Ever wondered if public adjusters are the real deal? Let me tell you – they’re absolutely legitimate professionals who serve as your personal advocates when dealing with insurance claims. Think of them as your insurance claim bodyguards, armed with state licenses and backed by strict regulatory oversight.

You know how a lawyer represents you in court? That’s exactly what public adjusters do with your insurance claims. They’re not just random folks who decided to help with paperwork – they’ve earned their stripes through rigorous licensing, bonding, and continuous education requirements in most states across the U.S.

What’s really eye-opening is their impact on claim settlements. Some policyholders have seen their settlements rocket up by as much as 747% when working with these pros. Sure, they charge for their expertise – typically 5-20% of your settlement – but wouldn’t you rather get a bigger slice of a larger pie?

These insurance claim wizards operate under the watchful eyes of state regulators and consumer protection laws. It’s like having a seasoned navigator who knows all the hidden shortcuts and potential pitfalls in the complex world of insurance claims. If you’re facing a challenging claim, having a public adjuster in your corner might just be the game-changer you need.

Key Takeaways

Are Public Adjusters Worth Your Trust? Here’s What You Need to Know

Think of public adjusters as your personal insurance claim advocates – they’re like having a skilled navigator in the choppy waters of insurance settlements. But what makes them legitimate?

First off, these pros aren’t operating in the shadows. They’ve got state-issued licenses and credentials, just like your doctor or lawyer. Every state’s insurance department keeps a watchful eye on their activities, making sure they’re playing by the rules.

Want to talk numbers? Let’s get real. When you’ve got a public adjuster in your corner, your settlement could skyrocket. Independent research reveals claims can jump up to 747% higher compared to going it alone – that’s like turning a $10,000 settlement into $84,700!

These folks come with built-in safety nets too. They’re required to carry surety bonds (think of it as insurance for their insurance work) and stay up-to-date with ongoing training. It’s not just a one-and-done deal – they’re constantly sharpening their skills.

Here’s what really sets them apart: public adjusters work for you, not the insurance company. While insurance adjusters might have split loyalties, your public adjuster has just one mission – getting you the fairest settlement possible.

Worried about transparency? Most states have got your back. You’ll get everything in writing – contracts, fees, and even a 10-day cooling-off period if you change your mind. It’s like having a money-back guarantee on your claim support!

Understanding the Role of Public Adjusters

The role of public adjusters in the insurance industry serves an essential function for policyholders seeking fair claim settlements. These state-licensed professionals work independently to represent policyholders throughout the claims process, offering expertise in claims navigation and sophisticated adjustment strategies to maximize recovery outcomes.

Public adjusters operate exclusively on behalf of policyholders, distinguishing them from insurance company adjusters. Their responsibilities encompass thorough claims management, from initial damage assessment to final settlement negotiations. Claims processing standards require maintaining 24-hour communication response times to ensure efficient client service.

Public adjusters serve as dedicated policyholder advocates, managing claims from start to finish while remaining independent from insurance companies.

Through their detailed understanding of insurance policies and industry practices, they evaluate coverage parameters, gather necessary documentation, and construct thorough claim presentations.

Their professional services typically involve a fee structure based on a percentage of the settlement, usually up to 10%. This arrangement guarantees alignment with policyholder interests while maintaining transparency in their operations. As licensed professionals, they must adhere to strict regulatory standards and maintain ethical practices in their dealings.

Studies demonstrate that policyholders who work with public insurance adjusters achieve settlements up to 800% higher than those who handle claims independently.

Licensing Requirements and State Regulations

Public adjusters must obtain state-specific licenses and meet strict regulatory requirements to operate legally in each jurisdiction.

Most states require public adjusters to secure surety bonds and maintain professional liability insurance to protect consumers from potential misconduct or errors.

These licensing and financial requirements vary by state, with some jurisdictions imposing additional conditions such as minimum bond amounts and specific insurance coverage limits.

Adjusters must maintain continuing education credits to stay current with industry standards and best practices.

Public adjusters who follow proper licensing requirements help policyholders achieve 800% higher settlements when representing insurance claims.

State-Specific License Rules

Across the United States, licensing requirements for public adjusters vary substantially by state, with some jurisdictions requiring strict licensure while others prohibit their practice entirely.

License variations reflect each state’s regulatory framework, with notable differences in how public adjusters can operate. For example:

- Alabama and Alaska do not license public adjusters, considering their work as practicing law

- Arizona mandates an adjuster license through their Department of Insurance

- Florida requires specific residency and citizenship qualifications

- Many states offer reciprocal agreements for nonresident licenses

States that permit public adjusters typically establish complete regulatory oversight through their respective insurance departments.

These departments enforce requirements including age restrictions, residency rules, examinations, and continuing education mandates. Public adjusters must maintain clean DOI records to ensure compliance with state regulations. Reciprocal agreements between states can streamline the licensing process for adjusters working across multiple jurisdictions.

Licensed public adjusters who join the PCAN Network undergo annual audits to maintain the highest standards of ethics and professionalism.

Required Bonds and Insurance

To maintain professional standards and protect consumers, state governments require public adjusters to secure specific bonds and insurance coverage as part of their licensing requirements. Twenty-six states mandate surety bonds, with amounts varying by jurisdiction, some starting at $20,000. These bonds guarantee financial compensation for insureds if adjusters engage in fraudulent or unfair practices. Public adjusters must maintain state licensing requirements to legally advocate for policyholders.

Bond specifics include a minimum 30-day notice period for termination, and the protection remains active throughout the adjuster’s licensed period. While premium costs vary based on underwriting factors like credit history, some states offer alternatives such as irrevocable letters of credit. The bonds guarantee payment of settlement funds and protect against unethical practices, with claims processes available for affected insureds. Legitimate public adjusters typically help policyholders secure 20-50% higher settlements through their expertise in insurance policies and regulations.

How to Verify a Public Adjuster’s Credentials

When selecting a public adjuster, the first essential step is to verify their active license status through official state platforms like the Texas Department of Insurance or Sircon.com.

A licensed public adjuster must maintain proper bonding and insurance coverage to operate legally within their jurisdiction. These credentials can be confirmed through state licensing authorities and should be readily available upon request from the adjuster.

State-mandated continuing education is required to maintain an active public adjuster license and ensure professional competency.

Public adjusters typically charge contingency fees ranging from 5-20% of the final insurance claim settlement amount. These fees are only paid if the claim is successful, providing an incentive for the adjuster to maximize the settlement amount. Understanding the different types of public adjuster fee structures explained can help policyholders make informed decisions when selecting a professional to assist them with their claims. Ultimately, this approach ensures that clients are not burdened by upfront costs, as their investment aligns with the outcome of their insurance recovery efforts.

Check License Status First

Before engaging a public adjuster’s services, consumers must verify the legitimacy of their licenses through state insurance departments. License validity checks establish the foundation for document verification and protect against potential fraud.

State departments maintain official databases where consumers can confirm credentials and review expiration dates.

- Access the state’s department of insurance website

- Navigate to the license verification portal

- Input the adjuster’s name or license number

- Review current status and any disciplinary actions

For adjusters operating across multiple states, verification of non-resident licenses is equally essential. These credentials must remain current and valid in both home and reciprocal states.

Consumers should document their findings and maintain records of all license verifications before proceeding with any claims assistance agreement.

Verify Bond and Insurance

Beyond license verification, a public adjuster’s bond and insurance status provide additional layers of professional credibility and financial security. Public adjusters must submit a $1,000 bond during the licensing period, which guarantees their compliance with state regulations and professional service standards.

Bond validation involves reviewing the submitted Acknowledgements and Power of Attorney forms, while insurance documentation requirements vary by state. Although specific insurance verification methods aren’t standardized across jurisdictions, state insurance departments oversee adjuster compliance.

Professional associations may require liability insurance coverage as an additional safeguard. Prospective clients should verify both bond status through state licensing authorities and any required insurance coverage through regulatory bodies to guarantee thorough protection when engaging a public adjuster’s services.

Common Myths vs. Reality in Public Adjusting

Despite the essential role public adjusters play in insurance claims, numerous misconceptions persist about their profession. Industry myths have created unwarranted skepticism, requiring systematic misperception debunking to establish the truth about these licensed professionals.

Common misconceptions about public adjusters include:

- They engage in fraudulent practices against insurance companies

- They charge excessive fees that consume most of the claim settlement

- They perform minimal work while collecting substantial payments

- They operate similarly to insurance company adjusters

The reality demonstrates that public adjusters are strictly regulated professionals who must maintain state licenses, pass background checks, and adhere to a rigorous code of ethics.

Their fees are typically capped by state law, often around 10% for residential claims during emergencies. Studies indicate their involvement can result in markedly higher claim settlements, with increases up to 747%.

Unlike company adjusters, they work exclusively for policyholders, providing thorough damage assessments and professional advocacy throughout the claims process.

Warning Signs of Public Adjuster Scams

Insurance industry watchdogs have identified key warning signs that distinguish legitimate public adjusters from unscrupulous operators. The most common red flags include unsolicited visits after disasters, pressure for immediate claim decisions, and promises of guaranteed settlements. Individuals presenting misleading credentials often operate under various titles like “loss consultants” or “insurance specialists” to circumvent licensing requirements.

Predatory tactics frequently involve demands for large upfront payments, offers to cover deductibles, and kickbacks for referrals. These operators may run “claim mill” operations, taking on more clients than they can effectively serve, or operate as contractors claiming insurance negotiation abilities.

Additional warning signs include the inability to provide valid licensing information, vague fee structures, and reluctance to furnish references. To protect themselves, property owners should verify credentials through state insurance departments, obtain detailed written agreements, and avoid making payments without clear service documentation.

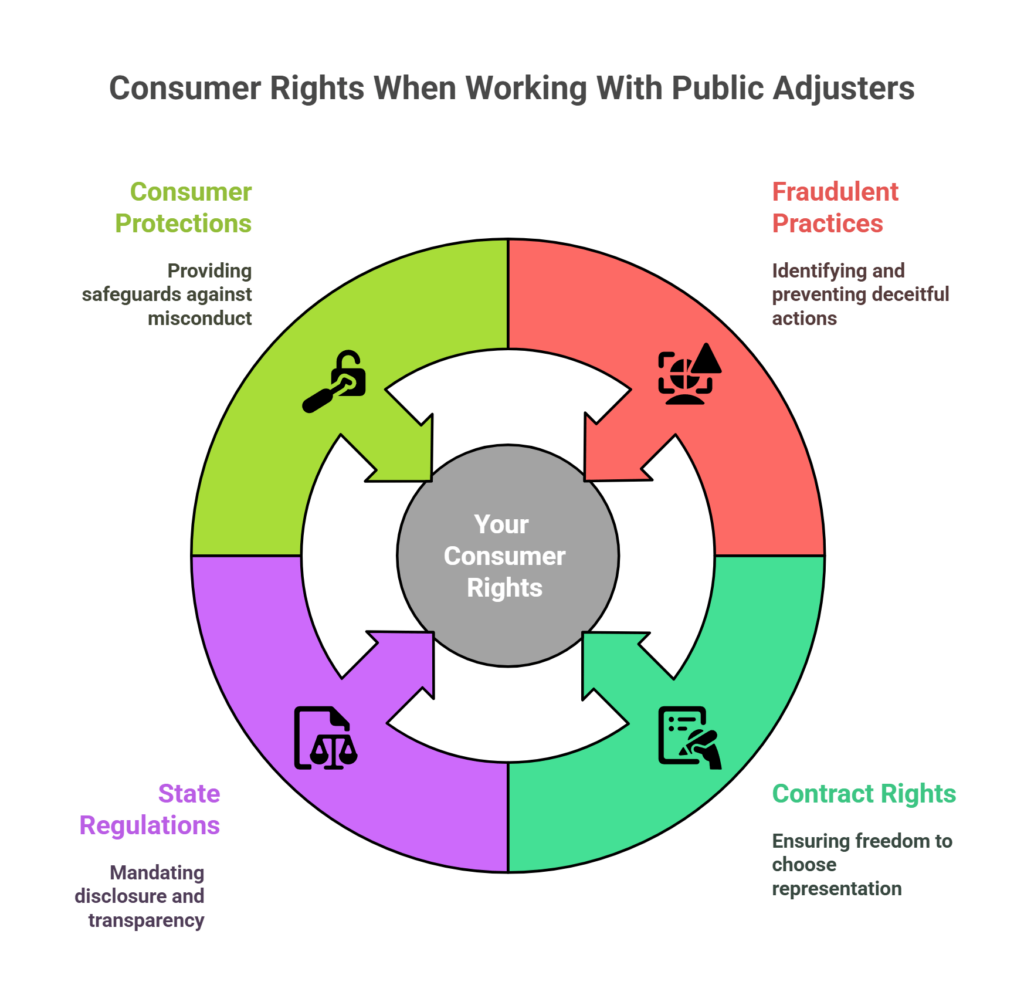

Consumer Rights When Working With Public Adjusters

While identifying fraudulent practices helps protect consumers, understanding one’s rights when working with public adjusters provides an equally important safeguard.

Contract rights guarantee policyholders the freedom to choose representation while maintaining protection under consumer fraud laws.

State regulations require public adjusters to meet specific disclosure requirements, including clear documentation of fees, potential conflicts of interest, and any financial relationships with recommended contractors.

Key consumer protections include:

- The right to receive written notification of all fees and contract terms before engagement

- The ability to file complaints with state insurance departments for misconduct

- Protection from deceptive practices through state consumer protection laws

- Access to complete documentation of claim negotiations and settlements

These fundamental rights enable policyholders to make informed decisions while maintaining legal recourse if issues arise. Understanding these protections helps consumers confidently navigate the claims process while working with public adjusters.

Legal Protections and Industry Standards

To safeguard both consumers and the industry, public adjusters operate within a thorough framework of legal protections and professional standards. This regulatory compliance structure guarantees legitimacy through strict licensing requirements, continuing education mandates, and ethical guidelines. Contractual safeguards protect policyholders through mandatory provisions, including clear fee structures and cancellation rights.

| Protection Area | Key Requirements |

|---|---|

| Licensing | Valid state license, continuing education |

| Contracts | Written agreement, 7-day submission to insurer |

| Fee Structure | No charges on deductibles, transparent pricing |

| Consumer Rights | 10-day cancellation period, settlement approval |

| Documentation | Detailed estimates, complete record keeping |

The industry maintains its credibility through stringent oversight of public adjusters’ conduct, prohibiting conflicts of interest and fraudulent activities. These measures guarantee that adjusters operate professionally while prioritizing policyholder interests, maintaining accurate records, and adhering to established settlement procedures.

Tips for Choosing a Reputable Public Adjuster

Building on the established legal framework, selecting a qualified public adjuster requires careful consideration of several key factors.

Professional memberships in organizations like NAPIA and regional associations serve as indicators of credibility and ethical commitment. Verification of licenses, credentials, and industry experience through state departments of insurance guarantees compliance with regulatory requirements.

Professional credentials and organizational memberships demonstrate an adjuster’s commitment to industry standards and regulatory compliance.

When evaluating potential adjusters, consider these essential steps:

- Verify current licensing and professional association memberships

- Review client testimonials and online feedback from multiple platforms

- Examine their specialization in relevant property types and disaster categories

- Obtain clear documentation of fee structures and service agreements

A thorough assessment of an adjuster’s qualifications, combined with careful examination of their track record and specializations, helps guarantee selection of a reputable professional.

This systematic approach protects policyholders while maximizing the likelihood of successful claim outcomes through qualified representation.

The Benefits Of Consulting A Public Adjuster

Public adjusters offer significant advantages through their expert knowledge of insurance claims and ability to conduct thorough, unbiased damage assessments. They understand the complexities of insurance policies and are skilled in negotiating with insurers to ensure clients receive fair settlements. However, clients should be aware of the public adjusters benefits and drawbacks, as hiring these professionals may involve fees that could impact the total payout. Nevertheless, the peace of mind and expertise they provide often outweigh the potential costs, making them a valuable resource in the claims process.

Their professional involvement streamlines the claims process by managing documentation, communication, and negotiations with insurance companies.

Studies consistently show that policyholders who engage public adjusters often receive higher claim settlements due to their complete understanding of policy terms and strategic negotiation skills.

Expertise In Insurance Claims

Insurance claim expertise stands as one of the primary advantages when consulting a public adjuster. These professionals possess thorough insurance knowledge and specialized experience in handling complex claims processes.

Their background often includes direct experience working within insurance companies, providing valuable insider perspective during negotiations.

Public adjusters demonstrate their claims expertise through:

- Thorough analysis of insurance policies to identify all applicable coverage

- Detailed documentation of property damage using industry-standard methods

- Professional evaluation of repair costs and replacement values

- Strategic negotiation with insurance carriers based on policy terms

This specialized knowledge enables public adjusters to navigate intricate policy language, identify coverage limitations, and guarantee proper claim documentation. Their expertise particularly benefits policyholders dealing with substantial property damage or complicated insurance scenarios.

Objective Damage Assessment

When property damage occurs, an objective assessment becomes essential for securing appropriate compensation through insurance claims. Public adjusters offer damage expertise that guarantees thorough evaluation of property losses through detailed documentation and precise cost estimation.

Their assessment precision extends to identifying hidden structural issues that might otherwise go unnoticed during standard inspections.

These professionals possess specialized knowledge in evaluating various types of damage, from natural disasters to complex situations involving multiple forms of property loss. They meticulously document all findings, prepare exhaustive reports, and guarantee compliance with legal requirements and filing deadlines.

Through their objective approach, public adjusters provide accurate damage evaluations that support strong insurance claims, ultimately helping policyholders receive fair compensation for their losses.

Streamlined Claim Process

Although handling insurance claims can be complex and time-consuming, professional public adjusters streamline the process through systematic management of documentation, communication, and settlements.

Their expertise minimizes bureaucratic delays while ensuring enhanced organization of claim-related materials.

The streamlined approach includes:

- Efficient handling of all paperwork and documentation requirements

- Coordinated communication between insurance companies and policyholders

- Strategic deployment of digital tools for real-time claim tracking

- Thorough analysis of policy coverage to maximize settlement potential

This systematic process allows policyholders to focus on recovery while public adjusters manage the technical aspects of their claims.

Through reduced delays and professional oversight, claims reach resolution more efficiently, demonstrating the legitimate value these professionals bring to the insurance settlement process.

Higher Claim Payouts & Settlements

Many policyholders discover significant financial advantages when engaging public adjusters for their insurance claims. Through detailed documentation and professional advocacy, these experts consistently secure enhanced recovery amounts compared to self-managed claims. Their thorough damage assessments and expert negotiation tactics guarantee all valid losses are properly documented and pursued.

| Aspect | Impact | Benefit |

|---|---|---|

| Expertise | Professional Assessment | Higher Valuation |

| Documentation | Complete Records | Maximum Coverage |

| Negotiation | Strategic Advocacy | Better Settlements |

| Policy Knowledge | Full Understanding | Valid Claims Pursuit |

| Legal Compliance | Regulatory Adherence | Protected Rights |

Studies demonstrate that claims handled by public adjusters typically result in higher settlements, with fees often offset by increased payouts. Their contingency-based fee structure, ranging from 5-20% of settlements, allows policyholders to access professional representation without upfront costs while maximizing potential claim recovery.

About The Public Claims Adjusters Network (PCAN)

Research efforts to provide detailed information about the Public Claims Adjusters Network (PCAN) have yielded limited results.

While Network Benefits and Membership Structure remain undefined, public adjusters typically operate independently or through established firms. These professionals maintain their legitimacy through state licensing requirements and adherence to industry regulations.

Professional networks in the public adjusting field generally focus on:

- Connecting licensed adjusters with policyholders requiring claim assistance

- Providing resources and support for complex insurance negotiations

- Maintaining professional standards and ethical practices

- Facilitating knowledge sharing among industry professionals

While specific information about PCAN remains unavailable, legitimate public adjusters continue to serve policyholders through established channels, whether independently or through recognized firms.

The industry’s focus remains on providing skilled representation for insurance claims while operating within state regulatory frameworks and maintaining professional standards.