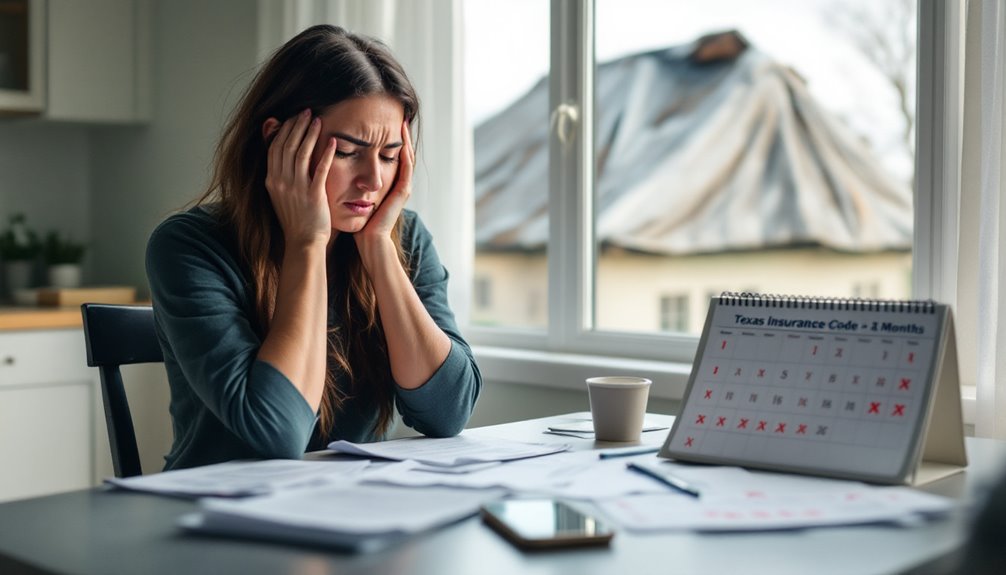

In Texas, insurance companies must initiate a claim investigation within 15 days of receiving a claim and complete it within 30 days. This timeline guarantees efficient claim resolution and a fair investigation process.

The insurer must approve or deny the claim within five (5) business days after completing the investigation.

Understanding these timelines is vital for policyholders to navigate the claims process effectively. Further examination of Texas insurance laws and regulations can provide additional insights into the claims process and the rights of policyholders.

Key Takeaways

- Insurance companies must investigate claims within 15 days.

- An investigation must be completed within 30 days in Texas.

- Complex claims allow a 45-day extension.

- Approval or denial must occur within 5 business days.

- Insurers face penalties for unreasonable delays over 60 days.

Claim Investigation Timeline

When initiating the claims process in Texas, how long can claimants expect the insurance claim investigation to take. The insurance company must begin the investigation within 15 days. Texas insurance laws dictate the claim investigation timeline, requiring completion within 30 days.

After investigation, insurers must approve or deny insurance claims within 5 business days. This timeline contributes to efficient claim resolution. Understanding the process can help claimants navigate insurance claims, potentially avoiding the need for legal representation. The structured timeline guarantees a swift and fair investigation, ultimately leading to timely claim resolution.

Insurance Company Deadlines

Insurance companies in Texas are subject to specific deadlines when handling claims, including the timeframe for claim acknowledgment, investigation, and payment. The claim time and investigation period are governed by a 30-day deadline from the claim acknowledgment date, with the option for a 45-day extension in complex cases.

The payment timeline is also regulated, requiring insurers to issue payment within 5 days of approving a claim, thereby defining the overall payment timeline in the claim resolution process.

Claim Time

Texas law dictates specific deadlines for insurance companies to investigate and resolve claims. Insurance companies must acknowledge a claim within 15 days and complete their investigation within an additional 15 days. Policyholders may take legal action if the insurance company fails to resolve a claim within this time frame. Understand your rights under Texas law to guarantee the insurance company approves or denies your claim in a timely manner. If they deny your claim, insurance adjusters must provide a reason. Claim processing should be completed within 35 days; otherwise, policyholders may seek assistance to protect their rights.

Investigation

Building on the understanding of claim timelines, the investigation process is a pivotal step in the insurance claim resolution cycle. In Texas, an insurance company must acknowledge a claim within 15 days, initiating the investigation. The investigation must be completed within 30 days, after which a decision to approve or deny the claim is made within 5 business days. If additional information is needed, it can be requested within the 15-day acknowledgment period. Failure to comply may result in penalties for the insurer, emphasizing the importance of timely investigation and decision-making in the claim process in Texas.

Payment Timeline

Generally, the payment timeline for insurance claims in Texas is governed by specific deadlines that insurers must adhere to. After an insurance company investigates a claim, they have 15 days to approve or deny it. Once approved, they must issue payment within 5 days. To initiate this process, policyholders must file their claim. Texas insurance companies must acknowledge a claim within 15 days of receipt. The total timeline for claim resolution is typically 35 days, ensuring efficient claim resolution in Texas. This framework helps insurance companies manage claims effectively, adhering to Texas regulations.

Filing a Claim Process

The filing a claim process in Texas entails the initial submission of a claim to the insurance company, which triggers a notice period during which the insurer must acknowledge receipt of the claim. Within 15 days of receiving the claim, the insurer is required to send an acknowledgment, thereby initiating the investigation process.

This notice period is a critical component of the claim filing process, as it sets in motion the timelines for investigation and resolution, including the insurer’s request for additional information to facilitate the investigation.

Claim Filing

Filing a claim sets in motion a regulatory framework that governs the insurance company’s response timeline in Texas. When an individual files a claim, the insurance company must acknowledge receipt within 15 days, initiating an immediate investigation. The Texas Insurance Code mandates timely communication to guarantee claim resolution.

If additional information is needed, the insurer must request it within the initial 15-day period. This framework facilitates a final determination, guaranteeing compliance with regulations and promoting efficient claim resolution through prompt investigation and acknowledgment.

Notice Period

Upon receipt of a claim, Texas insurance companies initiate a notice period that outlines the timeframe for acknowledging and investigating the claim. The insurance company must acknowledge receipt within 15 days. Key aspects include:

- Acknowledge receipt within 15 days

- Begin investigation immediately

- Request additional information if needed

- Approve or deny the claim within 30 days. Policyholders can file complaints with the Texas Department of Insurance if timelines are not met, ensuring fairness and prompt resolution of claims filed with an insurance company during the investigation.

Claim Approval Process

Most insurance claims in Texas follow a standard claim approval process, which typically begins with an acknowledgment of the claim by the insurance company within 15 days of receipt. The insurance company will then investigate a claim, potentially requesting additional information, such as medical records.

After investigation, the insurer has 15 days to approve or deny the claim. An insurance adjuster oversees this process to guarantee efficient claim resolution. The claim approval process is an essential step in the settlement process, where the insurance company determines the claim’s legitimacy and proceeds accordingly. This process aids in timely claim resolution.

Payment Terms Explained

Generally, insurance companies in Texas are required to adhere to specific payment terms once a claim has been approved. The insurance company must issue payment within 5 business days after approving a claim. Key aspects of payment terms include:

- Acknowledging a claim within 15 days

- Completing the investigation process within 30 days

- Approving or denying a claim within 15 days of receiving requested documents

- Issuing payment promptly to avoid penalties under Texas law.

Delayed Claim Penalties

Because insurance companies in Texas are subject to stringent regulations, failing to adhere to these guidelines can result in significant penalties for delayed claim settlements. The Texas Insurance Code enforces a 15-day timeframe to investigate a claim.

If an insurance company fails to settle within 60 days due to unreasonable delay, penalties may be incurred. Insurers must provide written notice of delays, ensuring transparency in the claims process.

Claimants should maintain communication records to support potential legal actions. These penalties can include fines and 18% interest on the claim amount, emphasizing the importance of prompt investigation and settlement by the insurance company.

Claim Settlement Options

In Texas, numerous claim settlement options are available to policyholders, each with its own set of guidelines and timelines. The insurance company has 30 days to investigate a claim and 5 business days to make a determination.

- Investigation completion within 30 days

- Determination within 5 business days

- Penalties for non-compliance

- Notification of claim decision to settle your claim, ensuring a smooth claims process in Texas.

Frequently Asked Questions

How Long Can an Insurance Company Take to Investigate a Claim in Texas?

Steering through Texas regulations, insurance companies typically adhere to a 15-45 day investigation timeline, balancing claims process efficiency with policyholder rights, amidst potential claim delays and rigorous insurance standards.

Can You Sue an Insurance Company for Taking Too Long in Texas?

Policyholders can pursue legal recourse for claim delays, exercising policyholder rights through litigation options, attorney representation, and bad faith claims, leveraging consumer protection laws to facilitate settlement negotiations and claim adjustment.

What Is the Time Limit for Insurance Claims in Texas?

Insurance claim deadlines in Texas dictate specific claim filing procedures and response times, governed by Texas insurance regulations, outlining insurance company obligations and claim settlement timelines, with common claim disputes addressed accordingly.

What Is the Unfair Claims Act in Texas?

Texas’ Unfair Claims Settlement Practices Act safeguards policyholders from unfair practices, claim denials, and guarantees insurance regulations protect consumer rights throughout the claim process.