Standard homeowners insurance policies cover hidden water damage from sudden, accidental incidents like burst pipes or appliance malfunctions. However, gradual leaks, seepage, and maintenance-related issues are typically excluded from coverage. Advanced detection methods like thermal imaging and moisture meters help document legitimate claims. While basic policies offer limited protection, additional endorsements can expand coverage for water-related damages. Working with a public adjuster substantially increases settlement amounts through proper documentation and negotiation expertise.

Key Takeaways

- Standard homeowners insurance covers sudden and accidental water damage but excludes gradual deterioration or maintenance-related issues.

- Hidden water damage from burst pipes, malfunctioning appliances, or sudden plumbing system failures typically qualifies for coverage.

- Water damage from long-term leaks, groundwater seepage, or flood damage is generally excluded from standard insurance policies.

- Additional endorsements may be necessary for specific water-related damages like sewage backup or hidden seepage.

- Professional documentation using thermal imaging and moisture meters significantly strengthens insurance claims for hidden water damage.

Understanding Hidden Water Damage Coverage

Hidden water damage poses complex challenges for homeowners seeking insurance coverage, as most standard policies only protect against sudden and accidental water damage rather than gradual deterioration.

Understanding the distinction between covered and non-covered incidents is essential for effective hidden damage prevention and dispelling common water damage myths.

Standard HO3 policies typically exclude damage resulting from ongoing maintenance issues or negligence. However, some insurers offer additional endorsements specifically designed to address water seepage and hidden damage scenarios.

The key factor in coverage determination lies in proving the damage resulted from a sudden, unforeseen event rather than long-term deterioration.

Documentation through thermal imaging and moisture meters plays an important role in substantiating claims.

These tools provide objective evidence of water intrusion patterns and help establish the timing and nature of the damage, which insurers require to evaluate coverage eligibility under policy terms.

Types of Water Damage Your Policy Protects Against

Standard homeowners insurance policies provide coverage for sudden and accidental water discharge from plumbing systems, including burst pipes and unexpected mechanical failures.

Coverage extends to water damage caused by malfunctioning appliances like dishwashers, water heaters, and washing machines that overflow or leak unexpectedly.

These protections apply specifically to incidents that are immediate and unforeseen rather than those resulting from gradual deterioration or lack of maintenance.

Sudden Plumbing System Failures

The unpredictability of plumbing system failures makes them one of the most common sources of water damage in homes. Insurance policies typically cover sudden leaks and plumbing emergencies that result from unexpected system malfunctions or accidents. Coverage extends to repairs of damaged walls, floors, and ceilings, as well as cleanup and restoration costs.

Key aspects of plumbing system failure coverage include:

- Burst pipes from freezing temperatures

- Sudden appliance-related water damage

- Unexpected plumbing system ruptures

- Accidental pipe damage

- Water damage from sudden fixture failures

However, standard policies exclude gradual leaks, maintenance-related issues, and damage from tree root intrusion.

Homeowners should maintain detailed documentation when filing claims and act promptly to prevent additional damage, as delayed response could affect coverage eligibility.

Appliance Overflow Coverage

Most homeowners insurance policies offer extensive coverage for sudden and accidental water damage resulting from appliance overflows, including incidents involving washing machines, dishwashers, water heaters, and plumbing fixtures. Coverage typically extends to both structural elements and personal belongings damaged by the overflow, though the malfunctioning appliance itself is excluded from coverage.

While burst pipes, clogged toilets, and storm-related incidents are generally covered, insurers exclude damage stemming from poor appliance maintenance tips or gradual deterioration.

Emergency response strategies are essential, as visible issues left unaddressed may void coverage, particularly in cases of mold development.

Standard policies do not cover flooding, groundwater seepage, or sewer backups, though additional coverage can be purchased for specific scenarios like sump pump failures and sewer-related incidents.

Key Exclusions in Standard Insurance Policies

Understanding insurance policy exclusions proves critical for policyholders seeking extensive coverage protection. Standard policies contain specific water damage exclusions and insurance policy limitations that can greatly impact claims. Homeowners must recognize that while sudden water damage may be covered, certain scenarios are commonly excluded from basic coverage.

Key water-related exclusions typically include:

- Flood damage from external water sources

- Sewage backup without specific endorsements

- Long-term water damage leading to mold growth

- Damage from lack of maintenance or neglect

- Groundwater seepage through foundation walls

Insurance carriers carefully define these exclusions within policy documents to establish clear boundaries of coverage.

Additional exclusions may apply to specific situations involving intentional damage, commercial usage, or professional services. Understanding these limitations enables property owners to make informed decisions about supplemental coverage options, such as flood insurance or sewage backup endorsements, to protect against excluded perils.

Detecting Hidden Water Issues With Thermal Imaging

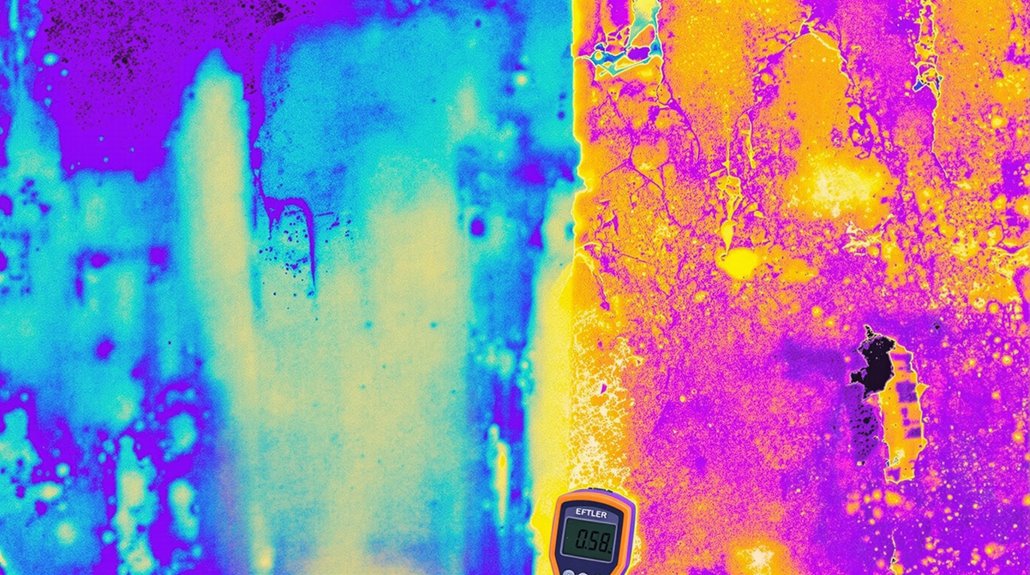

Thermal imaging technology detects hidden water damage by identifying temperature variations caused by moisture-affected materials emitting different levels of infrared radiation.

Advanced inspection methods combine thermal cameras with moisture meters to extensively map problem areas, strengthening documentation for insurance claims while preserving structural integrity through non-invasive testing.

The analysis of temperature patterns enables inspectors to distinguish between water damage and other issues like poor insulation, providing critical data for accurate damage assessment and timely remediation decisions.

Thermal Imaging Basic Principles

When examining the fundamental principles of thermal imaging technology, professionals rely on the detection of infrared radiation emitted by objects above absolute zero (-273.15°C).

This infrared technology operates within the thermal infrared band (8μm-14μm), utilizing specialized germanium lenses and infrared detectors to process thermal radiation into interpretable images.

Key aspects of thermal imaging applications include:

- Detection of temperature variations between wet and dry areas

- Non-invasive assessment of hidden moisture

- Conversion of thermal radiation into grayscale values

- Processing of infrared signals through cooled or uncooled detectors

- Formation of detailed thermal images for analysis

The technology functions similarly to conventional cameras but focuses on the infrared portion of the electromagnetic spectrum, which extends beyond visible light to approximately 1 mm, enabling the visualization of temperature differentials in various materials.

Advanced Damage Detection Methods

By integrating advanced thermal imaging technology with complementary detection methods, professionals can systematically identify and assess hidden water damage in residential and commercial structures.

These advanced detection techniques combine thermal imaging with moisture meters, endoscopes, and acoustic leak detection systems to provide thorough evaluations.

Thermal imaging technology rapidly scans large areas to detect temperature variations, while moisture meters verify the presence of water.

Endoscopes enable visual inspection of wall cavities, and acoustic detection pinpoints leaks in pressurized pipes.

Environmental factors, including ambient temperature, rainfall, and sun reflections, must be carefully considered during assessments.

For ideal results, thermographers account for these variables while differentiating between water damage and other thermal anomalies, such as poor insulation patterns.

Temperature Pattern Analysis Benefits

Through precise temperature pattern analysis, infrared imaging technology enables the detection of hidden water damage by revealing subtle thermal variations within building materials.

Thermal conductivity analysis identifies moisture-affected areas, as wet materials conduct heat differently than dry materials. Advanced moisture detection techniques utilize infrared radiation measurements to pinpoint compromised areas quickly and efficiently.

Key benefits of thermal imaging for water damage detection include:

- Rapid identification of moisture intrusion patterns and affected areas

- Non-invasive assessment of various building materials and structures

- Detection of subtle temperature differences indicating water presence

- Clear differentiation between moisture issues and insulation problems

- Effective monitoring of multiple building components simultaneously

This technology proves particularly valuable for detecting concealed water damage before it manifests visibly, enabling timely intervention and potentially reducing insurance claim complications.

Common Areas Vulnerable to Concealed Water Damage

Hidden water damage frequently occurs in several critical areas of residential and commercial properties, presenting significant risks to structural integrity and indoor air quality.

Common vulnerabilities include roof leaks around chimneys, vents, and damaged flashing, while ice dams and improper installation can lead to concealed moisture penetration.

Walls harbor numerous potential sources of concealed damage, particularly from plumbing leaks in bathroom fixtures, water heaters, and appliances.

Foundation cracks and condensation due to poor ventilation further compound these issues.

Basements face challenges from inadequate waterproofing, elevated groundwater, and failed sump pumps, while clogged gutters often contribute to water infiltration.

Crawl spaces represent another critical area of concern, where improper insulation, compromised vapor barriers, and insufficient ventilation create conditions conducive to hidden moisture accumulation.

These spaces are particularly susceptible to undetected plumbing leaks and pest-related damage that can compromise structural elements.

Documenting Your Hidden Water Damage Claim

Successful insurance claims for concealed water damage hinge on meticulous documentation and prompt action by property owners. Insurance claim processes require extensive evidence of hidden water damage, often discovered through professional hidden leak detection methods.

Property owners must utilize thermal imaging technology and expert assessments to identify and document concealed moisture problems.

Essential documentation requirements include:

- Detailed photographs and videos of affected areas

- Professional inspection reports and thermal imaging results

- Chronological records of all water damage discoveries

- Complete inventory of damaged property with values

- All communications with insurance representatives

Documentation should be maintained both digitally and in hard copy format, ensuring accessibility throughout the claims process.

Property owners should record all interactions with insurance adjusters, contractors, and restoration professionals. Regular updates to the insurance carrier about ongoing issues or new discoveries help maintain claim validity and support successful resolution of hidden water damage claims.

The Role of Professional Inspections

Professional inspections play an essential role in identifying concealed water damage that standard visual examinations might miss. Through advanced techniques like thermal imaging and moisture meters, certified inspectors can detect temperature variations and moisture levels that indicate hidden water intrusion.

These professional assessments provide critical documentation for insurance claims while helping prevent secondary issues like mold growth.

Skilled inspectors consider environmental factors that might affect readings, such as ambient temperature and reflective heat, ensuring accurate results. They can differentiate between genuine moisture problems and other issues like poor insulation through detailed pattern analysis.

This expertise proves particularly valuable when dealing with insurance carriers, as policyholders bear the responsibility of proving their claims. Professional assessments also help negotiate fair settlements by providing thorough documentation of damage extent and necessary repairs, often revealing issues that might otherwise go unnoticed until they become more severe and potentially uninsurable.

Steps to Strengthen Your Insurance Claim

While professional inspections establish the foundation for identifying water damage, taking specific steps to document and present evidence substantiates an insurance claim's validity.

Implementing proven insurance claim tips strengthens the likelihood of coverage for hidden damage prevention and successful claim resolution.

Key actions to strengthen an insurance claim include:

- Capturing extensive photographic and video evidence with timestamps, showing both overview shots and detailed close-ups

- Creating a thorough inventory of affected items, including pre-damage condition and replacement costs

- Preserving damaged materials for adjuster review when possible, documenting items that require immediate disposal

- Maintaining organized communication records with insurance providers and detailed incident reports

- Retaining all receipts for temporary repairs, materials, and professional services

These documentation steps create a robust evidence trail that supports the claim's legitimacy and helps guarantee proper coverage for both visible and hidden water damage throughout the claims process.

Preventing Hidden Water Issues in Your Home

Proactively preventing hidden water damage requires implementing extensive detection systems and maintenance protocols throughout residential properties.

Key leak prevention strategies include installing smart detection systems that provide real-time monitoring and automated water shutoff capabilities while integrating with home automation networks for thorough coverage.

Effective moisture control techniques encompass regular inspection of plumbing systems, particularly in concealed spaces like crawl spaces and attics. This includes upgrading to steel-braided hoses, maintaining gutters, and installing sump pumps in finished basements.

Properties should utilize water-resistant materials during renovations and implement proper ventilation systems to minimize condensation risks.

Homeowners must consistently monitor for indicators of hidden water issues, such as unexplained increases in water bills, musty odors, or visual signs like peeling paint and stains.

Additional preventive measures include installing flood barriers in susceptible areas and disconnecting outdoor hoses during freezing conditions to protect against pipe damage.

The Benefits Of Consulting A Public Adjuster

Public adjusters provide critical expertise in maneuvering complex insurance claims, offering objective assessments of hidden water damage through specialized tools and techniques.

Their professional involvement streamlines the claims process by managing documentation, communication with insurers, and negotiation of settlements on behalf of policyholders.

Studies indicate that claims handled by public adjusters often result in markedly higher settlements, primarily due to their thorough understanding of policy coverage and ability to identify damages that might otherwise go unnoticed.

Expertise In Insurance Claims

When dealing with hidden water damage claims, consulting a licensed public adjuster can greatly enhance the likelihood of a favorable settlement. Public adjusters possess extensive knowledge of insurance policy intricacies and expertise in managing claims process challenges. Their professional understanding guarantees accurate interpretation of policy terms and identification of covered damages that might otherwise go unnoticed.

- In-depth knowledge of insurance policies and coverage terms

- Experience in documenting and presenting water damage evidence

- Expertise in negotiating with insurance companies

- Understanding of regulatory compliance requirements

- Professional skill in maximizing settlement outcomes

These professionals streamline the claims process through systematic documentation, skilled negotiation, and thorough understanding of insurance procedures.

Their expertise enables them to effectively advocate for policyholders while guaranteeing all aspects of hidden water damage are properly addressed and fairly compensated.

Objective Damage Assessment

A thorough objective damage assessment forms the cornerstone of successful hidden water damage claims. Public adjusters utilize advanced thermal imaging technology to detect concealed water damage that remains invisible to standard visual inspections.

This specialized equipment, combined with their understanding of environmental factors and ventilation patterns, enables them to differentiate water-related issues from other structural problems.

Professional adjusters conduct extensive evaluations that incorporate detailed documentation and proof of loss preparation. Their expertise extends beyond basic damage assessment to include specialized knowledge of insurance policies and procedures.

By employing thermal imaging technology and professional assessment methods, public adjusters can identify the full scope of hidden water damage, leading to more accurate claims and fair settlements.

This systematic approach guarantees that no damage goes undetected or undocumented during the claims process.

Streamlined Claim Process

Consulting a public adjuster greatly streamlines the insurance claims process for hidden water damage through expert guidance and systematic documentation. Their claim strategy encompasses detailed damage assessment, policy interpretation, and professional negotiation with insurance companies.

Key advantages of working with a public adjuster include:

- Expert evaluation of hidden water damage to guarantee accurate documentation

- Professional management of all claim-related paperwork and correspondence

- Strategic negotiations with insurance companies to maximize settlement value

- Efficient coordination with contractors and specialists for repair estimates

- Reduction of policyholder stress through professional claim handling

Public adjusters utilize their expertise to navigate complex insurance procedures while advocating for the policyholder's interests.

Their systematic approach helps avoid common pitfalls, guarantees thorough documentation, and expedites the claims process for hidden water damage.

Higher Claim Payouts & Settlements

Professional representation through public adjusters consistently yields substantially higher insurance claim settlements for hidden water damage cases.

Statistical evidence demonstrates that settlements negotiated by public adjusters average 574% more than those secured by property owners independently, with FAPIA studies showing typical payouts of $22,266 compared to $18,659 without representation.

These significant public adjuster benefits stem from their expertise in claim negotiation strategies and thorough damage assessments.

Using advanced techniques like thermal imaging, they identify concealed water damage that might otherwise go undetected.

Their contingency-based fee structure incentivizes maximum settlement pursuit, while their meticulous documentation and expert negotiation skills guarantee all eligible damages are included in claims.

This systematic approach to claim preparation and negotiation consistently results in higher payouts while minimizing out-of-pocket expenses for property owners.

About The Public Claims Adjusters Network (PCAN)

The Public Claims Adjusters Network (PCAN) represents a consortium of licensed professionals who specialize in advocating for policyholders during insurance claims processes.

These experts provide extensive support throughout the claims lifecycle, leveraging their specialized knowledge to maximize settlement outcomes.

Key Public Adjuster Benefits and Claims Process Improvements include:

- Professional evaluation of insurance policies and coverage details

- Expert damage assessment and documentation services

- Strategic negotiation with insurance carriers

- Expedited claims resolution timeframes

- Protection of policyholder rights and interests

PCAN providers deliver value through their deep understanding of insurance policies and procedures, ensuring thorough documentation and evidence collection.

Their expertise particularly benefits complex cases involving hidden water damage, where proper assessment and documentation are essential for successful claims.

When selecting a PCAN provider, policyholders should evaluate the adjuster's experience, certifications, and track record in handling similar water damage claims.

Frequently Asked Questions

Does Insurance Cover Water Damage From a Neighbor's Leaking Pipe?

Standard homeowners insurance typically covers water damage from a neighbor's leaking pipe, with coverage dependent on neighbor liability. Both property owners' insurance policies may be involved in resolving claims.

Can I Switch Insurance Companies After Discovering Hidden Water Damage?

Switching insurance companies remains possible after discovering damage, but proper damage disclosure is required. Immediate documentation and continuous coverage between insurance options are essential to maintain valid claim eligibility.

How Long Do I Have to File a Hidden Water Damage Claim?

Claim timeframes for hidden water damage typically range from 12 to 24 months, depending on specific water damage policies. Insurance companies may grant extensions based on claim complexity and circumstances.

Will Insurance Cover Relocation Costs During Water Damage Repairs?

Insurance policies typically provide relocation assistance and temporary housing coverage when homes become uninhabitable due to covered water damage, subject to policy limits and documentation of additional living expenses.

Does My Insurance Rate Increase After Filing a Hidden Water Damage Claim?

Insurance rates typically increase 7-10% following hidden water damage claims. The claim impact on premium changes varies by location, claim history, and insurer-specific risk assessment protocols. In some regions, policyholders may see even more significant increases, depending on local risk factors such as flood zones or historical claim trends. Additionally, the average insurance payout for water damage can fluctuate widely, influenced by the severity of the incident and the specifics of the policy coverage. As a result, homeowners are often advised to review their insurance policies regularly and consider mitigation strategies to minimize future risks and potential premium hikes.