Public Adjusters For Commercial Property Damage Insurance Claims

How Can Public Adjusters Help With Commercial Property Damage Insurance Claims?

100% Contingency Based. We Don't Get Paid Unless YOU Get Paid!

Public adjusters serve as essential advocates for commercial property damage insurance claims for commercial property owners dealing with damage insurance claims.

Their specialized knowledge enables thorough assessments of property damage, uncovering both visible and hidden issues that insurers may overlook. By meticulously documenting evidence and interpreting complex insurance policies, they guarantee that policyholders understand their coverage and avoid potential financial pitfalls.

Skilled negotiation strategies further empower them to secure ideal settlements, addressing both the immediate and long-term financial impacts on businesses. Engaging a public adjuster can greatly enhance your chances of a favorable outcome, revealing valuable insights into the claims process ahead.

- Public adjusters conduct thorough damage assessments, documenting every detail to strengthen commercial property damage claims for homeowners.

- We handle all necessary paperwork and negotiations, ensuring timely submission and minimizing delays in the claims process.

- Public adjusters are experts in interpreting insurance policies, identifying coverage areas often overlooked by homeowners.

- Our strategic negotiation techniques help secure fair settlements that accurately reflect the true extent of losses.

- Hiring a public adjuster significantly increases the chances of obtaining higher compensation, providing peace of mind during recovery.

*Some Services Not Available In All Areas. Contingency Fee Not Permitted By Law In Lousianna. By law, services in Kansas are only available for commercial claims.

Request a Free Estimate

- Required Fields

*Some Services May Not Be Available In All Areas

What Our Expert Commercial Property Damage Adjusters Bring To The Table

Policy & Claims Specialists

PCAN's commercial property damage public adjusters have years of experience in claims & reviewing coverages. As such, they understand the numerous types of policies and endorsements. Their expertise allows them to find & utalize the various coverages your policy may have, and in many cases, inform you of coverage & clauses you may not even know about.

Advocacy

They advocate for your rights as the policy holder. PCAN public adjusters ensure that their clients’ rights are being protected throughout the claims process, and make sure you get all the benefits you are entitled to based on your policy. Your team of expert commercial property damage claim adjusters will be there with you every step of the way!

Experts In Seen & Unseen Damages

PCAN commercial property claims adjusters have years of experience identifying damage, and in most cases, come from professional construction, roofing, and insurance backgrounds. As such, they are able to find & isolate damages that you may not even know to look for, or know would/should be covered by your policy! They also incorporate the latest assessment techniques & technology when conducting their property inspections.

Expert Negotiators

Settlement negotiation is critically important when it comes to the claims process. PCAN public adjusters know how the insurance companies think, and come to the negotiation table fully prepared to make sure they know, that they know. Their expertise and experience in claims negotiations ensures that you get what you are actually entitled to under your policy ... not what the insurance company tells you that you are, based on their own interests. When the insurance company plays hardball or puts up a fight, PCAN adjusters aren't afraid to get in that ring and fight them for what's rightfully yours!

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Table of Contents

Key Takeaways

- Public adjusters conduct thorough damage assessments, identifying both visible and underlying issues to support accurate claims.

- They expertly navigate complex insurance policies, ensuring business owners understand coverage limits and exclusions.

- Public adjusters document claims meticulously, using high-quality evidence and detailed inventories to substantiate losses.

- Their negotiation skills help maximize compensation by presenting compelling arguments tailored to each claim’s context.

- Hiring a public adjuster often results in higher settlements, making their service a valuable investment for policyholders.

Understanding Public Adjusters For Commercial Property Damage Claims

While many property owners may be unaware of the complexities involved in maneuvering insurance claims, public adjusters serve as invaluable allies in the claims process.

Their primary role is to represent the policyholder, ensuring that all aspects of a claim are thoroughly assessed and accurately documented.

This representation is essential, as the insurance claim process can often be fraught with misunderstandings and misinterpretations that could jeopardize a property owner’s rightful compensation.

Public adjusters possess specialized knowledge of insurance policies and claim regulations, allowing them to navigate the intricate details of each unique case effectively. They conduct extensive evaluations of the damages, gather relevant documentation, and negotiate with insurance companies on behalf of the policyholder. This advocacy not only alleviates the stress associated with the claims process but also enhances the likelihood of a favorable outcome.

Initial Damage Assessment For Commercial Properties

The initial damage assessment is a vital step in the claims process, as it establishes the foundation for evaluating the extent and impact of the loss.

An on-site evaluation allows public adjusters to identify and document damage evidence meticulously, ensuring that no essential detail is overlooked.

This thorough documentation not only strengthens the claim but also enhances the likelihood of a favorable outcome for the property owner.

On-Site Evaluation Process

An effective on-site evaluation process is vital for accurately evaluating commercial property damage claims. This initial step, often conducted by public adjusters, involves thorough on-site inspections that allow for a complete understanding of the damage sustained. By physically evaluating the property, public adjusters can identify not only visible damage but also potential underlying issues that may not be immediately apparent.

During these inspections, the adjuster meticulously documents the extent of the damage, utilizing specialized tools and techniques to guarantee a precise damage evaluation. This detailed analysis is significant as it lays the groundwork for the entire claims process and influences the determination of coverage and compensation.

Furthermore, the on-site evaluation fosters a sense of partnership between the property owner and the public adjuster. By actively engaging in the evaluation, the adjuster demonstrates a commitment to achieving the best possible outcome for their client. This collaborative approach not only builds trust but also empowers property owners to navigate the complexities of insurance claims with confidence. Ultimately, a robust on-site evaluation process is instrumental in maximizing the likelihood of a successful claim resolution.

Documenting Damage Evidence

Effective documentation of damage evidence is essential for establishing a compelling initial damage evaluation in commercial property claims. This process begins with a thorough examination of the affected areas, guaranteeing that every detail is captured accurately. Public adjusters play a critical role in this stage, employing a systematic approach to create a all-encompassing damage inventory that reflects the extent of the loss.

Photographic evidence serves as a cornerstone of this documentation. High-quality images should be taken from multiple angles, showcasing not only the visible damage but also the surrounding context. This visual representation can greatly influence the outcome of the claims process, providing irrefutable proof to insurance adjusters. In addition to photographs, a detailed written description of the damage, including dimensions and materials affected, is essential.

Furthermore, maintaining an organized damage inventory aids in tracking repairs and evaluating potential future risks. By collaborating closely with public adjusters, property owners can guarantee that all evidence is meticulously documented, ultimately strengthening their position in negotiations with insurers. This attention to detail fosters a sense of community among property owners, as they navigate the complexities of commercial property damage claims together.

Navigating Commercial Property Insurance Policies

Understanding the intricacies of insurance policies is fundamental for business owners facing commercial property damage claims, as even minor misinterpretations can lead to significant financial repercussions.

A thorough grasp of coverage limits and policy exclusions is essential in guaranteeing that businesses can effectively navigate the complexities of their insurance contracts.

Coverage limits dictate the maximum amount an insurer will pay for a covered loss, and understanding these thresholds is key to avoid unexpected shortfalls. Conversely, policy exclusions often outline specific scenarios or damages that are not covered, which can leave business owners vulnerable in the wake of a disaster.

Engaging a public adjuster can be indispensable in this context. They possess the expertise to dissect insurance policies, identifying the nuances that could impact a claim’s outcome. Public adjusters empower business owners to make informed decisions and strategize effectively by meticulously reviewing coverage limits and exclusions.

In a landscape where the stakes are high, understanding your insurance policy is not just beneficial—it is critical. Enlisting the help of a professional can guarantee that your business is adequately protected and that you receive the compensation you deserve.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Commercial Property Damage Claim Documentation Process

In the aftermath of commercial property damage, the claim documentation process serves as a critical foundation for securing the compensation necessary to restore business operations.

Effective documentation not only facilitates smoother claims but also strengthens the case for various claim types, highlighting the importance of extensive evidence collection.

Public adjusters play a pivotal role in guiding businesses through this meticulous process. Their expertise guarantees that all necessary documentation is collected and presented effectively, ultimately enhancing the likelihood of a favorable outcome. By prioritizing meticulous documentation, businesses can navigate the complexity of claims with greater confidence and clarity.

Key elements of the claim documentation process include:

- Incident Report: A detailed account of the damage incident, including dates and descriptions.

- Photographic Evidence: Clear images illustrating the extent of the damage, which serve as visual proof.

- Inventory Lists: Thorough lists of affected property, including costs and purchase details.

- Repair Estimates: Professional assessments outlining the costs to restore property to its pre-loss condition.

- Witness Statements: Testimonials from individuals who observed the damage, adding credibility to the claim.

Negotiation Strategies For Commercial Property Damage Insurance Claims

Maneuvering the negotiation phase of commercial property damage claims requires a strategic approach to maximize compensation and achieve favorable outcomes.

Effective negotiation tactics are essential for guaranteeing that the complex nature of these claims is addressed thoroughly.

Public adjusters play a significant role in formulating and executing tailored settlement strategies that resonate with both the insurer and the insured.

A key element in successful negotiations is the thorough presentation of evidence. Public adjusters meticulously compile damage assessments, repair estimates, and relevant documentation, transforming them into compelling arguments for higher settlements. Engaging in clear communication is equally important; public adjusters articulate the validity of the claim, emphasizing not just the financial loss but the operational impacts on the business.

Moreover, understanding the insurer’s perspective allows public adjusters to anticipate counterarguments and prepare persuasive responses. This proactive approach fosters a collaborative atmosphere, which is often more conducive to settlements that satisfy both parties. By leveraging their expertise in negotiation tactics, public adjusters guarantee that business owners are not merely passive participants but active players in securing just compensation for their losses.

Benefits Of Hiring A Commercial Property Public Adjuster

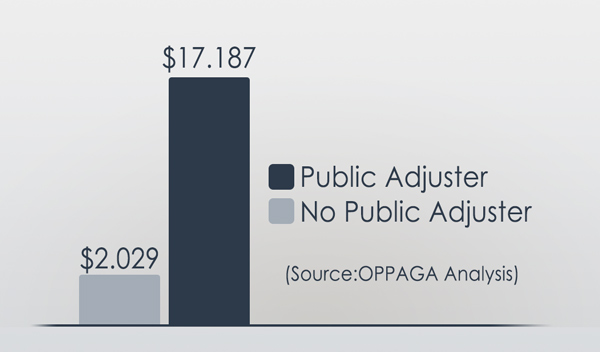

Recognizing the complexities inherent in commercial property damage claims, hiring a public adjuster can greatly enhance the likelihood of achieving a favorable settlement.

Public adjusters bring specialized knowledge and experience to the table, which can be invaluable during the claims process.

The benefits of enlisting their services are numerous:

- Expertise In Policy Interpretation: They understand the intricacies of insurance policies, ensuring all coverage options are utilized.

- Accurate Damage Assessment: Public adjusters conduct thorough evaluations to substantiate the claim, maximizing potential recoveries.

- Skilled Negotiation: They possess strong negotiation skills, advocating on your behalf to secure the best possible settlement.

- Client Testimonials: Many satisfied clients report increased settlements after hiring public adjusters, highlighting their effectiveness and trustworthiness.

- Cost Considerations: While there may be fees associated with their services, the return on investment often outweighs the initial costs, leading to better financial outcomes.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

The Commercial Property Damage Insurance Claim Recovery Process

PCAN’s State-licensed public commercial property damage adjuster members are fluent in “Insurance Policy Jargon”, and will guide you through the entire property insurance claims process, while we fight to make sure you get the highest compensation possible for your claim!

View 7-Step Commercial Property Insurance Claims Process

Step #1

Make Sure Your Family Is Safe

When disaster strikes, the priority is to make sure your family is safe. Always have an emergency bag!

Step #2

Contact A PCAN Commercial Property Public Adjuster

Contact one of our network’s verified, State-licensed, & highly experienced public insurance adjusters to schedule an appointment for them to come out & meet with you to inspect the damage.

Step #3

Thorough Review Of Your Policy

Your public adjuster will conduct a comprehensive review of your policy, note any coverage restrictions, coinsurance requirements, limitations, and review additional options that may be available to you.

Step #4

Create A Claims Strategy That Works For Your Specific Goals & Needs

They will discuss what is most important to you when it comes to your claim, then create & tailor the right claims strategy to take care of your family.

Step #5

Your Public Adjuster Takes Care Of All Insurance Related Paperwork, Negotiations, & Follow Up.

Once you & your PCAN public adjuster have agreed on a strategy, your adjuster will:

- Meet with insurance company adjusters & personnel at the loss/damage location.

- Agree to the scope of damages & make sure that they are including all the damages in the scope, as well as clearly deciding on what should be repaired vs. replaced.

- Prepare a detailed reconstruction estimate.

- Prepare a detailed inventory of personal property.

Step #6

Negotiations & Final Settlement

Your public adjuster will work to make sure you receive the highest settlement possible under your specific insurance policy.

Step #7

Restoration | Reconstruction | Relocation

They will negotiate with the insurance company to ensure that you can achieve your specific goals. Whether that’s full or partial restoration, rebuilding your property, or a full-relocation.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Get The HIGHEST & Most FAIR Settlement Amount, That You Are Legally Entitled To, From Your Commercial Property Claim!

Get a free on-site inspection & insurance policy evaluation from one of our expert public claims adjusters!

Work with public insurance claim adjusters who are licensed, bonded, and trained to handle all residential or commercial insurance claims, big or small! Our public insurance adjusters’ technical and detailed expertise has satisfied countless homeowners, business owners, condominium management companies, and HOAs.

Our team of experts have years of experience dealing with insurance companies. Many of our public adjusters also have previous backgrounds in construction, giving us a significant advantage in quickly securing the most compensation for our clients. We know what to look for, what repairs actually cost, and what the insurance company’s adjusters tend to ignore (and hope you don’t know about!).

Our inspections are free, and we are 100% contingency-based, meaning we only get paid if you do!

We take pride in maintaining superior customer service and providing clear and friendly communication. Contact us to speak with one of our expert adjusters today!

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

10 Tips To File Commercial Property Damage Insurance Claims

Public Adjusters For Commercial Property Damage Insurance Claims

Learn how public adjusters can simplify your commercial property damage insurance claims process, and maximize your compensation, ensuring higher settlement opportunities.

Service Type: Public Adjusters For Commercial Property Damage Insurance Claims

Price: 10-20%

Currency: USD

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.