Wondering if hiring a public adjuster is worth your hard-earned money? Let’s break it down!

Think of public adjusters as your personal insurance claim champions. They’re like having a skilled detective and negotiator rolled into one, fighting to maximize your settlement. When disaster strikes your home or business, these pros know exactly where to look for hidden damage that you might miss. They meticulously document every detail, ensuring that no potential loss goes unnoticed. However, it’s important to choose a reputable professional, as public adjuster legitimacy concerns can sometimes arise in the industry. By thoroughly vetting candidates and checking their qualifications, you can secure the best advocate for your claim, ensuring that your rights are upheld throughout the process.

The numbers tell a compelling story – homeowners who team up with public adjusters typically see 20-50% bigger settlements than those who go it alone. In major catastrophes, the difference can be even more dramatic, with some settlements soaring up to 747% higher with professional representation.

Sure, you’ll need to factor in their fees (usually 5-20% of your settlement), but here’s the kicker – the extra money they help you secure often makes their cost feel like a smart investment. It’s like hiring a savvy real estate agent who helps you sell your house for way above market value.

These insurance experts bring more to the table than just number-crunching. They’re fluent in complex policy language, master documentarians of property damage, and skilled negotiators who know how to stand their ground with insurance companies. They’ve seen countless claims and know exactly what it takes to build a rock-solid case for you.

Key Takeaways

Think of public adjusters as your insurance claim’s personal bodyguards – they’re often worth their weight in gold! Let’s break down why:

Show Me the Money 💰

When you’ve got a pro in your corner, settlements typically jump 20-50% higher than going it alone. Why? They know exactly where to look and what to ask for.

When Do You Really Need One?

You might want to consider bringing in the big guns if:

- Your claim tops $50,000

- You’re dealing with widespread damage (think hurricane aftermath)

- The insurance company’s playing hardball

- You’re too overwhelmed to handle the paperwork jungle

Hidden Treasure Hunters

These claim experts are like damage detectives – they’ll spot issues you might walk right past. From that sneaky water damage behind your walls to that tricky policy fine print, they’ve got your back.

Investment vs. Reward

Sure, they’ll take 5-15% of your settlement, but here’s the kicker – their expertise often uncovers enough additional damage to make their fee feel like a bargain. It’s like spending a dollar to make three!

The Professional Edge

Licensed adjusters don’t just know the rules – they live and breathe them. They’ll:

- Document everything (and we mean everything)

- Speak insurance-ese fluently

- Keep your claim legally bulletproof

- Fight for every penny you deserve

Want to know if your claim needs a pro? Ask yourself: “Could I navigate a courtroom without a lawyer?” If that makes you nervous, you might want a public adjuster on speed dial!

Understanding What Public Adjusters Do

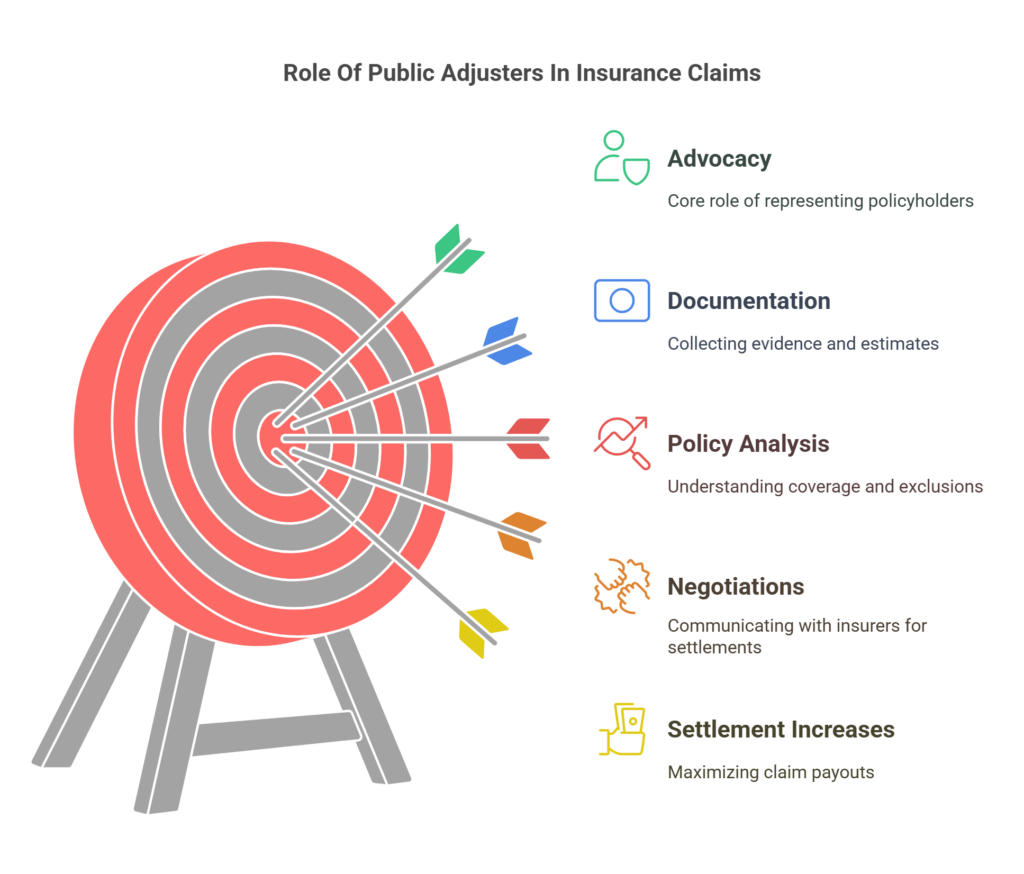

Public adjusters serve as licensed professionals who advocate for policyholders during the insurance claims process. Their primary responsibilities include conducting thorough property damage documentation and implementing systematic assessment methods to guarantee no damage goes unnoticed during inspections.

These professionals analyze insurance policies in detail to determine coverage parameters and exclusions, while compiling essential documentation such as detailed estimates, photographic evidence, and exhaustive reports. Settlement increases often justify their commission-based fees ranging from 5-15% of total claim payouts.

Public adjusters leverage their expertise to represent policyholders in all interactions with insurance companies, managing communications and negotiations to secure maximum claim settlements.

Public adjusters stand as advocates between you and insurers, expertly navigating negotiations to maximize your settlement value.

Their role extends beyond initial assessments, as they provide specialized guidance through complex claims processes and assist in dispute resolution when necessary. Operating under strict professional standards and ethical obligations, public adjusters must maintain state licenses and demonstrate commitment to protecting their clients’ interests throughout the claims management process.

Studies show that claims managed by public insurance adjusters typically result in settlements 20% to 50% higher compared to self-managed claims.

Key Benefits of Working With a Public Adjuster

Working with a public adjuster can substantially improve the likelihood of maximizing an insurance settlement through expert claim evaluation and strategic negotiation.

Public adjusters possess specialized knowledge to identify all compensable damages and navigate the complex procedural requirements of the claims process. Their expertise in policy interpretation and documentation requirements helps guarantee thorough claim submissions that address all potential areas of recovery. Studies show that working with public adjusters can lead to increased settlement amounts of 20-50% compared to undisputed claims.

For a contingency fee arrangement of 5-20% of the final claim amount, public adjusters handle property damage assessments and expedite negotiations without requiring upfront payment.

Maximizing Your Insurance Settlement

When maneuvering the complex landscape of insurance claims, maximizing settlement outcomes requires strategic expertise and professional advocacy.

Public adjusters employ proven settlement strategies and negotiation techniques to guarantee optimal compensation for policyholders.

Their specialized knowledge of policy terms enables thorough damage assessment and extensive documentation of eligible claims.

The PCAN network vetting ensures clients work with only the most qualified and ethical public adjusters in the industry.

Key components of maximizing settlements include:

- Detailed documentation of all property damages and losses

- Strategic presentation of evidence supporting claim values

- Expert negotiation with insurance carriers to achieve fair compensation

Public adjusters leverage their industry expertise to identify often-overlooked damages, challenge inadequate settlement offers, and verify all policy benefits are fully utilized.

Their professional representation typically results in substantially higher settlement amounts compared to claims filed without expert assistance.

While public adjuster fees can reach up to 10% of the final settlement amount, the significantly higher payouts they secure generally outweigh the cost.

Navigating Complex Claims Process

The intricate process of filing and managing insurance claims presents numerous challenges for policyholders seeking fair compensation for their losses. Public adjusters streamline claims coordination by managing all aspects of complex claims, from thorough damage assessment to detailed documentation and policy analysis. Claims adjusters face strict deadlines of 30-60 days for claim determinations, making professional expertise crucial.

Their expertise in interpreting technical jargon and understanding policy nuances guarantees accurate claim submissions.

These professionals monitor settlement progress while handling multi-damage scenarios involving structural, water, or fire losses. They expedite the process by preventing common pitfalls in documentation and maintaining effective communication with insurance companies.

Their exhaustive knowledge of claims procedures and policy terms enables them to navigate disputes efficiently, ultimately working to secure settlements that reflect the full extent of covered damages.

Research shows that settlements are typically 10-15% higher when public adjusters are involved in the claims process.

When to Consider Hiring a Public Adjuster

Large loss claims, particularly those exceeding $50,000, often warrant the expertise of a public adjuster due to their inherent complexity and substantial financial implications.

Complex policy matters frequently involve intricate coverage interpretations, exclusions, and endorsements that require professional analysis to guarantee maximum claim settlement.

The combination of significant financial exposure and policy complexity makes these situations ideal candidates for public adjuster intervention, as their specialized knowledge can directly impact settlement outcomes.

Named peril policies require particularly careful documentation and assessment to ensure coverage applies to the specific damage event.

Research shows that public adjuster settlements typically result in 20-50% higher claim recoveries compared to self-managed claims.

Large Loss Claims

Complex insurance claims involving substantial property damage often justify the engagement of a public adjuster.

In cases of catastrophic damages, these professionals provide essential expertise in documenting and valuing substantial losses that can reach into hundreds of thousands or millions of dollars.

Their specialized knowledge becomes particularly valuable when evaluating extensive property damage.

Common scenarios where public adjusters prove instrumental include:

- Natural disasters affecting multiple areas of a property, such as hurricane or flood damage

- Fire or smoke damage throughout commercial buildings

- Structural collapse or foundation issues requiring complex engineering assessments

Public adjusters leverage their industry experience to conduct thorough damage assessments, interpret complex policy provisions, and negotiate with insurance carriers to secure settlements that accurately reflect the full scope of significant property losses.

Complex Policy Matters

When insurance policies contain intricate provisions, exclusions, and endorsements, policyholders often benefit from engaging public adjusters to navigate these complexities.

These professionals excel at interpreting policy intricacies, identifying all eligible coverage components, and clarifying ambiguous terms that could impact claim outcomes.

Public adjusters provide essential expertise in coverage interpretation, ensuring that policyholders understand their rights and benefits under their insurance contracts.

They analyze policy endorsements and riders to maximize potential coverage while maintaining compliance with state and federal insurance laws.

Their thorough understanding of insurance terminology and regulations enables them to identify coverage gaps, resolve disputes over policy language, and secure appropriate settlements based on extensive policy analysis.

The Financial Impact on Insurance Claims

The financial impact of public adjusters on insurance claims represents a significant factor in the claims settlement process.

Financial Fundamentals indicate that policyholders who engage public adjusters often secure substantially higher settlements compared to those who process claims independently.

Claims Statistics demonstrate this advantage through documented increases in payout amounts, attributed to adjusters’ expertise in negotiation and thorough documentation practices.

Key elements that contribute to enhanced settlements include:

- Exhaustive damage documentation through detailed photographs and professional estimates

- Strategic negotiation techniques backed by insurance policy expertise

- Meticulous compilation of evidence supporting maximum claim values

While insurance companies may experience reduced profit margins and increased administrative costs when public adjusters are involved, the financial benefit to policyholders often outweighs these concerns.

The adjusters’ contingency-based compensation structure further incentivizes their efforts to maximize claim settlements, ultimately leading to more favorable financial outcomes for the policyholder.

Evaluating the Cost Structure

Understanding public adjuster fee structures forms a central component in determining their value proposition. A thorough rate analysis reveals three primary payment models: contingency fees ranging from 5% to 20% of the settlement, hourly rates between $250 and $750, and flat-rate arrangements for straightforward cases.

Fee comparisons across different regions indicate significant variations, with metropolitan areas typically commanding higher rates. State regulations play a vital role in fee structures, often implementing caps on maximum percentages and restricting certain payment arrangements.

The complexity of claims directly influences costs, with larger claims generally warranting lower contingency percentages. Professional experience levels also impact fee structures, as more seasoned adjusters typically charge premium rates.

Clients must carefully evaluate these cost structures against potential benefits, considering factors such as claim size, complexity, and the adjuster’s track record of successful settlements. State-specific regulations and certification requirements further inform the selection process.

Potential Risks and Drawbacks

Engaging a public adjuster presents several notable risks that warrant careful consideration before proceeding with their services.

The introduction of a third party can lead to conflict escalation with insurance companies, potentially transforming routine claims into adversarial proceedings. This heightened tension often results in delayed settlements and increased documentation requirements.

Key concerns include:

- Inconsistent expertise levels among adjusters, with some lacking the necessary experience or ethical standards

- Communication breakdowns between all parties, leading to misunderstandings and frustrated expectations

- Extended processing times due to increased scrutiny and complex negotiations

The varying quality of public adjusters across different jurisdictions creates additional uncertainty. State-specific regulations may offer limited oversight, exposing clients to potential misconduct. This inconsistency can lead clients to feel vulnerable when selecting a public adjuster, as they may not be fully aware of the qualifications and ethical practices in their area. However, despite these challenges, there are notable benefits of hiring public adjusters that can significantly ease the claims process. With their expertise, clients can navigate complex insurance policies and negotiate more favorable settlements, ultimately ensuring they receive the compensation they deserve.

Moreover, some adjusters may prioritize larger claims while providing inadequate attention to smaller cases, affecting the overall quality of service and claim outcomes.

Finding the Right Public Adjuster for Your Case

Selecting an appropriate public adjuster requires careful evaluation of multiple criteria to guarantee maximum claim representation and successful outcomes. Industry professionals recommend utilizing adjuster directories through organizations like NAPIA or regional associations, which maintain strict membership standards and ethical requirements. These directories facilitate locating qualified adjusters based on geographic proximity and specialization.

Verification of professional credentials, including state licensing, certifications, and relevant experience with similar claims, is essential. Prospective clients should examine fee structures, typically contingency-based at around 10% of the settlement, while considering negotiability for larger claims.

Additionally, investigation of the adjuster’s communication style, response time, and advocacy approach through client testimonials provides valuable insight. References from previous clients and professional networks, combined with online reviews and community feedback, help verify selection of a reputable adjuster who aligns with specific case requirements and demonstrates proven success in policyholder representation.

Real-World Success Stories and Outcomes

Real-world evidence demonstrates the substantial value public adjusters bring to insurance claims processes. Documented success rates reveal that policyholders working with public adjusters frequently secure settlements up to 747% higher than initial insurance company offers.

Client testimonials consistently highlight three primary benefits:

- Professional expertise in documenting and evaluating complex property damage claims

- Strategic negotiation capabilities that maximize settlement outcomes

- Complete understanding of insurance policies that identifies overlooked coverage

The effectiveness of public adjusters is further validated through numerous case examples where their intervention resulted in substantially improved claim settlements.

Public adjusters consistently prove their worth by transforming inadequate settlements into favorable compensation through expert claim intervention.

Their ability to thoroughly document damages, navigate complex policy terms, and advocate effectively for policyholders has proven instrumental in achieving favorable outcomes. These professionals’ expertise particularly shines in complex cases where detailed documentation and specialized knowledge of insurance procedures become critical factors in securing appropriate compensation for property damage claims.

The Benefits Of Consulting A Public Adjuster

Public adjusters provide specialized expertise in insurance claims handling, offering objective assessments of property damage and complete documentation that maximizes claim potential. Public adjusters explained their role as advocates for policyholders, ensuring they receive fair compensation from insurance companies. By navigating the complexities of the claims process, they alleviate the stress often associated with filing claims. Their thorough approach not only speeds up the settlement process but also helps in recovering the full extent of damages, ultimately benefiting clients significantly.

Their professional knowledge of policy interpretation and industry regulations enables a streamlined claims process that reduces administrative burden while ensuring compliance requirements are met.

Through skilled negotiation tactics and thorough understanding of insurance company practices, public adjusters frequently secure higher claim settlements compared to policyholder-managed claims.

Expertise In Insurance Claims

Insurance claim expertise stands as a cornerstone benefit when consulting a public adjuster. Their exhaustive policy knowledge and strategic analysis capabilities enable them to interpret complex insurance documentation and evaluate claims with precision.

Public adjusters leverage their experience in insurance company operations to maximize settlement outcomes.

Key aspects of their expertise include:

- Detailed assessment of damage scope and accurate valuation of losses

- Strategic negotiation with insurance carriers based on policy terms

- Thorough documentation and presentation of claim evidence

Their professional understanding of policy interpretation and claim procedures often results in more thorough evaluations and higher settlement amounts. This expertise becomes particularly valuable in complex claims involving extensive damage or when disputes arise with insurance providers regarding coverage terms or settlement amounts.

Objective Damage Assessment

Building upon specialized claim expertise, objective damage assessment emerges as a foundational component when evaluating property losses.

Public adjusters employ systematic damage verification processes to guarantee complete documentation of both visible and concealed property damage. Their assessment techniques incorporate detailed photographic evidence, precise measurements, and thorough structural evaluations.

These professionals excel at identifying hidden damages that property owners might overlook, such as structural compromises or developing mold issues.

Their meticulous approach to damage documentation creates a robust foundation for insurance claims, supporting fair settlement negotiations. Through independent evaluations, public adjusters provide unbiased assessments that prioritize the property owner’s interests, guaranteeing all damages are properly accounted for in the final claim submission.

Streamlined Claim Process

A streamlined approach to insurance claims emerges when property owners engage public adjusters, who systematically manage the entire claims process with proven expertise.

Their methodical handling of streamlined documentation and efficient paperwork substantially reduces administrative burdens while ensuring thorough claim submissions.

Public adjusters enhance the claims process through:

- Organized compilation and management of damage evidence

- Strategic communication between all involved parties

- Implementation of technology-driven documentation systems

Their professional oversight facilitates expedited settlements by preventing common filing errors and maintaining industry compliance standards. This systematic approach allows property owners to focus on recovery while the adjuster navigates complex policy requirements, maximizes available coverage options, and coordinates with necessary experts to support the claim’s validation.

Higher Claim Payouts & Settlements

Property owners seeking maximum claim settlements often discover substantial financial benefits when enlisting public adjusters, as evidenced by documented increases in payout amounts across various claim scenarios.

Settlement analysis demonstrates significant disparities between adjuster-assisted and unassisted claims. Studies in Florida reveal that public adjuster involvement resulted in settlements averaging $22,266 compared to $18,659 for unassisted claims.

Payout trends show even more dramatic differences in catastrophic events, where adjuster-assisted claims yielded settlements up to 747% higher than unassisted claims. Similarly, non-catastrophic claims saw increases of up to 574%. These substantial differences stem from public adjusters’ expertise in policy interpretation, thorough damage assessment capabilities, and skilled negotiation with insurance companies.

About The Public Claims Adjusters Network (PCAN)

The Public Claims Adjusters Network (PCAN) serves as a complete alliance of licensed public adjusters who collaborate to establish industry standards, share expertise, and provide unified support for policyholders across multiple jurisdictions.

Through adjuster networking, members gain access to collective knowledge, resources, and best practices for maximizing insurance claim settlements.

Membership benefits extend beyond professional development to include:

- Access to specialized training and certification programs

- Shared databases of claim precedents and settlement outcomes

- Collaborative case consultation with experienced adjusters nationwide

PCAN maintains stringent professional standards while fostering innovation in claims management techniques.

Members leverage the network’s combined expertise to navigate complex policy interpretations, implement effective documentation strategies, and develop advanced negotiation approaches.

This collaborative framework enables public adjusters to deliver superior results for policyholders while maintaining the highest ethical standards in insurance claim advocacy.