher payouts than what policyholders might secure on their own, ultimately helping to settle your claim efficiently and effectively.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Preventing Future Lightning Strike Damage

While repairing and recovering from lightning damage can be a significant undertaking, proactive measures can mitigate the risk of future incidents.

Homeowners can take steps to protect their properties from lightning strikes and subsequent damage.

A public insurance adjuster can provide valuable guidance on insurance claim tips and the claims process, including appliance damage.

Regular maintenance and inspections of lightning protection systems are essential to guarantee their effectiveness and compliance with safety standards, thereby enhancing overall property safety. By taking proactive measures, homeowners can reduce the risk of lightning damage and minimize the need for complex insurance claims.

To prevent future lightning damage, consider the following measures:

- Installing lightning rods to redirect lightning strikes away from structures

- Implementing grounding systems to safely dissipate electrical discharges into the earth, preventing fire hazards and electrical surges

- Using surge protectors at electrical entry points to safeguard electronic devices from voltage spikes caused by nearby lightning strikes

- Opting for fire-resistant and non-conductive building materials, such as metal roofing, to help disperse lightning energy and minimize damage during a strike

Benefits Of Hiring Public Adjusters For Lightning Strike Claims

Hiring a public adjuster can greatly enhance homeowners’ chances of securing a fair and thorough insurance settlement for lightning damage claims.

These experts specialize in evaluating and documenting lightning damage, guaranteeing all affected items are accurately represented in insurance claims to maximize settlement amounts.

By leveraging their knowledge of industry standards and claim procedures, public adjusters can negotiate effectively with insurance companies, often resulting in higher settlements than homeowners would achieve on their own.

Public adjusters provide expert guidance throughout the claims process, helping homeowners navigate complex insurance policies and avoid common pitfalls that could lead to claim denials. They assist in gathering necessary documentation and evidence, such as photographs, expert evaluations, and warranty information, to substantiate claims related to hidden or long-term damage from lightning strikes.

This involvement can expedite the claims process, allowing homeowners to recover more quickly from lightning-related losses and reduce the stress associated with dealing with insurance companies. By hiring a public adjuster, homeowners can guarantee their lightning damage claims are handled professionally and efficiently, resulting in a fair and maximum settlement.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

The Lightning Damage Insurance Claim Recovery Process

PCAN’s State-licensed public lightning damage adjuster members are fluent in “Insurance Policy Jargon”, and will guide you through the entire property insurance claims process, while we fight to make sure you get the highest compensation possible for your claim!

View 7-Step Lightning Insurance Claims Process

Step #1

Make Sure Your Family Is Safe

When disaster strikes, the priority is to make sure your family is safe. Always have an emergency bag!

Step #2

Contact A PCAN Lightning Public Adjuster

Contact one of our network’s verified, State-licensed, & highly experienced public insurance adjusters to schedule an appointment for them to come out & meet with you to inspect the damage.

Step #3

Thorough Review Of Your Policy

Your public adjuster will conduct a comprehensive review of your policy, note any coverage restrictions, coinsurance requirements, limitations, and review additional options that may be available to you.

Step #4

Create A Claims Strategy That Works For Your Specific Goals & Needs

They will discuss what is most important to you when it comes to your claim, then create & tailor the right claims strategy to take care of your family.

Step #5

Your Public Adjuster Takes Care Of All Insurance Related Paperwork, Negotiations, & Follow Up.

Once you & your PCAN public adjuster have agreed on a strategy, your adjuster will:

- Meet with insurance company adjusters & personnel at the loss/damage location.

- Agree to the scope of damages & make sure that they are including all the damages in the scope, as well as clearly deciding on what should be repaired vs. replaced.

- Prepare a detailed reconstruction estimate.

- Prepare a detailed inventory of personal property.

Step #6

Negotiations & Final Settlement

Your public adjuster will work to make sure you receive the highest settlement possible under your specific insurance policy.

Step #7

Restoration | Reconstruction | Relocation

They will negotiate with the insurance company to ensure that you can achieve your specific goals. Whether that’s full or partial restoration, rebuilding your property, or a full-relocation.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Get The HIGHEST & Most FAIR Settlement Amount Possible From Your Lightning Damage Property Damage Insurance Claim!

Get a free on-site inspection & insurance policy evaluation from one of our expert public claims adjusters!

Work with public insurance claim adjusters who are licensed, bonded, and trained to handle all residential or commercial insurance claims, big or small! Our public insurance adjusters’ technical and detailed expertise has satisfied countless homeowners, business owners, condominium management companies, and HOAs.

Our team of experts have years of experience dealing with insurance companies. Many of our public adjusters also have previous backgrounds in construction, giving us a significant advantage in quickly securing the most compensation for our clients. We know what to look for, what repairs actually cost, and what the insurance company’s adjusters tend to ignore (and hope you don’t know about!).

Our inspections are free, and we are 100% contingency-based, meaning we only get paid if you do!

We take pride in maintaining superior customer service and providing clear and friendly communication. Contact us to speak with one of our expert adjusters today!

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Lightning Damage Guide: How Public Adjusters Can Maximize Your Insurance Claim

Is It Safe To Shower During Thunderstorm?

Guide To Lighting Strike Damage Homeowners Insurance Claims

Guide To Power Surge Insurance Claims

Guide To Lightning Strike Roof Damage Insurance Claims

Guide To Lightning Strike Tree Damage Insurance Claims

How To Ground Your House From Lightning

Signs Of Lightning Strike To Ac Unit

What Does It Sound Like When Lightning Hits Your House?

Will You Die If Your House Gets Struck By Lightning?

Can Lightning Strike You In Bed?

Can Lightning Go Through A Roof?

Can You Get Struck By Lightning In Your House?

Can Lightning Strike Inside A House?

Can You Get Struck By Lightning Through A Window?

Can You Get Struck By Lightning In The Shower?

What Happens If Lightning Strikes A House?

What Attracts Lightning To A House?

10 Lightning Safety Tips

How To Prevent Lightning Strikes On Home

What To Do In A Thunderstorm In A House

Public Adjusters For Lightning Damage Insurance Claims

Public adjusters can simplify your lightning damage homeowners insurance claims process, and maximize your compensation, ensuring higher settlement opportunities.

Service Type: Public Adjusters For Lightning Damage Insurance Claims

Price: 10-20%

Currency: USD

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.