Flooded Basement Insurance Claims

How Can Public Adjusters Help With Flooded Basement Homeowners Insurance Claims?

100% Contingency Based. We Don't Get Paid Unless YOU Get Paid!

Flooded Basement Public Adjusters assist homeowners with flooded basement insurance claims by providing expertise in documenting and evaluating flood damage, negotiating with insurance companies for fair settlements, and appealing denied claims.

They manage the claims process to guarantee maximum settlement, conducting detailed damage assessments and effective communication with insurance companies.

By engaging a public adjuster, homeowners can save time and stress. They handle claims tasks on their behalf, and with their expertise, public adjusters increase the chances of favorable outcomes.

Understanding the role of public adjusters and how to choose the right one is crucial to benefit from their services fully.

- Public adjusters conduct thorough damage assessments, documenting every detail to strengthen flooded basement damage claims for homeowners.

- We handle all necessary paperwork and negotiations, ensuring timely submission and minimizing delays in the claims process.

- Public adjusters are experts in interpreting insurance policies, identifying coverage areas often overlooked by homeowners.

- Our strategic negotiation techniques help secure fair settlements that accurately reflect the true extent of losses.

- Hiring a public adjuster significantly increases the chances of obtaining higher compensation, providing peace of mind during recovery.

*Some Services Not Available In All Areas. Contingency Fee Not Permitted By Law In Lousianna. By law, services in Kansas are only available for commercial claims.

Request a Free Estimate

- Required Fields

*Some Services May Not Be Available In All Areas

What Our Expert Flooded Basement Damage Adjusters Bring To The Table

Policy & Claims Specialists

PCAN's flooded basement damage public adjusters have years of experience in claims & reviewing coverages. As such, they understand the numerous types of policies and endorsements. Their expertise allows them to find & utalize the various coverages your policy may have, and in many cases, inform you of coverage & clauses you may not even know about.

Advocacy

They advocate for your rights as the policy holder. PCAN public adjusters ensure that their clients’ rights are being protected throughout the claims process, and make sure you get all the benefits you are entitled to based on your policy. Your team of expert flooded basement damage claim adjusters will be there with you every step of the way!

Experts In Seen & Unseen Damages

PCAN flooded basement claims adjusters have years of experience identifying damage, and in most cases, come from professional construction, roofing, and insurance backgrounds. As such, they are able to find & isolate damages that you may not even know to look for, or know would/should be covered by your policy! They also incorporate the latest assessment techniques & technology when conducting their property inspections.

Expert Negotiators

Settlement negotiation is critically important when it comes to the claims process. PCAN public adjusters know how the insurance companies think, and come to the negotiation table fully prepared to make sure they know, that they know. Their expertise and experience in claims negotiations ensures that you get what you are actually entitled to under your policy ... not what the insurance company tells you that you are, based on their own interests. When the insurance company plays hardball or puts up a fight, PCAN adjusters aren't afraid to get in that ring and fight them for what's rightfully yours!

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Table of Contents

Key Takeaways

- Public adjusters document and evaluate flood damage to ensure accurate claim valuations and maximum settlements for homeowners.

- They negotiate with insurance companies to secure fair compensation and address discrepancies in offers.

- Public adjusters manage the claims process, saving homeowners time and stress, and advocate for their interests.

- They investigate and appeal denied claims, providing thorough documentation to support the appeal.

- Public adjusters work on a contingency fee basis, aligning their interests with homeowners’ outcomes and increasing chances of favorable settlements.

Understanding Flooded Basement Insurance Claims

With the intricacies of flood insurance policies often overwhelming homeowners, understanding flood insurance claims is essential in recovering from the devastating effects of a flooded basement.

Flood insurance claims can be complex, requiring a thorough understanding of policy specifics and coverage limitations.

Public adjusters are well-versed in maneuvering through these intricacies, providing expertise in documenting and evaluating flood damage to guarantee all affected areas are assessed and claim value is maximized.

A prompt and thorough filing of a flood insurance claim is vital, as delays can lead to complications or claim denial. Public adjusters can guide homeowners through the claims process, handling negotiations with insurance companies to secure fair settlements.

In the event of a denied claim, public adjusters can assist in appealing the decision by conducting thorough investigations and presenting evidence to support the claim’s validity.

Their expertise in insurance coverage and property damage assessment can help homeowners navigate the often-complex world of flood insurance claims, streamlining the process and facilitating a smoother recovery from flood damages.

Benefits Of Hiring Flooded Basement Public Insurance Adjusters

The expertise of a public adjuster can be a crucial asset for homeowners dealing with the aftermath of a flooded basement.

Managing the complexities of a flood claim can be overwhelming, but a public insurance adjuster can help property owners understand their coverage and maximize claim value.

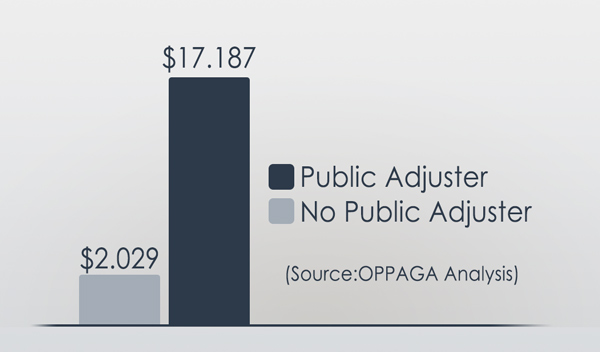

By hiring an experienced public adjuster, homeowners can benefit from expert documentation and flood damage evaluation, increasing the likelihood of securing ideal settlements that homeowners or insurance company adjusters might overlook.

Some key benefits of hiring a public adjuster for a water damage insurance claim include:

- Expert management of the claims process to guarantee maximum settlement

- Detailed damage assessments to accurately determine claim value

- Effective communication and negotiation with insurance companies to advocate for the homeowner’s interests

- Time and stress savings by handling claims process tasks on behalf of the homeowner

- On a contingency fee basis, the public adjuster’s interests should be aligned with the homeowner’s to secure the best possible outcome.

Maximizing Your Flooded Basement Insurance Settlement

Homeowners who have experienced a flooded basement often face considerable challenges in securing a fair insurance settlement, as the complexities of flood damage claims can lead to undervalued or delayed payouts.

A public adjuster can be essential in maximizing homeowners’ insurance settlements. Public adjusters guarantee that all affected basement areas are documented by thoroughly evaluating flood damage, resulting in a more accurate claim value.

Public adjusters develop tailored claims strategies considering policy limits and exclusions, greatly improving the likelihood of securing ideal settlements.

Their expertise in negotiating with insurance companies enables them to advocate for fair compensation based on detailed damage evaluations effectively. Public adjusters manage meticulous documentation and timely filing, streamlining the claims process and avoiding settlement delays.

By engaging a public adjuster, homeowners can increase their chances of a favorable outcome and maximize their insurance settlement, ultimately guaranteeing that they receive the compensation they deserve for their flood-damaged property.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Navigating The Flooded Basement Insurance Claims Process

Frequently, maneuvering through the complex flood insurance claims process can be a challenging task for homeowners, consuming considerable time and effort as they attempt to secure a fair settlement.

Public adjusters are essential in steering this process, utilizing their expertise to maximize settlement outcomes.

By engaging a public adjuster, homeowners can guarantee prompt claim filing, thorough damage documentation, and adherence to vital timelines, reducing the risk of denials due to delays or missed documentation.

Critical aspects of guiding the claims process with a public adjuster include:

- Developing a tailored claims strategy to understand coverage specifics under flood insurance policies

- Conducting thorough documentation of all damages to support the water damage claim

- Negotiating directly with insurance companies to secure fair settlements and address discrepancies in initial offers

- Maintaining continuous communication with stakeholders to keep homeowners informed throughout the claims journey

- Providing ongoing support to address any questions or concerns that may arise during the process

Choosing The Right Public Adjuster For Flooded Basement Claims

Selecting a qualified public adjuster is critical in guaranteeing a successful flood insurance claim outcome.

To confirm qualifications and adherence to industry standards, verify the Department of Insurance (TDI) for your state has a license for the adjuster on record.

Consider the following criteria when evaluating a public adjuster:

| Criteria | Description | Importance |

|---|---|---|

| Licensed | Verify TDI licensure | High |

| Recommendations | Check online reviews and ask for referrals | Medium |

| Experience | Confirm expertise in flood damage claims | High |

| Fee Structure | Understand the adjuster’s fee, up to 10% of the claim payout | Medium |

| Complaints | Check for disciplinary actions through TDI | High |

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

The Flooded Basement Damage Insurance Claim Recovery Process

PCAN’s State-licensed public flooded basement damage adjuster members are fluent in “Insurance Policy Jargon”, and will guide you through the entire property insurance claims process, while we fight to make sure you get the highest compensation possible for your claim!

View 7-Step Flooded Basement Insurance Claims Process

Step #1

Make Sure Your Family Is Safe

When disaster strikes, the priority is to make sure your family is safe. Always have an emergency bag!

Step #2

Contact A PCAN Flooded Basement Damage Public Adjuster

Contact one of our network’s verified, State-licensed, & highly experienced public insurance adjusters to schedule an appointment for them to come out & meet with you to inspect the damage.

Step #3

Thorough Review Of Your Policy

Your public adjuster will conduct a comprehensive review of your policy, note any coverage restrictions, coinsurance requirements, limitations, and review additional options that may be available to you.

Step #4

Create A Claims Strategy That Works For Your Specific Goals & Needs

They will discuss what is most important to you when it comes to your claim, then create & tailor the right claims strategy to take care of your family.

Step #5

Your Public Adjuster Takes Care Of All Insurance Related Paperwork, Negotiations, & Follow Up.

Once you & your PCAN public adjuster have agreed on a strategy, your adjuster will:

- Meet with insurance company adjusters & personnel at the loss/damage location.

- Agree to the scope of damages & make sure that they are including all the damages in the scope, as well as clearly deciding on what should be repaired vs. replaced.

- Prepare a detailed reconstruction estimate.

- Prepare a detailed inventory of personal property.

Step #6

Negotiations & Final Settlement

Your public adjuster will work to make sure you receive the highest settlement possible under your specific insurance policy.

Step #7

Restoration | Reconstruction | Relocation

They will negotiate with the insurance company to ensure that you can achieve your specific goals. Whether that’s full or partial restoration, rebuilding your property, or a full-relocation.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Get The HIGHEST & Most FAIR Settlement Amount Possible From Your Flooded Basement Property Damage Insurance Claim!

Get a free on-site inspection & insurance policy evaluation from one of our expert public claims adjusters!

Work with public insurance claim adjusters who are licensed, bonded, and trained to handle all residential or commercial insurance claims, big or small! Our public insurance adjusters’ technical and detailed expertise has satisfied countless homeowners, business owners, condominium management companies, and HOAs.

Our team of experts have years of experience dealing with insurance companies. Many of our public adjusters also have previous backgrounds in construction, giving us a significant advantage in quickly securing the most compensation for our clients. We know what to look for, what repairs actually cost, and what the insurance company’s adjusters tend to ignore (and hope you don’t know about!).

Our inspections are free, and we are 100% contingency-based, meaning we only get paid if you do!

We take pride in maintaining superior customer service and providing clear and friendly communication. Contact us to speak with one of our expert adjusters today!

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

How To Soak Up Water On Concrete In Basement

Cracks In Basement Floors: Types, Causes, & Fixes

Basement Sewer Line Replacement Cost Guide

Basement Sewage & Drain Backup: Causes, What To Do, & Repairs

Water Coming Up From Floor In Basement- What To Do

How To File A Basement Water Damage Insurance Claim

Who To Call To Pump Water Out Of Basement

What To Do When Your Basement Floods From Rain

Basement Flooding Insurance Claim Being Denied – What To Do

Does Homeowners Insurance Cover Finished Basements?

Does Homeowners Insurance Cover Flooding From Rain?

Flooded Bathroom Insurance Claim Guide

How To Get Rid Of Mold In Basement

Sump Pump Flooded Basement: Causes, Fixes, Costs & Insurance Claims

How To Get Rid Of Black Mold In Basement

Basement Sewage Cleanup: Causes, Cleanup Options, & Costs

Water Heater Flooded Basement: Causes, Fixes, Costs & Insurance Claims

How To Prevent Basement Mold After Flood & Water Damage

What To Do After Basement Flood To Reduce & Fix Water Damage

What To Do When Your Basement Floods & How To Stop It

What To Do To Prevent Basement Flooding & Water Damage

Public Adjusters For Flooded Basement Homeowners Insurance Claims

Learn how flooded basement public adjusters can simplify your flooded basement homeowners insurance claims, and maximize your compensation, ensuring higher settlement opportunities!

Service Type: Public Adjusters For Flooded Basement Insurance Claims

Price: 10-20%

Currency: USD

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.