Homeowners insurance typically covers floor collapse caused by sudden, accidental events such as burst pipes or structural failures. Standard HO-3 policies exclude damage from gradual deterioration, neglect, or foundation issues. Coverage requirements vary considerably among insurers, and claims must demonstrate unforeseen, catastrophic circumstances. Professional documentation and thorough evidence are essential for successful claims. Understanding specific policy terms and prevention strategies can make the difference between approved and denied claims.

Key Takeaways

- Homeowners insurance typically covers floor collapse caused by sudden, accidental events like pipe bursts or other unexpected catastrophes.

- Coverage excludes damage resulting from long-term deterioration, neglect, or poor maintenance of the property's foundation.

- Natural disaster-related floor collapse may require additional coverage options, as standard policies often limit or exclude these events.

- Claims must be reported immediately and include thorough documentation, photos, and professional assessments to validate coverage.

- Regular inspections and maintenance records strengthen claims and help ensure coverage when floor collapse occurs from covered perils.

Understanding Floor Collapse Coverage Under Standard Policies

A standard homeowners insurance policy's approach to floor collapse coverage hinges on specific circumstances and defined perils that trigger protection.

Homeowners insurance covers floor collapse when resulting from sudden, accidental events such as natural disasters or unexpected structural failures. However, foundation issues stemming from gradual deterioration or neglect typically fall outside the scope of coverage.

Insurance experts emphasize that collapse coverage requirements vary considerably among policies, with insurers maintaining strict definitions of what constitutes a legitimate collapse claim.

Claims for floor collapse must generally demonstrate that the damage caused was unforeseen and catastrophic rather than due to poor maintenance. When structural issues arise, documentation from licensed professionals becomes essential in establishing coverage eligibility.

The homeowners policy places responsibility on property owners for maintaining the integrity of their floors, requiring vigilant monitoring and prompt attention to warning signs.

Understanding these coverage parameters helps homeowners navigate potential claims and maintain appropriate protection for their property.

Like roof claims, understanding your policy limits and deductibles is crucial before filing a floor collapse claim with your insurance provider.

Common Causes of Floor Collapse and Their Insurance Implications

Multiple factors contribute to floor collapse incidents, each carrying distinct implications for insurance coverage and claim eligibility. While homeowners insurance covers sudden events stemming from covered perils, issues caused by negligence or gradual deterioration typically remain excluded.

| Cause | Insurance Status | Documentation Needed |

|---|---|---|

| Water Damage | Covered if sudden | Proof of pipe burst/event |

| Structural Defects | Limited coverage | Engineering assessment |

| Natural Disasters | Varies by policy | Photos and expert reports |

| Foundation Damage | Often excluded | Historical maintenance |

Understanding these distinctions is essential for homeowners, as insurance won't cover collapse due to negligence or lack of maintenance. When structural issues arise from covered perils like storms or fires, policies typically cover the resulting damage. However, deterioration from long-term water exposure or pre-existing foundation problems generally falls outside coverage parameters. Homeowners must maintain detailed records and address visible structural concerns promptly to guarantee valid claims when collapse occurs. Similar to floor collapse, standard flood damage requires separate insurance coverage beyond typical homeowners policies.

Steps to Take When Filing a Floor Collapse Claim

Filing a successful floor collapse claim requires homeowners to follow specific procedures and meet vital documentation requirements. The first vital step involves immediately reporting the incident to the insurance provider, as delayed reporting could jeopardize claim approval.

Comprehensive documentation of the damage through photographs and videos serves as vital evidence for the claim process. Homeowners must accurately complete all necessary claim forms provided by their insurance company, detailing the collapse incident and resulting damage.

An insurance adjuster will conduct an on-site assessment to evaluate whether the damage falls under covered perils within the policy terms.

To strengthen the claim, obtaining professional evaluations from certified contractors or structural specialists is essential. These experts can provide detailed repair estimates and technical analysis of the collapse cause.

Their documentation helps establish the scope of damage and supports discussions with the insurance company regarding coverage determinations and settlement amounts.

Understanding replacement cost coverage can significantly impact the final payout amount for floor collapse repairs.

Prevention Strategies and Insurance Policy Reviews

Proactive maintenance and strategic insurance planning serve as critical defenses against floor collapse incidents and their financial impact. Regular inspections and preventative measures considerably reduce the likelihood of structural problems, while all-encompassing insurance coverage protects homeowners from unexpected events. Establishing a systematic approach to both maintenance and policy reviews guarantees ideal protection. HO-3 policies provide standard coverage for dwelling and structural damage that may lead to floor collapse.

Key preventative measures include:

- Monitoring foundation issues through proper drainage management and soil moisture control

- Conducting thorough structural assessments to identify early warning signs

- Maintaining detailed documentation of all repairs and maintenance activities

Annual reviews of insurance policies with independent agents help homeowners maintain appropriate coverage levels for potential floor collapse scenarios.

These evaluations should consider supplementary policies for specific risks, such as earth movement or flood damage, particularly in areas prone to severe weather.

Additionally, maintaining extensive maintenance records strengthens the claims process by providing evidence of responsible property management and supporting documentation for potential structural issues.

Frequently Asked Questions

Will Homeowners Insurance Cover Floor Collapse?

Homeowners insurance may cover floor damage from sudden events, but policy exclusions apply. Coverage limits vary based on structural integrity, water damage causes, and maintenance responsibilities. Regular home inspections help prevent liability claims.

Does Insurance Cover Floor Buckling?

Like dominoes falling, floor buckling coverage depends on the cause. Insurance policies typically cover sudden water damage but exclude gradual deterioration, requiring thorough property assessments to determine liability coverage and repair costs.

Will Insurance Pay to Replace the Entire Floor?

Insurance coverage for complete floor replacement depends on policy limits, documented water damage, structural integrity assessments, and whether damage stems from covered perils rather than maintenance issues or gradual deterioration.

Does Homeowners Insurance Cover Subfloor Replacement?

Like a safety net beneath your feet, homeowners insurance covers subfloor replacement when damage stems from sudden water damage incidents, but excludes gradual deterioration, subject to specific coverage limits and policy terms.

Final Thoughts

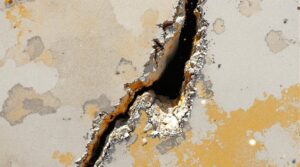

Floor collapse incidents underscore the critical intersection between structural integrity and insurance protection. Through meticulous documentation, regular structural assessments, and thorough policy analysis, property owners can fortify their coverage against catastrophic floor failures. The visual devastation of a collapsed floor—splintered joists, crumbling foundations, and compromised living spaces—serves as a stark reminder that proactive maintenance and proper coverage remain essential safeguards for homeowners' financial security.

For homeowners experiencing floor collapse or any property damage related to their homeowners insurance policy, insurance industry professionals and legal experts strongly advise consulting a qualified state-licensed public adjuster. These professionals work exclusively for policyholders, not insurance companies, serving as dedicated advocates throughout the claims process. Public adjusters are state-licensed experts who help navigate complex insurance policies, identify hidden damages often unknown to policyholders, thoroughly document losses, and negotiate with insurance companies to secure fair settlements while protecting policyholder rights.

By engaging a public adjuster, homeowners can maximize their claim payouts, expedite the claims process, and reduce the stress of dealing with insurance companies, allowing them to focus on property restoration. Policyholders seeking expert assistance with their property damage or loss claims can request a no-obligation free consultation with a Public Claims Adjusters Network (PCAN) member public adjuster through our contact page.