Has your basement flooding claim been denied? Don't let your dreams of reimbursement sink just yet! Let's dive into how you can keep your claim afloat.

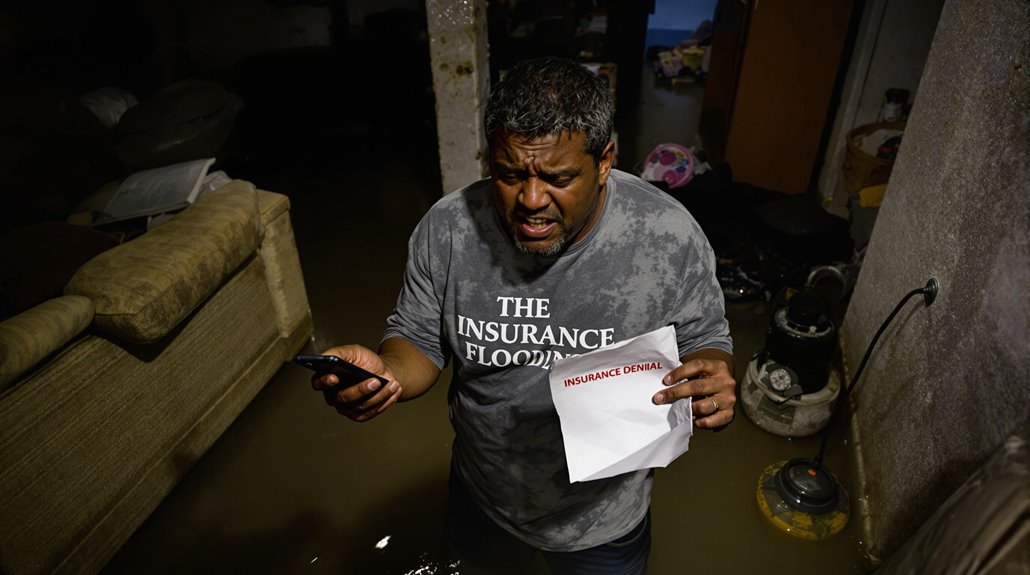

First things first – grab that denial letter and read it like you're solving a mystery. Insurance companies often hide crucial clues in the fine print about why they're saying "no" to your claim. Think of yourself as a detective gathering evidence for your case.

Your secret weapons? Time-stamped photos showing the damage (think "before and after" shots), professional estimates from contractors (the more detailed, the better), and maintenance records that prove you're a responsible homeowner. These documents are like puzzle pieces that help paint the complete picture of your loss.

Here's a game-changer: consider bringing in a public insurance adjuster. These pros know the National Flood Insurance Program (NFIP) guidelines like the back of their hand. They're like your personal insurance translators, helping you speak the same language as the insurance company. Plus, they've been known to help homeowners secure settlements up to eight times higher than going solo!

Remember, you're on the clock – you've got 60 days to appeal the decision. Think of it as a countdown timer in a game show, except this game involves your home and finances. Understanding your policy coverage isn't just helpful – it's your lifeline to turning that "no" into a "yes."

Want to stack the odds in your favor? Team up with insurance professionals who can navigate these choppy waters. They'll help you build a watertight case that's hard to deny!

Key Takeaways

Facing a Denied Basement Flooding Claim? Let's Turn That 'No' into a 'Yes'!

Don't let that denial letter sink your spirits! Think of it as your treasure map – here's how to navigate these murky waters:

Decode That Denial

Just like solving a puzzle, break down your denial letter piece by piece. What's their reasoning? Is it maintenance-related, or are they questioning the cause? Highlight key points and gather your counter-evidence like a detective building a case.

Build Your Digital Fortress

Your smartphone is your best friend right now! Snap detailed photos, shoot quick videos, and keep a flood diary. Think of it as creating your own insurance CSI episode – every water mark, damaged item, and conversation matters.

Bring in the Big Guns

Public insurance adjusters are like your personal claim champions. They speak 'insurance language' fluently and typically boost settlements dramatically – we're talking potential increases that could make your jaw drop!

Launch Your Appeal Rocket

You've got a 60-day countdown – make it count! Package your evidence like a pro: repair quotes, timeline, policy highlights, and those golden photos. Remember, clarity is your superpower here.

Call the Insurance Refs

When the game feels unfair, your state's insurance commissioner is like a referee waiting to make the right call. They're there to ensure everyone plays by the rules, and sometimes, having a lawyer in your corner might be the game-changer you need.

Remember: You're not just fighting for compensation – you're standing up for your rights as a policyholder. Let's get your basement (and your peace of mind) back to normal!

Common Reasons for Basement Flood Claim Denials

Let's dive into the murky waters of basement flood insurance claims – a headache many homeowners know all too well. Think of insurance claims like a game of chess; you need to know all the right moves to win.

Why do insurance companies say "sorry, not covered" to your basement flood claim? Well, it's like maintaining your car – skip the oil changes, and you're asking for trouble. The same goes for your home. Insurance providers often shake their heads when they spot signs of neglect, like:

- Clogged gutters collecting more leaves than a fall festival

- Aging sump pumps crying for replacement

- Cracked foundations that have been ignored for years

But here's the real kicker – policy exclusions can be sneakier than a leaky pipe. Your standard homeowner's policy might be giving you a false sense of security. Natural flooding? That's a whole different ballgame, requiring its own special coverage. It's like showing up to a basketball game with soccer cleats – you need the right equipment for the right situation. Working with a public adjuster can increase your settlement by up to 500% compared to handling the claim alone.

Want to avoid the claim denial blues? Think of documentation as your insurance superhero cape. Just like you wouldn't wait a week to call the fire department, don't drag your feet reporting water damage. Take photos faster than an Instagram influencer, keep receipts like they're winning lottery tickets, and follow your policy requirements to the letter.

Only about 27% of homeowners in flood-prone areas actually carry flood insurance, leaving many vulnerable to devastating financial losses.

Understanding Your Insurance Policy Coverage

Decoding Your Basement Flooding Insurance: What's Really Covered?

Ever wondered why your insurance company might give you the cold shoulder when your basement turns into an unwanted indoor pool? Let's dive into the nitty-gritty of basement flood coverage – it's not as straightforward as you might think!

Think of your standard homeowners policy as a protective umbrella – but one with some strategic holes. While it's got your back for those surprise indoor water accidents (like your rebellious washing machine or that ancient water heater finally giving up), it turns a blind eye to Mother Nature's shenanigans. With only 27% of residents in flood-prone areas carrying flood insurance, many homeowners remain dangerously unprotected.

Here's the scoop: Your regular policy jumps in when indoor plumbing goes haywire, but waves goodbye when groundwater comes knocking. That's where NFIP flood insurance enters the picture – your backup dancer for natural flooding events. But hold onto your boots – even this coverage has its quirks!

In your basement, it'll cover the basics (think structural elements and hardwired appliances) but won't bat an eye at your stored holiday decorations or that fancy finished basement.

And here's a curveball – your trusty sump pump? If it decides to take an unscheduled break, you might be out of luck unless you've added special coverage. It's like having a spare tire – you don't think about it until you really need it!

Pro tip: Become best friends with your policy documents and keep a detailed inventory of your basement kingdom. Snap photos, save receipts, and maintain a repair diary. When water crashes your party, you'll thank yourself for being prepared!

Remember: Insurance policies can be as complex as a maze, but understanding your coverage doesn't have to give you a headache. Stay informed, stay prepared, and don't let basement flooding catch you off guard!

With the average flood claim reaching $39,000 per incident, proper coverage becomes essential for protecting your home investment.

Essential Documentation for Fighting a Denial

Fighting Your Basement Flooding Claim Denial: Your Essential Documentation Guide

Ever felt like you're drowning in paperwork after your insurance company denied your basement flooding claim? Let's turn that tide around! Think of your appeal as building a watertight case – you'll need rock-solid evidence to keep those insurance waters at bay.

Your Documentation Arsenal: What You'll Need

✓ Before & After Visuals: Snap photos and videos that tell your flooding story

✓ Expert Backup: Get detailed estimates from licensed contractors

✓ Paper Trail: Keep every email, call log, and text with your insurance company

Smart Appeal Tactics That Work

- Timeline Mastery: Map out your flood saga from day one

- Policy Power Play: Match every piece of evidence to specific policy clauses

- Damage Details: Break down losses room by room

Remember, you've got 60 days to make your case count! Think of your appeal package as a puzzle – each piece needs to fit perfectly.

Include these key elements:

- Your original policy (the rulebook)

- The denial letter (what you're fighting)

- Adjuster's report (their perspective)

- Your property inventory (what's damaged)

Pro tip: Beef up your case with independent voices – weather reports, neighbor statements, or news coverage of the flooding event. The more voices backing your story, the stronger your position becomes. Smart leak detectors can help prevent future claims by identifying water issues early.

By organizing your evidence like a pro detective, you're not just throwing documents at the problem – you're building a compelling narrative that's hard to deny.

Ready to dive in and fight that denial? Let's get your basement flood claim back on track!

Hiring a public adjuster can increase your claim settlement by 30-50% on average.

Step-by-Step Guide to Filing an Appeal

Got Your Insurance Claim Denied? Here's Your Basement Flooding Appeal Game Plan!

Don't let a denied basement flooding claim leave you underwater! Think of your appeal like building a watertight case – you'll need the right tools and a solid strategy to plug the holes in your claim.

First things first: dive deep into that denial letter. What's their reason for saying "no"? Insurance companies speak their own language, so you'll want to decode their explanation like a detective solving a mystery. Circle those key phrases – they're your roadmap to a successful appeal.

Now, let's build your evidence fortress:

- Snap crystal-clear photos showing every angle of the damage

- Round up repair estimates from licensed contractors

- Create a detailed timeline (think journalist-style: who, what, when, where, why)

- Track down maintenance records showing you've been a responsible homeowner

Remember that ticking clock – you've typically got 60 days to file your appeal, so treat it like a countdown mission. Just like preparing for a storm, you need to move quickly but thoroughly.

Pro tip: Think like an insurance adjuster. What would convince YOU if you were reviewing this case? Package your evidence as if you're telling a compelling story, connecting all the dots between the flooding event and your policy coverage. Carefully review your declarations page to understand your exact coverage terms and limitations.

Want to boost your chances? Consider bringing in a public adjuster – they're like your personal insurance translator and advocate rolled into one. They speak the industry lingo and know exactly what buttons to push to get results.

With a public adjuster's help, you could receive up to 800% higher settlements compared to handling the claim on your own.

Review Your Denial Letter

Got a Denial Letter? Let's Crack the Code Together!

Think of your insurance denial letter as a puzzle – once you know how to piece it together, you're halfway to winning your appeal.

Let's dive into what really matters when reviewing that frustrating "no" from your insurer.

Decoding Your Denial: The Must-Know Elements

- The "Why Not" Section

- Pinpoint exactly why they're saying no

- Look for specific policy exclusions they're hiding behind

- Spot any gaps in documentation they're claiming

- The Policy Fine Print

- Track down every policy section they've mentioned

- Connect their reasoning to actual coverage terms

- Flag any questionable interpretations of your coverage

- Your Action Plan Timeline

- Mark those non-negotiable appeal deadlines

- List required supporting documents

- Note exactly where and how to submit your appeal

Think of your denial letter review like building a strong court case – every detail matters.

By methodically unpacking these key components, you'll build a rock-solid foundation for your appeal strategy.

Pro Tip: Create a simple checklist as you review, highlighting anything that doesn't quite add up.

Your insurer's interpretation might not be the final word, especially if you spot inconsistencies between their denial reasoning and your actual policy coverage.

Remember: Knowledge is power when challenging a denial.

The more thoroughly you understand their reasoning, the better equipped you'll be to prove why they should reconsider your claim.

Be aware that standard policies typically include structural coverage up to $250,000 for qualifying damage.

Consider working with public adjusters who specialize in maximizing settlement amounts and providing expert claims advocacy.

Document Evidence Thoroughly

Building Your Flood Damage Appeal: A Evidence-Gathering Guide

Ready to fight that insurance denial? Let's turn you into a documentation pro! Think of gathering evidence like building an airtight case – every photo, receipt, and document is another brick in your foundation.

Start by capturing the whole story of your basement flooding:

- Snap detailed photos and videos (think CSI-level thoroughness!)

- Get multiple repair estimates from licensed pros

- Ask your state-certified surveyor for a detailed assessment

- Rally support from neighbors who've faced similar issues

Pro tip: Create your "appeal arsenal" by organizing:

✓ Your insurance policy (highlight those key coverage sections)

✓ A day-by-day communication log with your insurer

✓ All proof of loss paperwork

✓ Emergency repair receipts

✓ A comprehensive damage inventory with costs

Want to level up your documentation game? Think like a detective – every detail matters. Infrared cameras can help detect hidden moisture damage that might not be visible to the naked eye.

Keep your evidence organized in digital and physical folders, just like sorting pieces of a puzzle. Remember, you're not just collecting papers; you're building a compelling narrative that shows exactly why your claim deserves approval.

Remember to timestamp everything and keep copies – digital and physical.

Your evidence portfolio should tell such a clear story that even someone who's never seen your property can understand exactly what happened and why you deserve coverage.

Consider hiring a public adjuster who works exclusively for policyholders to ensure you receive the highest possible settlement.

Working With Public Insurance Adjusters

Has Your Basement Flooding Claim Been Denied? Here's Why You Need a Public Insurance Adjuster

Think of a public insurance adjuster as your personal claims champion – someone who knows all the ins and outs of flood insurance like the back of their hand. When your basement flooding claim gets denied, they're your secret weapon for turning that "no" into a "yes."

Why should you consider partnering with one? Well, imagine trying to navigate a maze blindfolded – that's what dealing with insurance companies can feel like. Public adjusters light the way through this complex process, bringing:

- Deep expertise in National Flood Insurance Program (NFIP) guidelines

- Sharp negotiation skills honed through years of claim battles

- An unbiased eye that spots policy details you might miss

Ready to challenge that denial? Here's how we'll tackle it together:

1. Deep Dive Assessment

Your adjuster will dissect the denial letter and your policy with surgical precision, identifying key leverage points for appeal.

2. Evidence Arsenal Building

We'll gather compelling proof – from professional damage assessments to detailed repair estimates – creating an ironclad case for your claim. Understanding building coverage limits up to $250,000 helps ensure you receive maximum compensation for structural damage.

3. Strategic Appeal Launch

Using industry-specific knowledge and proven tactics, your adjuster crafts and executes a winning appeal strategy.

The best part? You can focus on getting your life back to normal while your adjuster handles those stressful insurance conversations.

They're not just fighting for fair compensation – they're fighting for your peace of mind.

Remember: Having a public adjuster in your corner can dramatically increase your chances of overturning that denial and securing the settlement you deserve.

Studies show claims handled by public insurance adjusters result in settlements up to 800% higher than those without professional representation.

Legal Options and Rights for Homeowners

Dealing with Denied Basement Flooding Claims? Here's Your Legal Gameplan!

Has your insurance company given you the cold shoulder on your basement flooding claim? Don't let that "no" be the final word! You've got more power in your corner than you might think.

Think of your legal rights as a homeowner's Swiss Army knife – there are multiple tools at your disposal. First up, you'll want to become besties with your state's insurance laws. These regulations are your shield against unfair claim denials, and trust me, they pack quite a punch!

Ready to fight back? Here's how to tackle this head-on:

- Team up with a property insurance ninja (aka an experienced attorney) who knows the ins and outs of coverage disputes.

- File a complaint with your state's insurance commissioner (they're like the referees of the insurance game).

- Consider mediation – it's like having a friendly negotiator in your corner who can help settle things without going to court.

Pro tip: Document everything like you're writing the next bestseller! Save those emails, snap photos, and keep a diary of every conversation. Think of it as building your case's armor – the stronger it is, the better your chances.

Remember those pesky deadlines for appeals? Mark them on your calendar in big, bold letters. Missing them is like forfeiting the game before it even starts. Stay sharp, stay organized, and don't let those insurance companies push you around!

Want to supercharge your case? Keep detailed records of:

- All communications with your insurer

- Photos and videos of the damage

- Repair estimates and receipts

- Weather reports from the incident date

Your basement might be underwater, but your rights don't have to be! Take action now, and show those insurance companies you mean business.

Working with public adjusters can increase your settlement amount by up to 500% in non-catastrophe incidents.

Preventive Measures to Strengthen Future Claims

Want to bulletproof your basement flooding claims? Let's build your defense like a seasoned pro!

Think of your basement as a fortress – it needs a solid battle plan. Start by becoming a documentation ninja: snap monthly photos, keep detailed maintenance logs, and collect professional inspection reports like you're gathering evidence for a water-related crime scene!

Your drainage system is your first line of defense. Just like cleaning your teeth prevents cavities, regular gutter and downspout maintenance prevents costly disasters. Don't forget those foundation drains – they're the unsung heroes keeping your basement dry.

And hey, proper grading around your house isn't just fancy landscaping – it's your moat redirecting water away from your castle walls.

Ready to go high-tech? Water detection devices are like having tiny flood forecasters on duty 24/7. These smart little guardians send alerts straight to your phone, creating a digital paper trail that insurance companies love.

It's like having a time-stamped diary of every drop that dares to threaten your space.

Document Everything Monthly

Don't Let Your Basement's Story Go Untold: Monthly Documentation Guide

Ever thought about your basement as a diary that needs regular entries? That's exactly what monthly documentation is – telling your basement's story to keep insurance companies in the loop.

Think of documentation as your basement's social media feed – regular updates that showcase its health and your dedication to maintenance. You're not just collecting papers; you're building a bulletproof case for potential insurance claims.

Your Monthly Documentation Checklist:

✓ Snap Those Shots: Grab your phone and capture date-stamped photos of your basement's nooks and crannies.

✓ Keep a Maintenance Diary: Log every sump pump test, gutter clean-out, and plumbing check.

✓ Foundation Health Check: Record any wall cracks, water spots, or drainage hiccups.

Pro Tips for Documentation Success:

- Create a digital folder system (think of it as your basement's cloud backup).

- Set monthly reminders – your basement will thank you!

- Document even small changes – today's tiny crack could be tomorrow's claim evidence.

Remember, solid documentation isn't just paperwork – it's your insurance policy's best friend. When water decides to crash your basement party, you'll have a rock-solid timeline showing you've been a responsible homeowner all along.

Want to level up your documentation game? Start treating your monthly checks like a home detective story, where every detail matters and nothing's too small to note. Your future self (and insurance adjuster) will be impressed by your thorough detective work!

Maintain Proper Drainage Systems

Is Your Basement a Water Magnet? Let's Fix That Drainage System!

Think of your home's drainage system as its personal umbrella – it needs to be in top shape when storm clouds gather. A well-maintained drainage network isn't just about keeping your basement dry; it's your first line of defense against costly water damage and your secret weapon for smoother insurance claims.

Want to be a drainage superhero? Start with these game-changing moves:

- Give your sump pump regular workout sessions

- Keep those gutters and downspouts squeaky clean

- Check on your French drains and weeping tiles like they're old friends

Smart homeowners are jumping on the tech bandwagon too. Pop a hygrometer in your basement to track humidity levels and let your dehumidifier work its magic. It's like having a weather station right in your home!

But here's the real kicker – don't go solo on this mission. Team up with drainage pros who can craft a solution tailored to your home's unique needs. They're like water-management architects, designing systems that work specifically for you.

Remember the scout's motto: "Be Prepared"? That's exactly why you need backup systems. Installing a secondary sump pump and multiple drainage routes is like having an insurance policy for your insurance policy!

Plus, when you keep detailed maintenance records, you're basically giving insurance companies a highlight reel of your responsible homeownership.

Install Water Detection Devices

Don't Let Water Sneak Up on You: Master Your Home's Water Defense System

Ever wondered how some homeowners seem to dodge those devastating water damage disasters? The secret weapon? Smart water detection devices – your home's personal flood patrol!

Think of these nifty gadgets as your basement's bodyguards, standing watch 24/7 against unwanted water intrusion. They're not just fancy tech toys; they're your first line of defense against costly floods and those dreaded insurance headaches.

Ready to build your water detection fortress? Here's where to deploy your defenders:

🚰 Around Water Warriors: Keep your water heater and washing machine under surveillance

🏠 Basement Battlegrounds: Guard those sneaky entry points and sump pumps

💧 Moisture Magnets: Don't forget those hidden crawl spaces where dampness loves to lurk

Today's water detection systems are like tiny environmental scientists, tracking everything from temperature swings to humidity spikes. They'll even chat with your smart home setup, sending alerts straight to your phone when trouble's brewing.

Want to really impress your insurance company? These devices aren't just protective – they're proactive. By documenting your water-safety efforts, you're showing them you mean business when it comes to home protection. It's like having a digital paper trail of your home maintenance dedication!

Key Strategies for Successful Claim Resolution

Got a Denied Basement Flooding Claim? Here's Your Battle Plan!

Dealing with a denied insurance claim for your flooded basement can feel like swimming upstream, but don't throw in the towel just yet! Let's crack the code on getting your claim approved with some battle-tested strategies.

Think of your claim like a court case – you need solid evidence and a winning argument. Start by playing detective with your denial letter. What exactly made them say no? Is it hiding in the fine print of policy exclusions, or did they spot coverage gaps you weren't aware of?

Your secret weapon? Rock-solid documentation. Think of it as building your case file:

- Snap photos that tell the whole story (before, during, and after)

- Round up multiple repair quotes (the more, the merrier!)

- Keep a paper trail of every chat, call, and email with your insurance company

Not getting anywhere? Time to bring in the cavalry! You've got options:

- Mediation: Like having a friendly referee help you both see eye-to-eye

- Arbitration: Think of it as 'court lite' – faster and cheaper than a full-blown lawsuit

- State Insurance Department: Your consumer protection watchdog

Remember, taking legal action should be your last card to play – it's like bringing out the big guns when all else fails. But sometimes, that's what it takes to get the resolution you deserve.

Want better odds of winning? Be your own advocate! Speak their language, know your rights, and stay persistent. After all, navigating insurance claims is a marathon, not a sprint!

The Benefits Of Consulting A Public Adjuster

Is your insurance claim giving you headaches? Let's talk about your secret weapon – a public adjuster! Think of them as your personal insurance claim superhero, especially when dealing with tricky situations like that frustrating basement flooding denial.

You know how maze-like insurance policies can be, right? Public adjusters navigate these complex waters daily, making them your expert guides through the claims jungle. They're like having a seasoned detective on your side, meticulously documenting every water-damaged item and building a rock-solid case for your claim.

What's really cool is how they handle all those nerve-wracking conversations with insurance companies. No more stressing over paperwork or wondering if you're saying the right things! These pros speak the insurance language fluently and know exactly which buttons to push to get things moving.

The best part? Public adjusters often help you unlock significantly higher settlements. Why? Because they understand the fine print that most homeowners miss – those little policy details that could mean thousands of dollars in your pocket.

They're essentially your insurance claim translators, turning complex coverage terms into real-world benefits.

Ready to turn that claim denial into an approval? A public adjuster might just be your ticket to finally getting that flooded basement situation sorted out, while you sit back and watch the experts work their magic.

Expertise In Insurance Claims

Feeling Lost in the Insurance Claims Maze? Here's Why Public Adjusters Are Your Secret Weapon

Think of public adjusters as your personal insurance claim GPS – they know exactly where you're headed and how to get there efficiently. While you might be scratching your head over policy jargon, these pros have already mapped out your path to maximum compensation.

What makes public adjusters worth their weight in gold?

🔍 Policy Whisperers: They decode complex insurance language into plain English, spotting coverage opportunities you might never know existed. It's like having someone who speaks "insurance-ese" as their native language!

📊 Documentation Masters: From capturing every crack and crevice to organizing evidence like a master detective, they build your case with military precision. No detail escapes their expert eye.

💪 Negotiation Ninjas: Armed with industry insights and years of experience, they go toe-to-toe with insurance companies. Think of them as your claims champion, fighting to protect your interests while you focus on getting your life back to normal.

Why navigate the claims labyrinth alone when you could have an expert guide?

Public adjusters typically help homeowners secure significantly higher settlements – and let's face it, who doesn't want more money for their claim while avoiding the headaches of DIY claims management?

Remember: Insurance companies have their experts working for them. Shouldn't you have one working for you too?

Objective Damage Assessment

Let's Talk Basement Flood Damage: Your Essential Assessment Guide

Ever wondered how insurance pros determine the real impact of water wreaking havoc in your basement? Think of an objective damage assessment as your basement's medical examination – it's that crucial detective work that uncovers every water-damaged nook and cranny.

Professional public adjusters are like CSI investigators for your flooded space. They don't just peek around – they dive deep with their trusty assessment toolkit: high-res photos, moisture meters, and detailed reports that leave no wet drywall undocumented.

This isn't just paperwork; it's your golden ticket to a fair insurance claim.

Why does all this matter to you? When your insurance company comes knocking with their assessment, you'll want your own rock-solid evidence in your corner. Think of it as building your case with undeniable proof – from that warped hardwood flooring to those soggy walls that tell the whole story.

Got a denied claim? That's where your detailed documentation becomes your secret weapon. It's like having a trump card that helps you challenge those frustrating claim denials and fight for what you deserve.

Remember, in the world of basement flooding claims, thorough documentation isn't just helpful – it's your lifeline to fair compensation.

Want to stay ahead of the game? Start documenting everything the moment you spot water where it shouldn't be. Your future self (and your wallet) will thank you!

Streamlined Claim Process

Navigating Insurance Claims: Your Public Adjuster Superhero

Think of a public adjuster as your personal insurance claim quarterback – they're here to turn your basement flood nightmare into a winning game plan. Why tackle the complex world of insurance claims alone when you've got a pro in your corner?

Here's how these claim-savvy experts make your life easier:

- They speak "insurance-ese" fluently, translating complex policies into plain English.

- Document every drip, drop, and damage detail with laser precision.

- Play hardball with insurance companies so you don't have to.

Your public adjuster brings a powerful one-two punch to the table:

- Expert damage assessment that leaves no stone unturned.

- Bulletproof documentation that insurance companies can't ignore.

- Strategic negotiation skills honed through years of industry experience.

Remember that time you tried assembling furniture without instructions? Filing an insurance claim without a public adjuster can feel just as frustrating.

These professionals know every twist and turn of the claims maze, ensuring you don't leave money on the table or miss crucial deadlines.

By having a public adjuster champion your cause, you're not just filing a claim – you're maximizing your chances of a fair settlement while focusing on what really matters: getting your life back to normal.

They're like your insurance GPS, guiding you through the choppy waters of claims processing with expertise and precision.

Higher Claim Payouts & Settlements

Want to Know Why Public Adjusters Are Your Secret Weapon for Better Insurance Settlements?

Let's face it – navigating flood insurance claims feels like trying to solve a Rubik's cube blindfolded. But here's the game-changer: policyholders who team up with public adjusters consistently land more substantial settlements than DIY warriors.

Think of public adjusters as your personal insurance detectives. They've got an eagle eye for spotting those sneaky damage details you might miss – you know, the ones that could put more money in your pocket. It's like having a seasoned poker player at your side, reading the insurance company's tells and knowing exactly when to push for more.

What makes these pros worth their salt? They're masters at:

- Documenting damage with CSI-level precision

- Speaking the complex insurance lingo fluently

- Turning policy fine print into financial wins

- Going toe-to-toe with insurance companies' tactics

Remember that leaky roof that seemed like a simple fix? Your public adjuster might uncover hidden structural damage that deserves compensation.

They're not just filling out paperwork – they're building your case with the tenacity of a champion boxer in your corner.

By leveraging their insider knowledge and proven strategies, these experts ensure you don't leave money on the table.

And in the world of flood insurance claims, that's the difference between staying afloat and sinking under repair costs.

About The Public Claims Adjusters Network (PCAN)

Meet PCAN: Your Insurance Claim Champions

Ever felt lost in the maze of insurance claims? That's where the Public Claims Adjusters Network (PCAN) steps in as your trusted navigator. Think of these licensed professionals as your personal insurance advocates – they're the experts who stand between you and complex insurance settlements.

Why Choose a PCAN Professional?

These insurance wizards don't just shuffle paperwork; they're your strategic partners who speak the language of insurance companies. Working exclusively for policyholders (that's you!), they'll roll up their sleeves to:

- Decode your policy's fine print (yes, even those tricky exclusions!)

- Document every scratch, dent, and damage with eagle-eyed precision

- Battle it out with insurance companies to get you what you deserve

The Money Talk

Worried about upfront costs? Don't be! PCAN adjusters work on contingency, meaning they only get paid when you win. Their fee comes as a percentage of your settlement – it's like having a teammate who only scores when you do.

Playing by the Rules

Just like referees in a game, PCAN members follow strict state guidelines. They can't knock on your door at midnight pushing their services (there are specific solicitation hours), and every contract is crystal clear about what you're getting into. Think of them as your insurance world bodyguards – professional, regulated, and 100% focused on protecting your interests.

Remember: When disaster strikes, you don't have to face insurance giants alone. PCAN professionals are your experienced allies in turning policy promises into actual payouts.

Frequently Asked Questions

How Long Does Flood Damage Take to Cause Structural Problems?

Want to know how quickly flood damage can turn your home's structure into a ticking time bomb? Let's break it down: Your home's structural battle with floodwater starts faster than you might think. Within the first 24 hours, water begins its sneaky invasion into your building's bones – think of it as water playing a dangerous game of hide-and-seek with your foundation. By day three (that's 72 hours), you're looking at a serious threat as moisture seeps deeper into walls, support beams, and floor joists. Give it a full week of water exposure, and you're facing potentially devastating structural issues – like a house of cards that's been left out in the rain. The longer water lingers, the more it weakens crucial building materials, turning what was once solid ground into a structural nightmare. Early intervention is your best defense against this waterlogged countdown.

Can I Stay in My House During Basement Flood Repairs?

Wondering if you can tough it out at home during basement flood repairs? Let's dive into what you need to know!

Your safety comes first, and staying put isn't always the smartest move. Think of your home like a patient in recovery – sometimes it needs space to heal properly. A qualified restoration expert needs to evaluate your situation, just like a doctor would diagnose an illness.

Red flags that signal you should pack your bags include:

- Active mold growth (those sneaky spores aren't roommate material)

- Contaminated water exposure (especially from sewage backups)

- Compromised structural integrity

- Electrical system concerns

Even if you're tempted to camp out upstairs while work happens below, harmful particles can travel through your HVAC system. Plus, construction noise and constant foot traffic from repair crews can make daily life pretty challenging.

Consider temporary relocation as an investment in your health and peace of mind. Once professionals give you the green light that your home's vital signs are stable, you can return to a safer, drier living space.

Remember: When in doubt, don't tough it out – your well-being matters more than saving on temporary housing costs.

Will My Insurance Rates Increase After Filing a Basement Flood Claim?

Wondering if your insurance rates will take a hit after that basement flood claim? Let's dive into the reality (pun intended!).

When you file a water damage claim, your premiums might get a bit soggy. Insurance companies typically view basement flooding as a red flag, similar to how a dentist raises an eyebrow at multiple cavities. Your rates could rise, but the increase varies depending on several factors:

- Your claims history – first-time claim? Less impact.

- Local flood risk factors

- Steps you take to prevent future flooding

- Insurance provider policies

Smart move? Install preventive measures while handling your current claim. Think sump pumps, waterproofing, or improved drainage systems. It's like putting an umbrella up before the storm – these proactive steps can help cushion future premium increases.

Remember: Multiple flood claims can make your rates skyrocket faster than water rushing through a cracked foundation. Working with your insurer to develop a solid prevention plan might help keep those premiums from floating away.

Pro tip: Document all your flood-proofing improvements. Insurance companies love seeing homeowners who take initiative – it shows you're not just bailing water, but actually fixing the root cause.

Are Basement Flood Mitigation Systems Tax Deductible?

Wondering if you can catch a tax break for keeping your basement dry? Unfortunately, basement flood mitigation systems typically don't qualify for tax deductions in residential properties. However, you might be eligible for deductions under specific circumstances: if you're using the space for business operations, if it's medically necessary for a household member's health condition, or when calculating your property's cost basis for future sale. Think of it as Uncle Sam being selective about which home improvements get the green light for tax benefits – flood prevention systems generally don't make the cut unless they fall into these special categories.

Does Homeowners Insurance Cover Damages to Neighboring Properties From My Flood?

Wondering if your homeowners insurance has your back when your flood becomes your neighbor’s nightmare? Let’s dive into this wet situation! If your home suffers water damage from a flood, it’s essential to understand how your policy responds, especially when your predicament also affects those nearby. Homeowners insurance typically does not cover flood damage, which means you might need a separate flood insurance policy to protect your investment. Be sure to review your homeowners insurance flood coverage details to ensure you’re adequately protected and to avoid any unpleasant surprises when disaster strikes.

Your standard homeowners policy likely won't help if your flood waters decide to take an unwanted vacation next door. Think of it like this: just as your car insurance doesn't cover your friend's vehicle when they're driving their own car, your basic home insurance won't cover flood damage – whether it's on your property or your neighbor's.

The real solution? Separate flood insurance is your golden ticket. Without it, you could be personally responsible for any flood-related damages that splash over to nearby properties. However, there's a silver lining – if the water damage comes from a covered internal issue (like a burst pipe or overflowing washing machine), your standard policy's liability coverage might step in to help.

Smart tip: Chat with your insurance agent about adding flood coverage before the waters rise. It's better to have an umbrella before the storm than scramble to find one when it's already pouring!

References

- https://propertydamageinsuranceclaimsattorneys.com/2024/09/09/common-reasons-for-flood-damage-claim-denials/

- https://dryforcecorp.com/what-to-do-when-your-basement-flooding-insurance-claim-being-denied/

- https://www.floodsmart.gov/memo/basement-coverage-limitations-decision-overturned

- https://panditlaw.com/steps-to-take-if-your-flood-insurance-claim-is-denied/

- https://www.millerpublicadjusters.com/free-property-insurance-claim-advice-blog/what-to-do-when-your-property-flooding-claim-is-denied

- https://carrigananderson.com/faqs/why-would-a-water-damage-claim-be-denied/

- https://www.broadlandshoa.org/hoaforum/index.php?threads/basement-flooding-insurance-claim-being-denied.19454/

- https://quotewizard.com/home-insurance/does-home-insurance-cover-basement-flooding

- https://www.progressive.com/answers/does-home-insurance-cover-basement-floods/

- https://agents.floodsmart.gov/sites/default/files/fema_basement-flooding_fact-sheet_01-22.pdf