Statistical data indicates that sewer and water line insurance is not cost-effective for most homeowners. With less than 1% filing annual claims and average repair costs of $1,565, long-term premium payments typically exceed potential repair expenses. Modern piping materials last 30-80 years, reducing failure risks considerably. Many standard homeowner policies already include adequate coverage. A thorough assessment of property age, existing coverage, and local risk factors reveals the most prudent protection strategy.

Key Takeaways

- Less than 1% of homeowners file water line claims annually, with average repair costs of $1,565, suggesting low risk.

- Monthly premiums of $5.99 often exceed the cost-effective choice of saving for repairs, given the low probability of issues.

- Modern piping materials last 20-80 years, reducing the need for repairs in newer homes.

- Many homeowners insurance policies already include water line coverage, making additional insurance redundant.

- Coverage limitations, waiting periods, and non-transferability reduce the overall value of specialized water line insurance.

Understanding Water Line Coverage and Claims

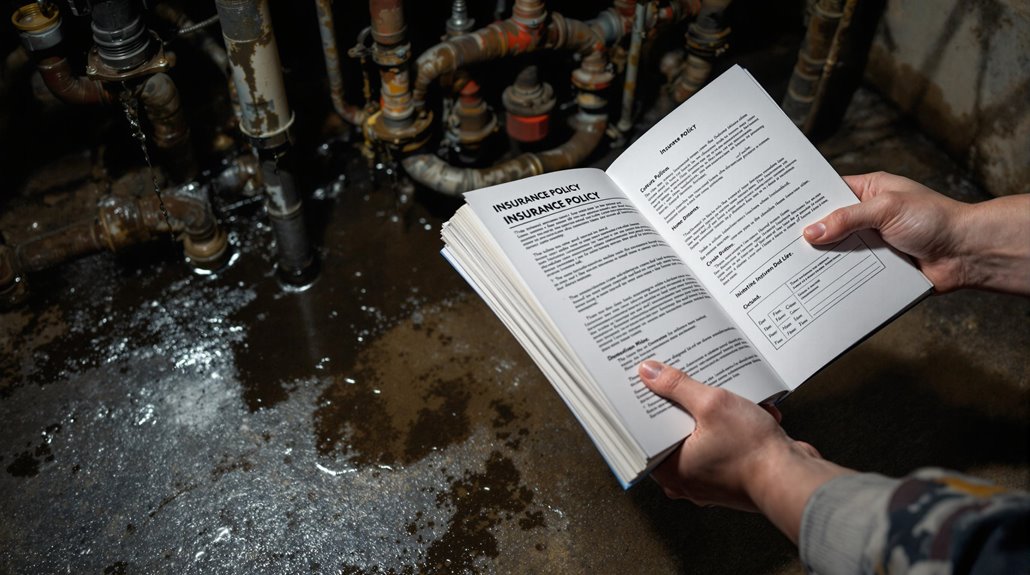

When evaluating water line coverage and claims, homeowners must first recognize that service line insurance differs fundamentally from traditional insurance policies. Rather than protecting against unexpected events, these plans function more like warranties for predictable wear and tear on water lines.

Statistical data reveals that water line claims are relatively rare, with less than 1% of homeowners filing claims annually. The average repair costs for water line leaks amount to approximately $1,565, considerably lower than the cumulative cost of maintaining service line coverage.

Many utility companies partner with third-party providers to market these plans, often emphasizing worst-case scenarios that rarely occur.

Before purchasing additional service line coverage, homeowners should review their existing homeowners insurance policy. Many standard policies already include adequate protection for water line issues, making supplementary coverage unnecessary.

This examination can prevent duplicate coverage and provide cost-effective protection against genuine risks.

Cost Analysis of Insurance Vs Out-Of-Pocket Repairs

Although sewer and water line insurance premiums appear modest at first glance, starting at $5. 99 monthly, a thorough cost-benefit analysis reveals potential inefficiencies in this coverage option. Consumers may find that the coverage limits and deductibles often associated with these plans can diminish their overall value, particularly when compared to the potential costs of repairs without insurance. Furthermore, while some may consider the dominion energy water line insurance benefits appealing, it is essential to evaluate whether the annual expenses truly justify the protection provided. In many cases, setting aside a dedicated savings fund for unexpected repairs may prove to be a more financially sound strategy.

Statistical data indicates that only 0.7% of customers file sewer line claims annually, suggesting the insurance worth may be questionable for most homeowners.

When comparing average repair costs—$1,565 for water lines and $430 for sewer lines—against annual premium payments, many homeowners may find self-insuring more economical.

While extensive replacements can reach $22,000, causing significant financial strain, the long lifespan of modern piping materials (30-80 years for copper, 20-40 years for PVC) reduces the likelihood of major repairs.

Additionally, existing homeowners insurance policies may already provide adequate coverage, making separate water line insurance unnecessary.

Coverage exclusions in specialized policies further diminish their value proposition, particularly for residents of newer homes where infrastructure deterioration risks are minimal.

Risk Assessment for Different Property Types

The risk profile for sewer and water line failures varies considerably across different property types, with age serving as a primary determining factor. Statistical data indicates that only 0.3% to 0.7% of homeowners need water line repairs annually, suggesting relatively low overall risk.

However, this risk assessment differs markedly between newer and older properties. Homeowners with an old house face higher probabilities of requiring water line coverage worth considering, as aging infrastructure increases vulnerability to breaks and leaks. For these properties, insurance against water main failures may be prudent.

Conversely, modern homes built with contemporary materials typically exhibit lower risk profiles, making additional coverage less essential. A contract typically covers repair costs, but property responsibilities should be clearly understood, particularly regarding maintenance from the shut-off valve.

Local historical data and neighboring experiences provide valuable insights for determining whether replacing your water line insurance is necessary, as geographical factors can influence risk levels greatly.

Key Policy Terms and Coverage Limitations

Understanding service line insurance policies requires careful attention to their unique terms and limitations, which differ substantially from traditional homeowner's insurance coverage.

These policies function more like warranties for aging infrastructure than standard insurance protection against unexpected events.

Critical coverage limitations include mandatory waiting periods, typically 30 days before claims can be filed, and specific exclusions for damage caused by natural disasters or homeowner negligence.

Coverage is generally restricted to lines running from the property edge to the house exterior, with maximum annual benefits often capped at $7,000 for water lines.

Most policies are non-transferable to new property owners. Claims statistics indicate that only 0.7% of sewer line claims are filed annually, highlighting the relatively low frequency of repair needs.

Homeowners should note that service line insurance excludes various scenarios and may not cover the full cost of extensive repairs that exceed policy limits.

Making an Informed Decision Based on Data

Statistical evidence suggests that homeowners should carefully weigh the cost-benefit ratio of service line insurance before purchasing coverage.

With annual claims rates at just 0.7% for sewer lines, and monthly premiums ranging from $2.99 to $12.98, the likelihood of utilizing this coverage remains remarkably low.

When making an informed decision, homeowners should consider several key data points.

First, the lifespan estimates of piping materials, which can range from 20 to 100 years, considerably impact the necessity of coverage based on home age.

Second, while water line repair costs can exceed $3,000, the cumulative cost of premiums over time may approach or exceed this amount.

Additionally, existing homeowners insurance policies may already provide adequate protection, making supplemental coverage redundant.

Analysis of these factors, combined with an assessment of the property's specific characteristics and current coverage, enables property owners to make a data-driven decision about service line insurance necessity.

The Benefits Of Consulting A Public Adjuster

Consulting a licensed public adjuster for sewer and water line insurance claims provides access to specialized expertise in policy interpretation and damage documentation.

Professional public adjusters conduct detailed, objective assessments of property damage while managing the complex documentation requirements and negotiations with insurance carriers.

Studies indicate that policyholders who engage public adjusters typically receive considerably higher settlement amounts, with increases of up to 800% compared to those who handle claims independently.

Expertise In Insurance Claims

When sewer and water line issues strike, a public adjuster's expertise can greatly impact the outcome of an insurance claim. Their in-depth knowledge of claims processes and insurance policies enables them to navigate complex paperwork and negotiations with insurance companies effectively.

Studies indicate that homeowners working with public adjusters typically secure settlements 20-30% higher than those handling claims independently.

While public adjusters charge 10-15% of the claims amount, their expertise often justifies this investment through superior outcomes. They understand intricate policy clauses and documentation requirements, allowing them to build stronger cases for maximum compensation.

Objective Damage Assessment

Professional damage assessment by a public adjuster provides homeowners with an unbiased evaluation of sewer and water line issues.

These specialists conduct thorough inspections to determine the full extent of damage, ensuring accurate repair costs are documented for insurance claims.

Public adjusters leverage their expertise to maximize claim value, typically securing 20% to 30% higher settlements compared to self-filed claims.

Their objective damage assessment encompasses detailed documentation of affected areas, potential long-term implications, and necessary repairs.

Through their understanding of insurance policy intricacies, they identify applicable coverage details that homeowners might overlook.

This all-encompassing evaluation strengthens negotiating positions with insurance companies, while simultaneously relieving homeowners of complex paperwork and communication responsibilities.

The result is a more efficient claims adjustment process backed by professional documentation.

Streamlined Claim Process

A public adjuster's involvement transforms the insurance claim process into a structured, efficient operation that significantly reduces complications and delays. Their expertise streamlines the claims process through extensive understanding of insurance policies and state regulations, ensuring accurate documentation submission and maximum payout potential.

| Adjuster Benefits | Impact on Claims |

|---|---|

| Technical Expertise | Accurate Documentation |

| Regulatory Knowledge | Expedited Approvals |

| Negotiating Skills | Higher Settlements |

| Damage Assessment | Detailed Validation |

| Time Management | Reduced Processing |

Public adjusters provide professional representation when dealing with water line insurance claims, leveraging their negotiating skills to advocate for homeowners. Their thorough assessment of damages and repairs strengthens claim validity, while their familiarity with coverage limits and exclusions helps prevent claim denials. This specialized assistance especially benefits those facing complex sewer and water line damage scenarios.

Higher Claim Payouts & Settlements

Substantial evidence demonstrates that engaging a public adjuster leads to notably higher insurance claim settlements for sewer and water line damage.

Statistics reveal that homeowners working with public adjusters receive settlements averaging 30% higher than those negotiating directly with insurance companies.

Public adjusters maximize claim payouts through detailed evaluation of repair costs and thorough expert documentation. Their specialized knowledge helps identify all eligible expenses and coverage options that property owners might otherwise overlook.

Through skilled negotiation, they guarantee insurance claims reflect the full scope of water line damage and necessary repairs.

While public adjusters charge a percentage of the settlement, the increased payout typically exceeds their fee greatly.

Their expertise in documenting and presenting claims helps homeowners secure settlements that accurately reflect actual restoration costs.

About The Public Claims Adjusters Network (PCAN)

The Public Claims Adjusters Network (PCAN) operates as a nationwide organization of state-licensed public adjusters who have met rigorous vetting standards.

With coverage across 40+ states and expertise in over 30 different claim types, PCAN members specialize in both residential property and commercial property damage insurance claims.

PCAN serves as a crucial connection point between policyholders seeking expert assistance and thoroughly vetted licensed adjusters.

Network members must complete an intensive application and interview process before admission, ensuring only the most qualified professionals join their ranks.

The organization maintains strict oversight through mandatory annual audits of licenses and complaint records.

Members are required to demonstrate consistent adherence to the highest standards of ethics and professionalism.

This systematic approach to quality assurance positions PCAN as a trusted resource for property owners seeking expert guidance with their insurance claims, while simultaneously providing a platform for elite public adjusters to serve their communities.

Frequently Asked Questions

Is Water Sewer Backup Coverage Worth It?

Statistical analysis indicates sewer backup coverage provides limited value, with low annual claims rates and high premiums relative to repair costs. Homeowners should evaluate existing policy limits and financial risks before purchasing additional coverage.

How Much Does Sewer Line Insurance Cost?

Typical sewer line insurance premiums range from $5.49 to $12.98 monthly, with most homeowners paying around $10.99 for $10,000 in annual coverage limits, depending on location and provider-specific policy exclusions.

Does Homeowners Insurance Cover Sewer Line Problems?

Standard homeowners insurance typically excludes external sewer line repairs, covering only internal plumbing issues. Homeowners maintain liability for exterior line maintenance, though water damage from sudden internal breaks receives coverage under most policies.

Is Service Line Coverage Worth It for Homeowners?

Like a knight's armor with holes, service line coverage rarely justifies its cost. Statistical analysis shows low claim rates (0.7%) and high premiums compared to actual repair expenses, making standard homeowners insurance sufficient.